![]()

See this visualization first on the Voronoi app.

Use This Visualization

The Home Price-to-Income Ratio of U.S. Cities

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

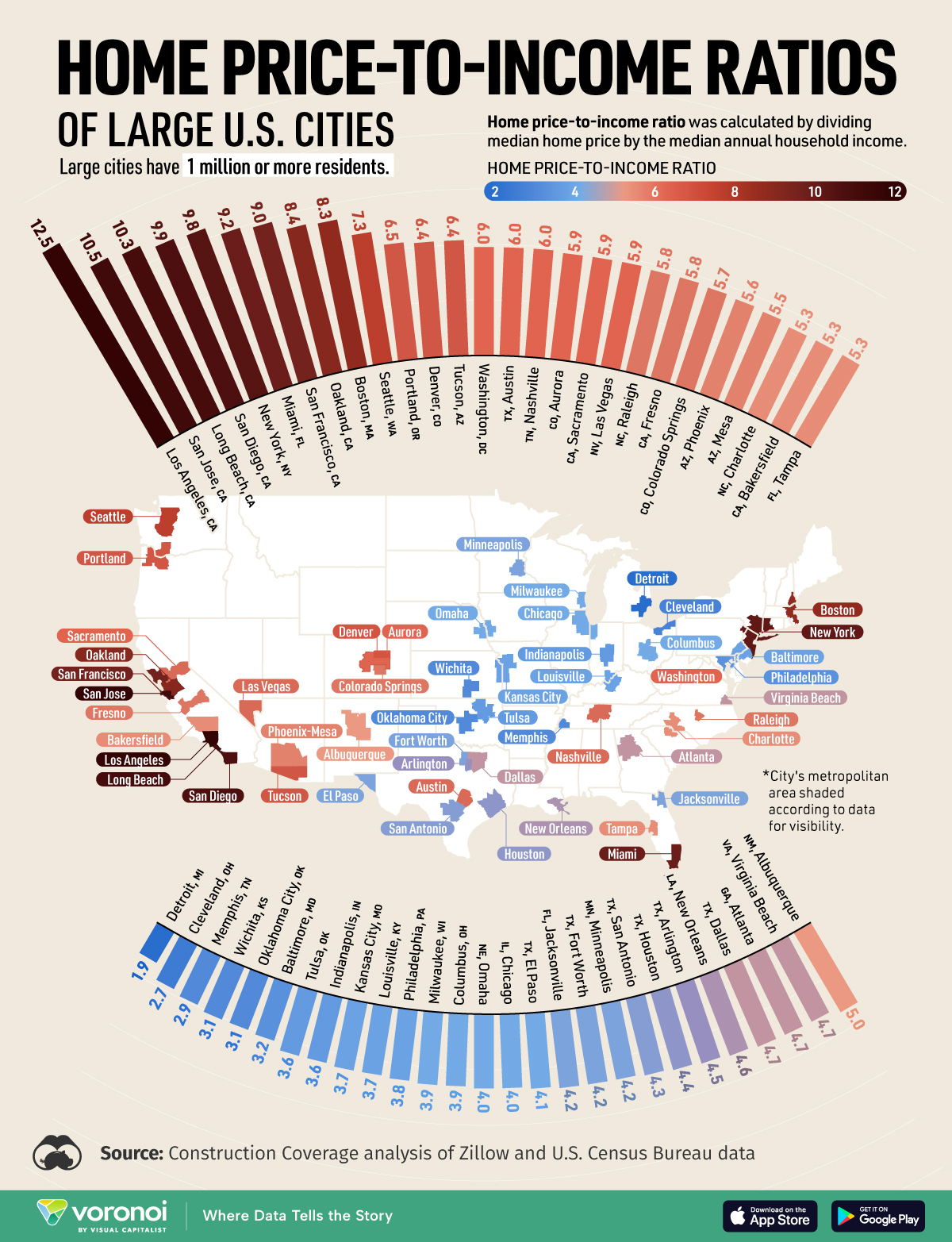

Many Americans continue to find homeownership financially out of reach due to rising house prices and stagnant wages, among other contributing factors. But which U.S. cities are the least affordable?

One way to assess housing affordability is through the home price-to-income ratio, which measures the ratio of the median home price to the median household income.

This map shows the home price-to-income ratio of 54 large cities (population over one million) in the U.S. using data from Construction Coverage’s analysis of Zillow and U.S. Census Bureau data.

