By the SRSrocco Report,

According to the fundamentals, gold and silver are severely compressed coiled springs looking for an opportunity to release their tremendous power. Yes, it is true, the precious metals still hold a great deal of power. Which is why their prices are constantly controlled by market intervention.

Of course, the market intervention of gold and silver didn't start recently. Oh no, this has been going on for quite some time. Even though the Central Banks and Gadflies on the financial networks have been able to BAMBOOZLE the public into believing gold is a "Barbarous relic", fundamentals and the laws of nature can't be broken forever... as serious consequences normally follow.

When I read comments from supposedly intelligent people who believe gold is nothing more than a "13th century Middle Ages relic", and "that digital currency is the new future", what in the hell happened to IQ levels recently???

There seems to be this notion put forth by many in the Mainstream and Alternative media that "TECHNOLOGY" is going to save us all and be the new religion of the future. While I have nothing against technology per say, it will not be the solution to our extremely serious energy predicament we are about to face head on.

For example, there are several voices out in the Alternative media suggesting that "Alien technology" will be finally released into the world, thus allowing our ADVANCED EMPIRE to continue indefinitely. This of course would be a great benefit for Americans as it would allow them to continue filling their homes and rental storage units with all sorts crappy consumer products.

According to the supposed history of Alien encounters on the earth, they have been toying with humans for quite some time. So, the idea that they will allow us to use some of their technology to save a species that shows such a high degree of IGNORANCE, STUPIDITY, CRUELTY & GREED, doesn't pass the smell test to me.

Hold on.. I can take that a step further, How many EMPIRES have come and gone in the past?? Okay, we had the Egyptian, Persian, Roman and Mayan Empires to name a few. You would think if Aliens were going to start saving humans from being the POOR UNWORTHY SLOBS they have been for thousands of years, they would have done so already. Wouldn't they??

But, maybe we finally passed the test for our species, and now the Aliens think we deserve a break.... just like a freshly opened bottle of Coke. Yes, that's it. We have passed the test of being WISE, PRUDENT, CARING and GENEROUS with one another, the plant and animals... and let's not forget the environment.

On the other hand, logic suggests we are about to hit another SENECA CLIFF just like all the other prior empires that dried up and blew away.... and quite quickly, I may add. So, even though there may be more intelligent life forms roaming the galaxy, it doesn't seem quite likely they are going to waste much time on a species that has totally run AMUCK.

Which means, we little people here on earth are going to have to take it upon ourselves to continue on-wards when the GREATEST FINANCIAL PONZI SCHEME finally pops. And pop it will.

The Gold & Silver Coiled Springs... Storing Tremendous Power

Over the years, monetary power shifted away from the precious metals and over to the FIAT MONETARY REGIME (a debt-based worthless paper currency system). This stared long ago, but if we have to put a date on it, it would be 1969. I will get into the particulars in an upcoming article. However, the notion (again) that gold is a "13th century Barbarous relic" fails to consider that the world ran on a Gold-Backed U.S. Dollar system up until 1971. This wasn't that long ago.

Moreover, we still used silver in our coinage up until 1965. While some silver coins, such as the Kennedy Half Dollar, were still minted for the general public up until 1969, silver was removed from U.S. coinage in 1965.

The real reason that silver was finally removed from U.S. coinage in 1965, was that it was too valuable to be used as money.... LOL. I know that sounds silly, but that is the truth. Now, when I say "money", I mean what it has degraded to over the past 50 years.

There just wasn't enough silver to go around to meet the insatiable demand coming from the expanding industrial and jewelry sectors. To use silver in coinage as well as supply future industrial and jewelry demand... there just wasn't enough of the shiny metal.

This is exactly what President Lyndon Johnson stated during his comments after signing the 1965 Coinage Act:

Now, all of you know these changes are necessary for a very simple reason--silver is a scarce material. Our uses of silver are growing as our population and our economy grows. The hard fact is that silver consumption is now more than double new silver production each year. So, in the face of this worldwide shortage of silver, and our rapidly growing need for coins, the only really prudent course was to reduce our dependence upon silver for making our coins.

Well, there you have it. While the grand conspiracy that silver was removed from currency to give more power to the elite may hold some truth, the REAL REASON was much more simple. There just wasn't enough silver to go around.

Furthermore, I really don't believe the elite are really as smart and clever as some make them out to be. Again, if we go back in history and look at all the EMPIRES that have come and gone, you would think that the elite would have had a better plan than allow everything to go to hell in a hand-basket... time after time.

We must remember, back in day when the world was using silver as money, life was a lot simpler. There were no cell phones, or I-pads. There were no electronics or solar panels that required silver. Rather, we basically spent most of our time walking around dressed in glorified burlap sack clothing, growing food or producing simple consumer goods, while enjoying a bath once a week. Gosh, how times have changed.

Regardless, the days of the Fiat Monetary Regime are numbered. There's just too much debt and derivatives over-hanging the system to allow us to continue for much longer. Thus, in order to keep the Fiat Monetary Regime alive, the value of REAL MONEY, such as gold or silver, has to be kept in the DARK.

