The Briefing

- Bridgewater Associates remains the top hedge fund by assets under management (AUM)

- Brevan Howard witnessed strong growth in AUM, moving from 26th to 19th in the ranking

Ranked: The World’s 20 Biggest Hedge Funds

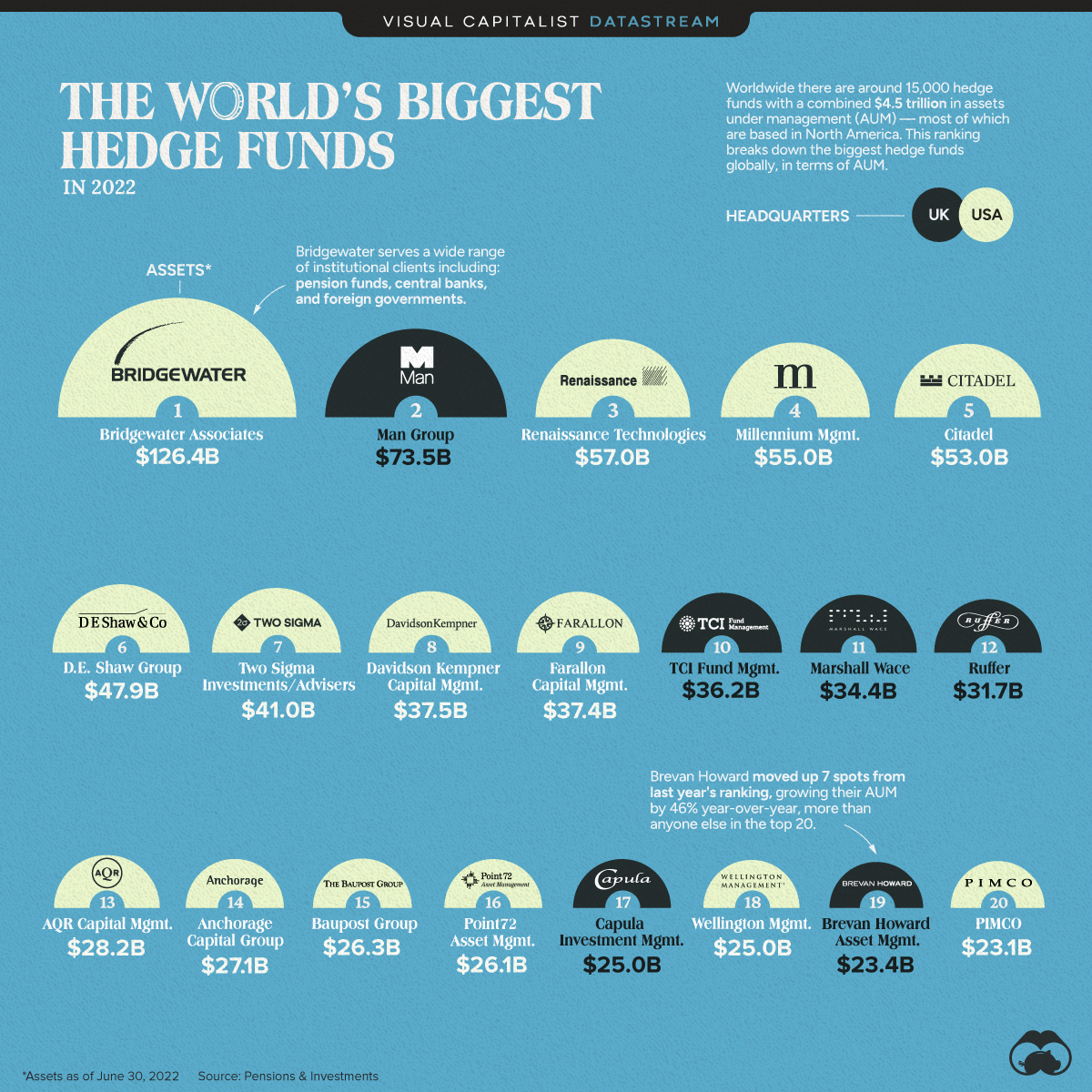

Collectively, the world’s 15,000 hedge funds manage around $4.5 trillion in assets for their clients, weathering economic storms and world events to ensure returns.