Housing Affordability Worst in Coastal U.S. Cities

Below, we show the home price-to-income ratio, median home price, and median household income, for 54 large cities in the United States of America.

| Rank | City | State | Price-to-income | Median home price | Median household income |

|---|---|---|---|---|---|

| 1 | Los Angeles | CA | 12.5 | $953,501 | $76,135 |

| 2 | San Jose | CA | 10.5 | $1,406,957 | $133,835 |

| 3 | Long Beach | CA | 10.3 | $825,502 | $80,493 |

| 4 | San Diego | CA | 9.9 | $994,023 | $100,010 |

| 5 | New York | NY | 9.8 | $732,594 | $74,694 |

| 6 | Miami | FL | 9.2 | $558,873 | $60,989 |

| 7 | San Francisco | CA | 9 | $1,236,502 | $136,692 |

| 8 | Oakland | CA | 8.4 | $780,188 | $93,146 |

| 9 | Boston | MA | 8.3 | $718,233 | $86,331 |

| 10 | Seattle | WA | 7.3 | $847,419 | $115,409 |

| 11 | Portland | OR | 6.5 | $524,870 | $81,119 |

| 12 | Denver | CO | 6.4 | $563,372 | $88,213 |

| 13 | Tucson | AZ | 6.4 | $327,123 | $51,281 |

| 14 | Washington | DC | 6 | $610,180 | $101,027 |

| 15 | Austin | TX | 6 | $533,719 | $89,415 |

| 16 | Nashville | TN | 6 | $432,592 | $71,767 |

| 17 | Aurora | CO | 5.9 | $483,228 | $81,395 |

| 18 | Sacramento | CA | 5.9 | $472,412 | $80,254 |

| 19 | Las Vegas | NV | 5.9 | $407,969 | $68,905 |

| 20 | Raleigh | NC | 5.8 | $434,407 | $75,424 |

| 21 | Fresno | CA | 5.8 | $370,798 | $64,196 |

| 22 | Colorado Springs | CO | 5.7 | $449,123 | $78,568 |

| 23 | Phoenix | AZ | 5.6 | $422,001 | $75,969 |

| 24 | Mesa | AZ | 5.5 | $434,369 | $79,496 |

| 25 | Charlotte | NC | 5.3 | $391,750 | $74,401 |

| 26 | Bakersfield | CA | 5.3 | $380,862 | $72,017 |

| 27 | Tampa | FL | 5.3 | $375,241 | $71,089 |

| 28 | Albuquerque | NM | 5 | $321,411 | $64,757 |

| 29 | Virginia Beach | VA | 4.7 | $391,244 | $83,245 |

| 30 | Atlanta | GA | 4.7 | $390,373 | $83,251 |

| 31 | Dallas | TX | 4.7 | $307,990 | $65,400 |

| 32 | New Orleans | LA | 4.6 | $241,369 | $52,322 |

| 33 | Arlington | TX | 4.5 | $315,222 | $70,433 |

| 34 | Houston | TX | 4.4 | $264,626 | $60,426 |

| 35 | San Antonio | TX | 4.3 | $253,762 | $58,829 |

| 36 | Minneapolis | MN | 4.2 | $312,872 | $74,473 |

| 37 | Fort Worth | TX | 4.2 | $302,359 | $71,527 |

| 38 | Jacksonville | FL | 4.2 | $294,450 | $69,309 |

| 39 | El Paso | TX | 4.1 | $216,673 | $52,645 |

| 40 | Chicago | IL | 4 | $284,818 | $70,386 |

| 41 | Omaha | NE | 4 | $272,286 | $67,450 |

| 42 | Columbus | OH | 3.9 | $238,286 | $61,727 |

| 43 | Milwaukee | WI | 3.9 | $191,149 | $49,270 |

| 44 | Philadelphia | PA | 3.8 | $215,593 | $56,517 |

| 45 | Louisville | KY | 3.7 | $233,464 | $63,049 |

| 46 | Kansas City | MO | 3.7 | $230,526 | $62,175 |

| 47 | Indianapolis | IN | 3.6 | $218,591 | $61,501 |

| 48 | Tulsa | OK | 3.6 | $194,784 | $54,040 |

| 49 | Baltimore | MD | 3.2 | $177,786 | $55,198 |

| 50 | Oklahoma City | OK | 3.1 | $198,826 | $63,713 |

| 51 | Wichita | KS | 3.1 | $186,528 | $59,277 |

| 52 | Memphis | TN | 2.9 | $144,347 | $50,622 |

| 53 | Cleveland | OH | 2.7 | $100,734 | $37,351 |

| 54 | Detroit | MI | 1.9 | $68,379 | $36,453 |

Cities on the West Coast, particularly in California, face the most significant housing affordability challenges.

The top four cities with the highest ratios are all in California, while other major West Coast cities like San Francisco, Seattle, and Portland rank among the top 15.

The top five cities, including New York City, have a home price-to-income ratio more than double the national average of 4.7, making them highly unaffordable.

While median household income in cities like San Francisco, San Jose, and Seattle are among the highest in the country, they also have some of the most expensive house prices in the country.

The Midwest and parts of the South have much lower ratios, including Detroit (1.9), Cleveland (2.1), and Memphis (3.1). Midwest cities consistently rank among the most affordable for housing and cost of living.

Learn More on the Voronoi App

To learn more about the U.S. housing market, graphic that 10 fastest-growing housing markets in the U.S., based on their housing stock growth between 2013 and 2022.

The post Mapped: Home Price-to-Income Ratio of Large U.S. Cities appeared first on Visual Capitalist.