![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

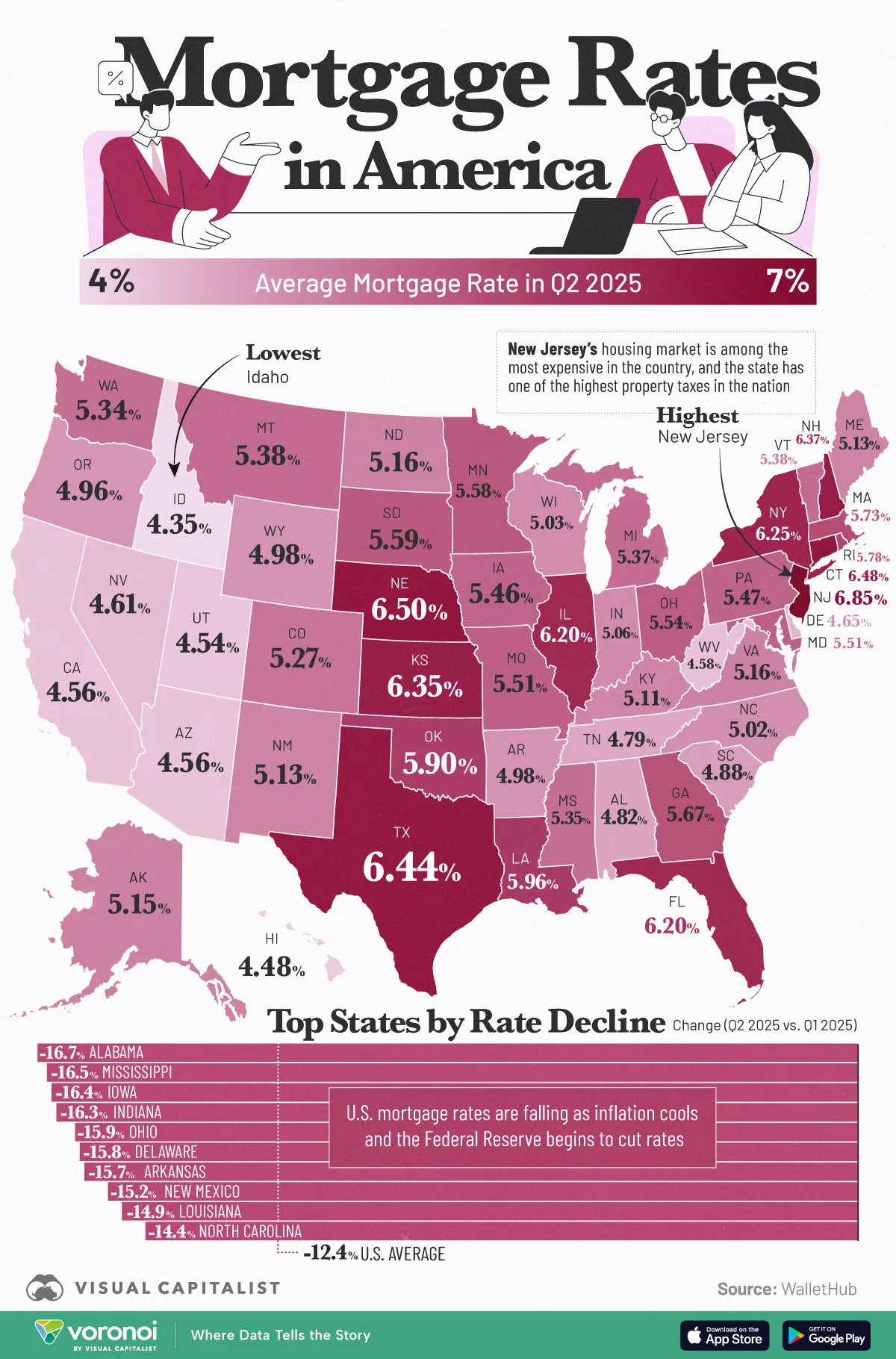

Mapped: The Average Home Mortgage Across U.S. States in 2025

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- New Jersey tops the nation with the highest average mortgage rate (6.85%) in Q2 2025.

- Alabama saw the largest quarter-over-quarter decrease in average mortgage rates (−16.7%).

