One month ago, when the market was getting excited about the imminent Fed rate hike, now due less than one week from today, Jefferies analysts flagged a red flag about the imminent rate liftoff: few, if anyone, know precisely how it will take place in practice.

We cited Jefferies economists Ward McCarthy and Thomas Simons who in their December 16 note wrote that "indeed the liftoff date, the Fed is running out of time to be 'well before' raising rates." They added that as per the July 29-30 minutes, FOMC participants agreed the committee should provide additional information to the public regarding details of normalization well before first steps in reducing policy accommodation.

And yet, aside from some vague reassurance that the Reverse Repo - IOER corridor "should" work, and an extensive profile by the WSJ of the person tasked with conducting the liftoff, Simon Potter, there has been no detail on the topic. To Jefferies this is a glaring problem: "The lack of any discussion of liftoff logistics is puzzling to us and a potentially significant communication snafu."

Jefferies added that the Fed has never attempted to raise fed funds rate under "IOER regime" so lack of confidence "is not unreasonable." In the note, the authors write that still unresolved issues about liftoff logistics and normalization process include:

- Issues include how to communicate liftoff, spread between IOER and RRP, as well as spread between RRP rate and fed funds

- FOMC members still struggling with risks associated with RRP facility, including “appropriate size” that would limit Fed’s role in financial intermediation

And then there is uncertainty “about the efficacy” as how combination of RRP and IOER rates will control fed funds rate.

The punchline according to Jefferies is that the idea that IOER will be primary tool to move fed funds rate is "wishful thinking" as IOER was initially intended to put floor under fed funds rate yet hasn’t been "an effective tool for doing so."

* * *

Earlier today, Bloomberg picked up on this major caveat to the Fed's experiment rate hike (experimental, because never before has a tightening been attempted with $2.5 trillion in excess reserves still sloshing around in the financial system), reporting that "as the Fed prepares to raise interest rates from near zero as soon as next week, bond investors are on edge. Beyond all the "is-this-the-right-move" questions that surround every increase, there’s a logistical concern: With so much cash sloshing around, will Fed officials be able to nudge rates as high as they want? Will the new-fangled tools they’ve created to engineer the move work, or instead sow the kind of confusion that can dent the Fed’s credibility and spur a broader market selloff?"

Bloomberg notes that as a result of these numerous questions, "many investors are taking no chances."

So what are they doing:

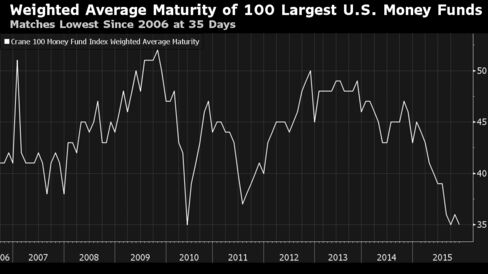

They’re piling into the safest, most liquid securities available, or those that move them as far away from the epicenter of the U.S. financial system as possible. James Camp at Eagle Asset Management is buying Treasuries and unloading debt linked to credit, such as corporate bonds. Peter Yi, director of short-term fixed income at Northern Trust Corp. is stockpiling cash. Jerome Schneider, head of short-term strategies at Pacific Investment Management Co., is diversifying into securities such as debt in foreign currencies. In a sign of the search for liquidity, U.S. money funds have cut the average maturity of their assets to the lowest since 2006.

Paradoxically, one of the "flights to safety" away from the short-end of the curve which is the biggest question market in the upcoming rate hike, is the long end, and many investors are buying up the belly of the curve in response, in the process further flattening the curve, and impairing bank Net Interest Margins, once again a thoroughly undesirable outcome to the Fed which needs to see a curve steepening to get validation by the market that it is doing the right thing and not engaging in policy error. After all, an inverted curve would be an undisputed signal by the market that a recession is just around the corner.

“You just stay away from this one,” said Camp, director of fixed-income at Eagle Asset, which manages $30.6 billion in St. Petersburg, Florida. “You just let this play out. It’s OK to wait and see, and see how risk markets react. I love Treasuries here.”

Camp boosted Treasuries holdings by 20 percent in the last six months, most recently adding seven- to 10-year maturities. He sees government debt offering shelter in case the Fed’s tightening leads investors to shun riskier assets, such as high-yield securities, and prefers longer maturities that would be less influenced by turbulence in shorter-dated obligations.

Others are stockpiling liquid and easy to dispose of shorter maturities.

Yi at Chicago-based Northern Trust, which manages $946 billion, has cash and securities maturing within five days as much as 15 percent above levels of prior years in the short-term funds he oversees. He’s focused on boosting holdings that are easy to sell in the event he faces withdrawals.

