![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

Ranked: Battery Manufacturing Investment by Country

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

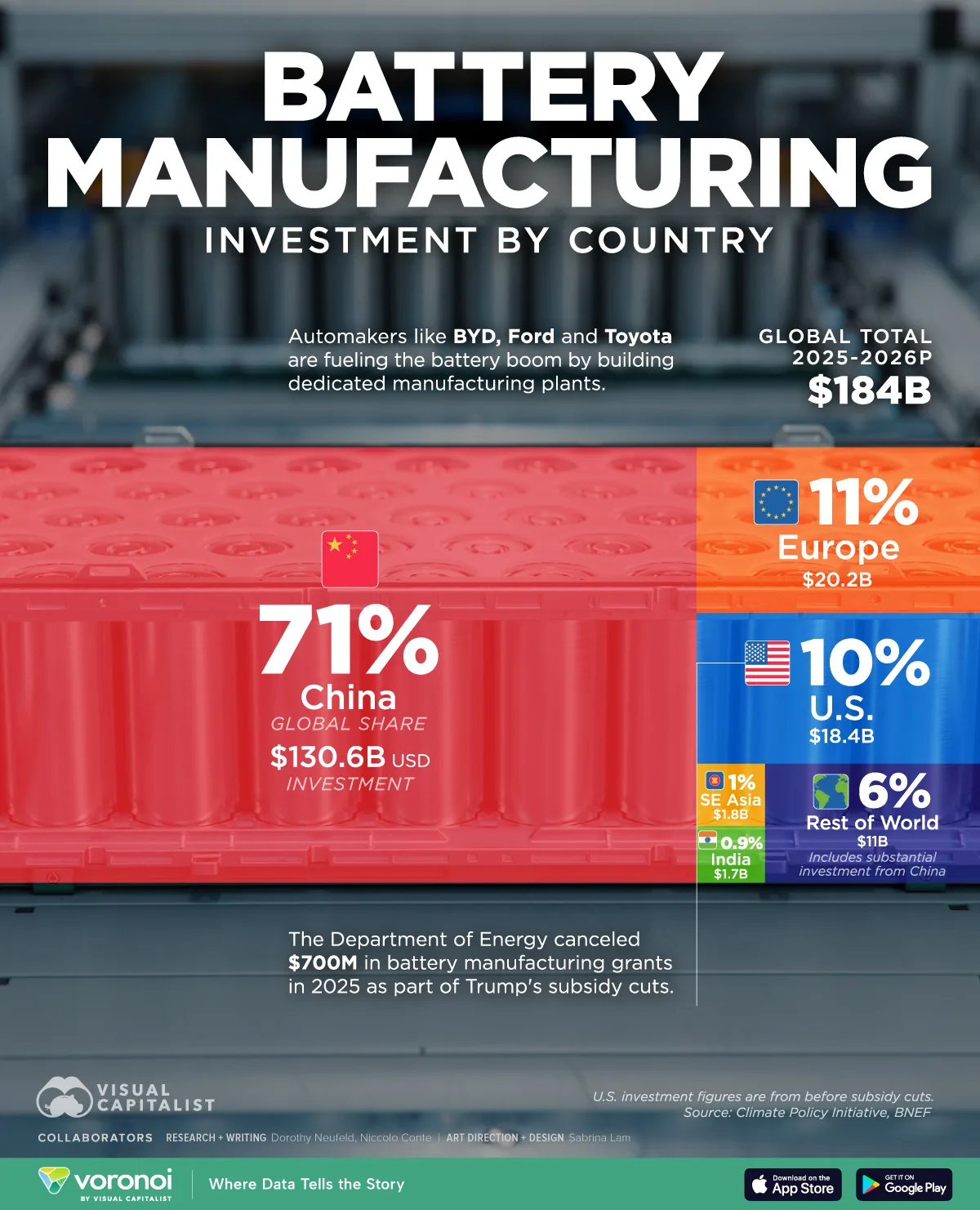

- China is projected to drive 71% of global battery manufacturing investment between 2025 and 2026, more than sevenfold that of America.

- Europe is forecast to account for 11% of the total investment, although domestic battery-makers face stiff competition from lower-cost products in China.

Battery manufacturing investment is surging as EVs expand to a fifth of car sales worldwide.

Additionally, energy storage for grids plays another key role in battery demand. Here, large grid batteries store excess energy and release it when the energy supply is low.

This graphic shows the global leaders in battery manufacturing investment, based on data from the Climate Policy Initiative and BNEF.

China’s Massive Battery Production Investment

Below, we show investment projections in the 2025/26 period with a comparison to the 2023/24 period, highlighting China’s dominance in the battery industry:

| Country/ Region | Investment2025-2026P ($USD) | Share2025-2026P | Investment2023-2024 ($USD) | Share2023-2024 |

|---|---|---|---|---|

| China | $130.6B | 71.0% | $92.4B | 84.0% |

| Europe | $20.2B | 11.0% | $9.4B | 8.5% |

| U.S. | $18.4B | 10.0% | $5.5B | 5.0% |

| Rest of World | $11.0B | 6.0% | $2.2B | 2.0% |

| Southeast Asia | $1.8B | 1.0% | $0.4B | 0.4% |

| India | $1.7B | 0.9% | $0.1B | 0.1% |

| Global Total | $184.0B | 100.0% | $110.0B | 100.0% |

With 71% of the global share, China is forecast to pour nearly $131 billion into battery manufacturing in 2025 and 2026.

CATL, the world’s largest battery-maker, commands a significant share of the industry. Not only does it provide 30% of the batteries used in EVs globally, about a third of global grid energy-storage systems use CATL batteries.

Meanwhile, BYD also produces a notable share of batteries as part of the EV maker’s vertical integration strategy.

Europe ranks in second, supported by ambitious government policies. However, production costs are roughly 50% higher compared to China, making it challenging to compete. Moreover, the region’s largest domestic battery-maker, Northvolt, declared bankruptcy in March after missing production targets and losing key customers.

In the U.S., manufacturing investment was projected to reach over $18 billion, however these figures were prior to Trump’s subsidy cuts. So far in 2025, at least $700 million in battery manufacturing grants have been canceled, ultimately slowing national production.

Learn More on the Voronoi App ![]()

To learn more about this topic, check out this graphic on the top countries for lithium-ion battery production by 2030.