Published

19 seconds ago

on

July 19, 2024

| 19 views

-->

By

Alan Kennedy

Article & Editing

- Julia Wendling

Graphics & Design

- Lebon Siu

- Athul Alexander

The following content is sponsored by Franklin Templeton

Bitcoin Returns vs. Major Asset Classes

Bitcoin had an average annual return 230% in the 10 years between March 2011 and 2021, showing that, despite its volatility, it’s a top-performing asset class.

So, to investigate this further, Visual Capitalist has joined forces with Franklin Templeton to explore historical bitcoin returns and how they compare against other major asset classes.

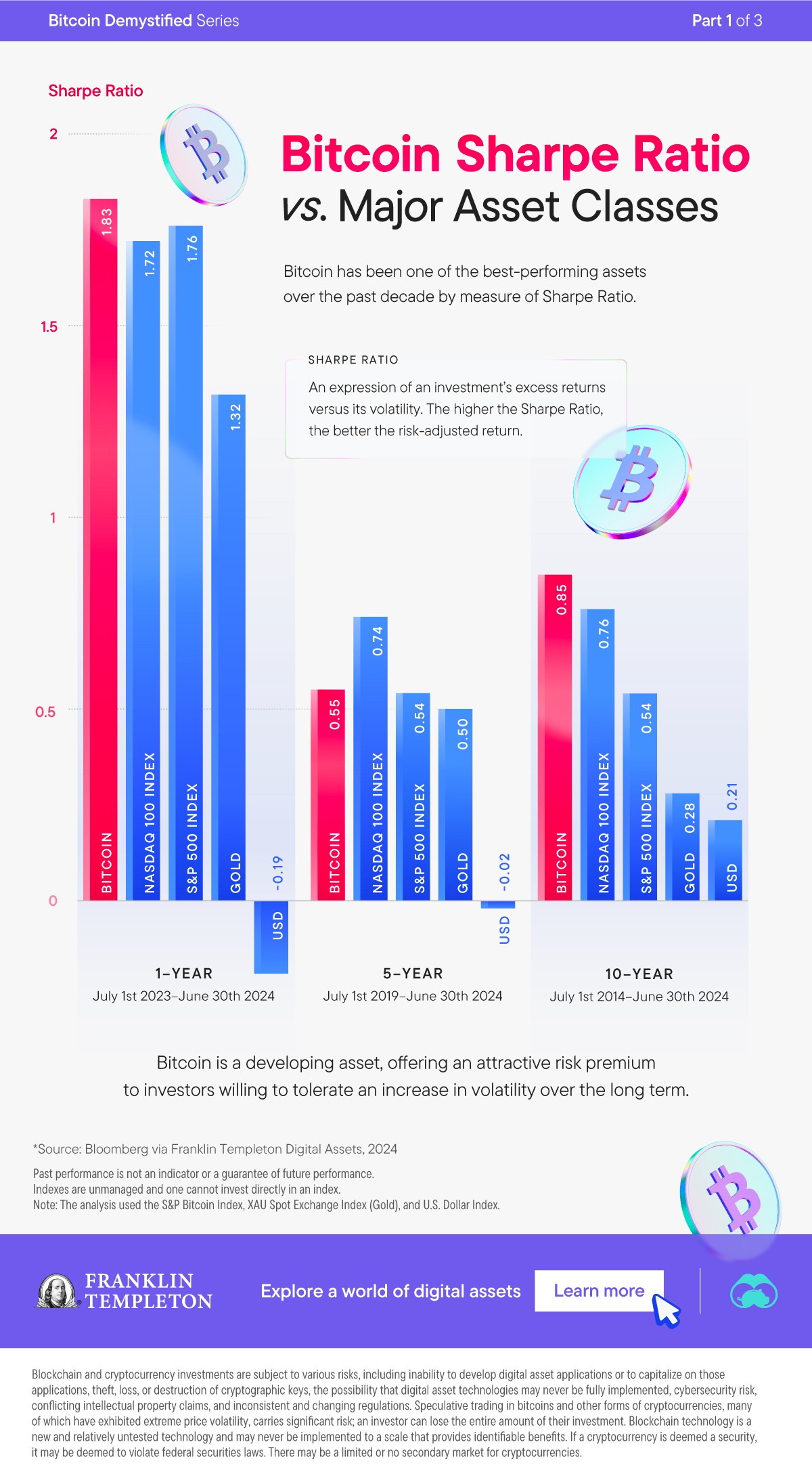

Bitcoin vs. Popular Assets

One way to express risk-adjusted returns is using the Sharpe ratio, which describes an investment’s excess returns versus its volatility.

So, the higher the Sharpe ratio, the better the risk-adjusted return. A Sharpe ratio of three or above would translate to ‘excellent’ risk-adjusted returns, whereas a Sharpe ratio of less than one would be ‘sub-optimal.’