After two years of high borrowing costs, mortgage rates eased in Q2 2025 across most U.S. states. Still, buying a home remains difficult. The median age of homebuyers has climbed from 30 in 2010 to a record 38 in 2024, showing that more Americans are entering the housing market later in life.

In this map, we chart the average home mortgage rate by state, based on data from WalletHub.

New Jersey Leads

At 6.85%, New Jersey has the highest average rate in Q2 2025. This lines up with its expensive housing market and one of the highest property tax burdens in the country. Nearby high-cost states like Connecticut (6.48%) and New York (6.25%) also sit near the top.

| State | Average Rate (Q2 2025) | Change (Q1-Q2 2025) |

|---|---|---|

| New Jersey | 6.85% | -8.86% |

| Nebraska | 6.50% | -14.20% |

| Connecticut | 6.48% | -9.30% |

| Texas | 6.44% | -7.71% |

| New Hampshire | 6.37% | -10.36% |

| Kansas | 6.35% | -13.58% |

| New York | 6.25% | -9.05% |

| Florida | 6.20% | -10.45% |

| Illinois | 6.20% | -10.82% |

| Louisiana | 5.96% | -14.88% |

| Oklahoma | 5.90% | -13.45% |

| Rhode Island | 5.78% | -9.87% |

| Massachusetts | 5.73% | -9.07% |

| Georgia | 5.67% | -10.62% |

| South Dakota | 5.59% | -12.85% |

| Minnesota | 5.58% | -10.72% |

| Ohio | 5.54% | -15.91% |

| Maryland | 5.51% | -11.12% |

| Missouri | 5.51% | -14.13% |

| Pennsylvania | 5.47% | -13.28% |

| Iowa | 5.46% | -16.35% |

| Montana | 5.38% | -12.52% |

| Vermont | 5.38% | -6.73% |

| Michigan | 5.37% | -12.95% |

| Mississippi | 5.35% | -16.47% |

| Washington | 5.34% | -10.30% |

| Colorado | 5.27% | -10.52% |

| North Dakota | 5.16% | -13.75% |

| Virginia | 5.16% | -12.91% |

| Alaska | 5.15% | -12.95% |

| Maine | 5.13% | -13.07% |

| New Mexico | 5.13% | -15.18% |

| Kentucky | 5.11% | -14.07% |

| Indiana | 5.06% | -16.34% |

| Wisconsin | 5.03% | -8.43% |

| North Carolina | 5.02% | -14.36% |

| Arkansas | 4.98% | -15.73% |

| Wyoming | 4.98% | -10.07% |

| Oregon | 4.96% | -11.15% |

| South Carolina | 4.88% | -13.85% |

| Alabama | 4.82% | -16.65% |

| Tennessee | 4.79% | -13.08% |

| Delaware | 4.65% | -15.80% |

| Nevada | 4.61% | -13.28% |

| West Virginia | 4.58% | -13.29% |

| Arizona | 4.56% | -13.86% |

| California | 4.56% | -9.42% |

| Utah | 4.54% | -11.76% |

| Hawaii | 4.48% | -8.87% |

| Idaho | 4.35% | -14.24% |

Meanwhile, a cluster of Western and Southern states anchor the lower end: Idaho (4.35%), Hawaii (4.48%), Utah (4.54%), California (4.56%), Arizona (4.56%), and South Carolina (4.88%).

Largest Quarter-Over-Quarter Movers

When comparing to Q1 2025, the biggest relative drop in mortgage rates occurs in Alabama (−16.7%), followed by Iowa (−16.4%), Indiana (−16.3%), Ohio (−15.9%), and Delaware (−15.8%).

Several Plains and Midwestern states—Nebraska (−14.2%), Kansas (−13.6%), and Missouri (−14.1%)—also recorded steep declines.

Market Expectations

After a Federal Reserve rate cut and a drop in 10-year Treasury yields, the average rate on 30-year mortgages has settled in the mid to low 6% range, down from nearly 7% earlier in the year.

Most forecasts expect rates to stay steady through the rest of 2025. The Mortgage Bankers Association predicts the average 30-year rate will end the year at 6.5%, while Fannie Mae projects 6.4%.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out America’s Home Buyers by Generation on Voronoi, the new app from Visual Capitalist.