![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

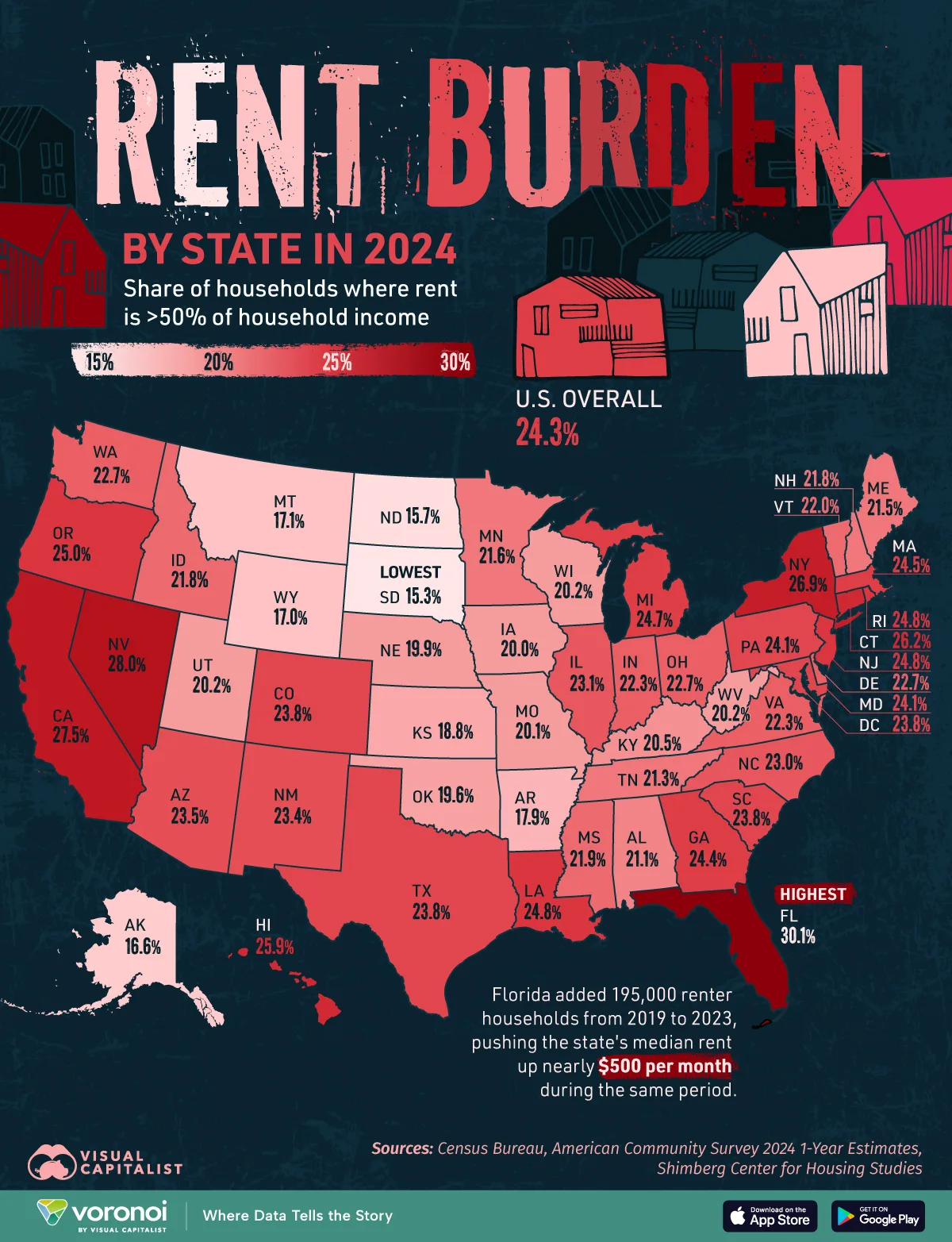

Ranked: The Most Rent-Burdened States in America

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Nationwide, 24.3% of renter households spend more than half their income on rent.

- Florida is the most rent-burdened state, with 30.1% of renters paying over 50% of their income toward housing.

- Nevada and California follow closely behind, both exceeding 27%.

The cost of housing continues to strain American renters, especially in states with rapid population growth and limited housing supply.

This chart ranks U.S. states by the share of renter households spending more than half of their income on rent—commonly known as being “severely rent-burdened.” The data comes from the U.S. Census Bureau’s American Community Survey (ACS) 2024 1-Year Estimates.

America’s Highest Rent Burdens

Across the country, roughly one in four renter households is severely burdened by rent. But in some states, that share climbs much higher.

| State | Share of households spending >50% of household income on rent |

|---|---|

| Florida | 30.1% |

| Nevada | 28.0% |

| California | 27.5% |

| New York | 26.9% |

| Connecticut | 26.2% |

| Hawaii | 25.9% |

| Oregon | 25.0% |

| Rhode Island | 24.8% |

| New Jersey | 24.8% |

| Louisiana | 24.8% |

| Michigan | 24.7% |

| Massachusetts | 24.5% |

| Georgia | 24.4% |

| Pennsylvania | 24.1% |

| Maryland | 24.1% |

| District of Columbia | 23.8% |

| Colorado | 23.8% |

| Texas | 23.8% |

| South Carolina | 23.8% |

| Arizona | 23.5% |

| New Mexico | 23.4% |

| Illinois | 23.1% |

| North Carolina | 23.0% |

| Ohio | 22.7% |

| Washington | 22.7% |

| Delaware | 22.7% |

| Indiana | 22.3% |

| Virginia | 22.3% |

| Vermont | 22.0% |

| Mississippi | 21.9% |

| Idaho | 21.8% |

| New Hampshire | 21.8% |

| Minnesota | 21.6% |

| Maine | 21.5% |

| Tennessee | 21.3% |

| Alabama | 21.1% |

| Kentucky | 20.5% |

| West Virginia | 20.2% |

| Utah | 20.2% |

| Wisconsin | 20.2% |

| Missouri | 20.1% |

| Iowa | 20.0% |

| Nebraska | 19.9% |

| Oklahoma | 19.6% |

| Kansas | 18.8% |

| Arkansas | 17.9% |

| Montana | 17.1% |

| Wyoming | 17.0% |

| Alaska | 16.6% |

| North Dakota | 15.7% |

| South Dakota | 15.3% |

Florida leads with 30.1% of renters spending more than half their income on housing. Rents in Florida increased by nearly 40% between 2019 and 2023 due to high population growth and limited rental supply.

Other high-burden states include Nevada (28.0%) and California (27.5%) in the West. Overall, coastal states are prevalent in the top 10, including New York, Oregon, and Hawaii.

Where Rent Pressure Is Lowest

At the other end of the list, rental housing remains relatively affordable in parts of the Midwest and Great Plains.

States such as South Dakota (15.3%), North Dakota (15.7%), and Wyoming (17.0%) report the lowest shares of rent-burdened households. These states also see relatively slower growth in population and demand for rental housing.

America’s Rent Problem

According to a survey of over 31 million households, housing is the single largest expense for renters in the United States.

Households that spend over 30% of their household income on housing costs are considered “cost-burdened”, and nearly half of all renter households in the U.S. fall in this category. Those who spend over 50% of their income on rent and housing costs are considered severely rent-burdened, and almost one in five U.S. households are in this bracket.

Rental unaffordability remains an important challenge for millions of U.S. households, especially as inflation and housing prices outpace wage growth across the country.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out The Top 20 Cities With Sky-High Rent in 2025 on the Voronoi app.