Despite risk and volatility, bitcoin returns have been positive over one, five, and ten years.

| Asset | 10-Year Sharpe Ratio | 5-Year Sharpe Ratio | 1-Year Sharpe Ratio |

|---|---|---|---|

| Bitcoin | 0.85 | 0.55 | 1.83 |

| NASDAQ 100 Index | 0.76 | 0.74 | 1.72 |

| S&P 500 Index | 0.54 | 0.54 | 1.76 |

| Gold | 0.28 | 0.5 | 1.32 |

| U.S. Dollar | 0.21 | -0.02 | -0.19 |

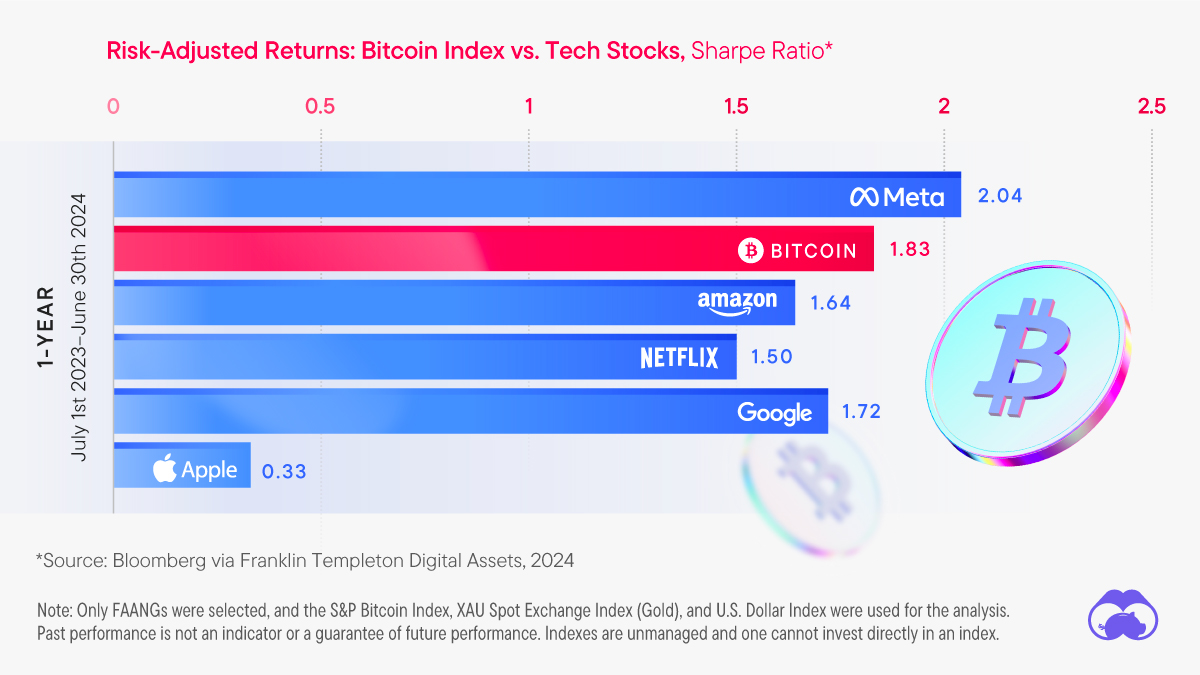

Bitcoin vs. Tech Stocks

Tech stocks like Google and Microsoft are often used as examples of assets with positive risk-adjusted returns. However, bitcoin returns have also been strong and have offered more risk-adjusted returns than most tech stocks over the past year.

Easily Invest in Bitcoin

Bitcoin and other emerging digital assets have shown that they can offer an attractive risk premium to investors willing to tolerate significant volatility over the long term, especially when compared to other major assets.

In the second part of the Bitcoin Demystified series, we explore what opportunities Bitcoin halvings could present for investors.

Learn more about the exciting world of digital assets with Franklin Templeton

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #bitcoin #investing #gold #s&p 500 #u.s. dollar #nasdaq 100 #bitcoin returns #major assets #Franklin Templeton

You may also like

-

Technology7 days ago

Chart: The Price of Entertainment Subscription Services

From Netflix to Google Play Pass, we compare the cost of subscription services across a range of entertainment platforms.

-

Technology1 week ago

How Do Americans Watch TV in 2024?

While broadcast and cable remain the most popular form of watching TV, streaming services are at near-record levels of U.S. TV viewership.

-

Markets1 month ago

Ranked: The 20 Biggest Tech Companies by Market Cap

In total, the 20 biggest tech companies are worth over $20 trillion—nearly 18% of the stock market value globally.

-

Technology1 month ago

What is the Median Pay of Magnificent Seven Companies?

The Magnificent Seven companies are fueling stock market gains. In this graphic, we show the median pay of each company in 2023.

-

Technology1 month ago

Visualizing the 15 Most Valuable Bitcoin Addresses

The most valuable Bitcoin address is worth $17.5B.

-

Technology1 month ago

Charted: How Many Data Centers do Major Big Tech Companies Have?

Data centers are critical for modern business operations and digital services, including cloud computing, e-commerce, social media, and big data analytics.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Ranked: Bitcoin Returns vs. Major Asset Classes appeared first on Visual Capitalist.