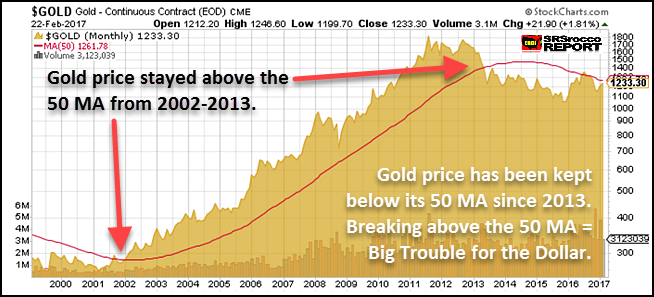

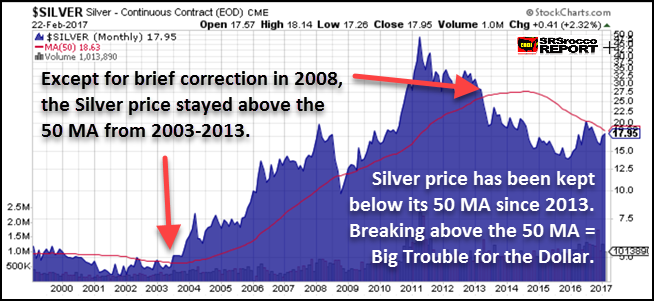

If we look at the following two charts, we can plainly see that gold and silver are both standing at the doorway of a major inflection point:

Normally, I don't pay much attention to "Technical Analysis", but in this case, we are on the verge of a very critical technical breakout. Of course, this is more important for Hedge Funds, Institutions and large traders to follow, but in both charts, the gold and silver price remained above the 50 MA (50 month Moving Average) for a decade.

However, when QE3 was announced at the end of 2012, Central Bank liquidity made its way into stocks, bonds and real estate. The precious metals were left out to dry.

If we recall from the quote above when Lyndon Johnson stated that silver was a scarce material over 50 years ago, it's even more scarce today. The same with gold. When the gold and silver prices were knocking on the DOOR to reach new highs in 2012, this just could not stand.

Which is precisely why both gold and silver's 50 MA level (RED LINE) and have fallen below and stayed there for the past four years. However, both precious metals are once again tapping up against that 50 MA. They first tapped up against the 50 MA in 2016... for good reason.

When the Dow Jones Index was scaring the living hell out of the markets by rapidly falling in the beginning of 2016, investors were getting a HINT of PRECIOUS METALS RELIGION. Thus, investors flocked into gold and silver (gold and blue colored lines) in a big way, pushing their prices up as the Dow Jones Index fell nearly 1,000 points during five trading days in the beginning of February 2016:

This isn't rocket science. FEAR provides an excellent motivation for bringing people back to their senses. However, this was just for a short while as the Fed and Central Banks ramped up their stock and bond purchases. God only knows just how insane this amount must be.

Thus, calm was brought back into the markets allowing investors to go back to being TOTALLY INSANE once again. Unfortunately, duct tape, baling wire and hot air cannot keep a market from succumbing to the fundamental laws of real economics.

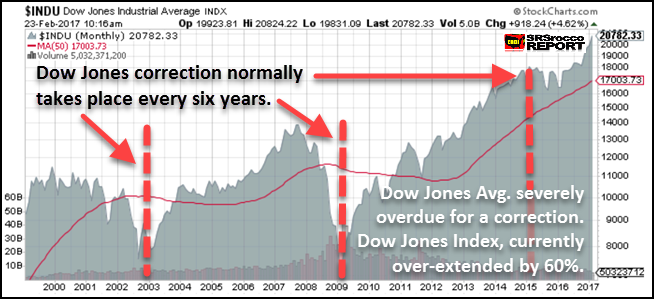

The Dow Jones Index is so inflated, it's overvalued by at least 60%.... for starters:

According to the economic contraction cycle that occurs about every six years, the Dow Jones Index is severely overdue for a good 'ole fashion beating. If we assume that a normal correction for the Dow Jones would be for it to fall to about 8,000 points, the index is overvalued by at least 60%. And that is just for starters.

As I have mentioned in previous articles, where we are heading is nothing like anything we have experienced before. Well sure, we could go back and look at the remains of the Egyptian, Persian, Roman and Mayan Empires for clues, but this would not be a good topic to bring up at the next family gathering or office party.

We must remember, most Americans are way too busy spending money they don't have on crap that they really don't need, to be bothered with the TRUTH that we are going to go head over the SENECA CLIFF, and there isn't anything to stop it.

For all those who are new to the alternative media, the SENECA CLIFF came from the work of an ancient Roman philosopher, named Lucius Seneca. According to Lucius Seneca (published on Ugo Bardi's blog):

increases are of sluggish growth, but the way to ruin is rapid." Lucius Anneaus Seneca, Letters to Lucilius, n. 91

Like it or not, we will most certainly experience the ramifications of the SENECA CLIFF in the future. Unfortunately, technology will not save us from this fate. Rather, the more technology we use to try to solve our dire energy predicament, the worse the cliff dive will be. I discussed this in my article, CONTINENTAL RESOURCES: Example Of What Is Horribly Wrong With The U.S. Shale Oil Industry.

While I am being a broken record on this subject matter, I continue to receive new subscribers every day on the site. Furthermore, the more individuals look at this data and information, the more LIGHT BULBS go off. It takes time for this stuff to sink in. Heck, it has taken me years to come to this realization.

Lastly, the value of gold and silver are going to skyrocket in the future. However, I have no idea how bad things are going to be when the PHAT DEBT LADY finally sings. But, at least physical precious metals will offer much better options in the future rather than 99% of the STOCK, BOND and REAL ESTATE liabilities out there which are masquerading as assets.

Lastly, if you haven't checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

Check back for new articles and updates at the SRSrocco Report.