"We need to be prudent about any interest-rate exposure," said Pimco’s Schneider, who manages about $250 billion of short-term assets at the Newport Beach, California-based firm. "We’re looking for ways to diversify our liquidity risk in high-quality assets, and doing so with the view that rates are going higher."

The issue at hand, as discussed extensively over the past several years, is the logistical mechanics of the rate hiking corridor which the Fed will try to push up, bounded on the bottom side by the Fed's Reverse Repo operations, and on the top end by the interest the Fed pays on Excess reserves. Considering the unprecedented amounts of liquidity, it is not the ceiling of the corridor that is the concern, but rather the floor, and whether the Fed will be able to raise the rate on all paper at the same time.

In previous tightening cycles, there were far less reserves sloshing around in the financial system. That made it a lot easier for policy makers to hit their desired rate.

As Bloomberg summarizes this, "policy makers need new methods to drain that money and push rates higher in an interbank lending market, known as fed funds, that has become harder to influence now that cash-heavy banks rely on it infrequently.

And while many are willing to put their trust in the Fed's rate plumbing mechanics, "others are watching how the Fed handles the mechanics of the move. Camp at Eagle Asset and strategists at TD Securities say policy makers will need to more than triple the size of its daily reverse-repo program -- where they drain money from the financial system by temporarily lending out securities -- to at least $1 trillion. Expanding the program, which officials began in September 2013, would help anchor the fed funds rate. Yet the Fed may balk at the move because officials have signaled they’re wary of playing too big a role in money markets."

Furthermore, as has also been discussed previously, for the first time in a monetary policy move, the Fed will tap an expanded pool of counterparties, including investment companies such as BlackRock Advisors LLC, Federated Investors Inc. and Fidelity Investments as participants in the reverse repo program. It used to just deal with primary dealers, a group that currently numbers 22.

Bloomberg's closing quote is troubling for a Fed which in recent months has stretched its credibility with the capital markets:

“This is new territory for investors,” said Yi at Northern Trust. “We are all hoping it works, but can’t rule out a possibility that it’s not perfect. Our expectation is that it is probably going to be initially pretty sloppy.”

Alas, the Fed can hardly afford to be sloppy in illiquid capital markets in which one false move can result in an immediate flash crash in one or more asset classes.

* * *

But even assuming the Fed will be flawless in executing a rate hike experiment that has never been tried before, another just as important question is what the impact on market liquidity this purported 25 bps rate hike will have. Luckily, we roughly know what the answer is, as reported last week in "But It's Just A 0.25% Rate Hike, What's The Big Deal?" - Here Is The Stunning Answer, in which we cited the work, and calculation, Wedbush's Scott Skyrm:

Where will General Collateral trade when the fed funds target range is moved 25 basis points higher to .25% to .50%? In the most simple method, GC has averaged about .15% for the past month, which implies a GC rate around .40% after the Fed move.

However, given the unprecedented amount of liquidity in the financial system, there's a belief the Fed will have problems moving overnight rates higher.

We have two quantifiable events over the past few years where the Fed moved Repo rates higher or lower: quarter-end and the QE programs. Given there are so many moving parts, consider these to be very rough estimates: Beginning in 2015, when funding pressure began each quarter-end, the market, on average, took approximately $255B additional collateral from the Fed and, on average, GC rates averaged 20.5 basis points higher.

In 2013 on my website, I calculated that QE2 moved Repo rates, on average, 2.7 basis points for every $100B in QE. So, one very rough estimate moved GC 8 basis points and the other 2.7 basis points per hundred billion. In order to move GC 25 basis points higher, in a very rough estimate, the Fed needs to drain between $310B and $800B in liquidity.

So according to Skyrm, to push rates by a paltry 25 bps, the smallest possible increment, what the Fed will have to do is drain up to a whopping $800 billion in liquidity!

As we put that in context last week, QE2 - which pushed the S&P higher from November 2010 until June 2011 - was "only" $600 billion. In other words, to "prove" to itself that it is in control and the economy is viable, the Fed will effectively conduct, via reverse repo, an overnight QE2, only in reverse.

* * *

To conclude: we are less than one week away from a historic monetary experiment in two parts: the first one, which will attempt the (almost literally) Sisyphean task of pushing up the rate of interest on over $2.5 trillion in excess liquidity, and the second one, to assure the market that it has correctly priced in the overnight evaporation of up to $800 billion in liquidity in current asset prices.

If one or both of these fail to deliver, than the embarrassing disappointment that marked the ECB's December announcement and its dramatic impact on asset prices and FX levels, will be a walk in the park compared to "disappointment" that the Fed will unleash once the market realizes that while in theory the Fed can and is ready to hike, it simply can't do so in practice. And if that implies that trillions in excess reserves be drained first before the RR-IOER corridor can work then watch out below...