This visual breaks down the world’s biggest hedge funds in terms of assets under management using data from Pensions & Investments.

The Top 20

The world’s biggest hedge fund by a mile is Ray Dalio’s Bridgewater Associates. At the time of this ranking, Bridgewater managed over $126 billion in assets for clients as wide ranging as university endowment funds, charities, and foreign country’s central banks.

Here’s a closer look at the ranking:

| Rank | Hedge Fund | Assets (millions USD) | Headquarters |

|---|---|---|---|

| #1 | Bridgewater Associates | $126,400 | U.S. |

| #2 | Man Group | $73,500 | UK |

| #3 | Renaissance Technologies | $57,000 | U.S. |

| #4 | Millennium Management | $54,968 | U.S. |

| #5 | Citadel | $52,970 | U.S. |

| #6 | D.E. Shaw Group | $47,861 | U.S. |

| #7 | Two Sigma Investments/Advisers | $40,969 | U.S. |

| #8 | Davidson Kempner Capital Management | $37,450 | U.S. |

| #9 | Farallon Capital Management | $37,400 | U.S. |

| #10 | TCI Fund Management | $36,200 | UK |

| #11 | Marshall Wace | $34,400 | UK |

| #12 | Ruffer | $31,662 | UK |

| #13 | AOR Capital Management | $28,200 | U.S. |

| #14 | Anchorage Capital Group | $27,100 | U.S. |

| #15 | Baupost Group | $26,300 | U.S. |

| #16 | Point72 Asset Management | $26,100 | U.S. |

| #17 | Capula Investment Management | $25,000 | UK |

| #18 | Wellington Management | $24,968 | U.S. |

| #19 | Brevan Howard Asset Management | $23,353 | UK |

| #20 | PIMCO | $23,054 | U.S. |

This annual ranking uses AUM data from June 2022

Overall, 70% of hedge funds are headquartered in North America, with many of the world’s largest based in the United States, specifically.

Hedge funds are essentially pooled investments pulled together by the fund’s clients. The managers then utilize a variety of strategies to produce returns on investments, buying and selling assets such as stocks, commodities, real estate, bonds, and so on. The fund itself makes money by charging fees to their clients and taking a percentage of the profits earned on trading.

The Fastest Growing Hedge Funds

Many of these large hedge funds were new to the top 20 category, having moved up dramatically from the 2021 ranking. Here’s a look at some of the AUM growth rates year-over-year.

| Rank | Hedge Fund | Growth in AUM (% Change Y-o-Y) |

|---|---|---|

| #1 | Brevan Howard Asset Management | 46.0% |

| #2 | Citadel | 40.8% |

| #3 | PIMCO | 25.3% |

| #4 | D.E. Shaw Group | 20.4% |

| #5 | Point72 Asset Management | 19.7% |

| #6 | Bridgewater Associates | 19.6% |

| #7 | Man Group | 15.9% |

| #8 | Wellington Management | 10.5% |

| #9 | AQR Capital Management | 8.0% |

| #10 | Millennium Management | 5.1% |

| #11 | Capula Investment Management | 4.6% |

| #12 | Marshall Wace | 3.9% |

| #13 | Two Sigma Investments/Advisers | 3.6% |

| #14 | Davidson Kempner Capital Management | 0.3% |

| #15 | Renaissance Technologies | -1.7% |

| #16 | Farallon Capital Management | -1.8% |

| #17 | TCI Fund Management | -9.5% |

| #18 | Anchorage Capital Group | -12.8% |

| #19 | Baupost Group | -15.2% |

| #20 | Ruffer | - |

UK-based Brevan Howard jumped from 26th to 19th, witnessing a 46% increase in their assets under management.

Hedge fund growth can be uncorrelated with the broader market, and is not necessarily an indicator of the overall economy. However, analyzing the strategies used by hedge funds and their performance can often provide useful insight for investors.

Where does this data come from?

Source: The Pensions & Investments annual ranking of largest hedge funds.

Source: This ranking uses AUM data from June 2022. This visualization can be used as a consistent snapshot of the size and proportionality of hedge funds. Current AUM for each may very.

The post Ranked: The World’s 20 Biggest Hedge Funds appeared first on Visual Capitalist.