Via Dana Lyons' Tumblr,

After a record run of muted movement, will recent volatility send negative shock waves through stock market?

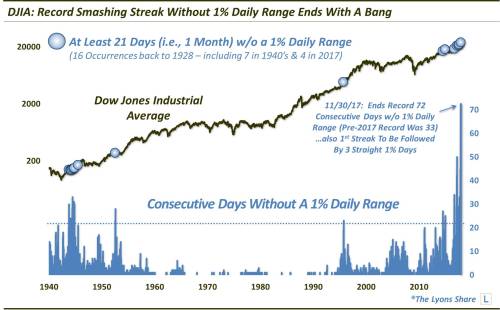

The recent uptick in stock volatility has some investors on edge (OK, it is mostly just financial news editors on edge). The truth is, while volatility over the past week has seen an increase, it is not all that far away from the historical norm. Last Thursday through Monday, for example, the Dow Jones Industrial Average (DJIA) experienced 3 straight “volatile” days, with daily ranges of between 1% and 1.6% on all 3 days. Looking historically, however, we find that the average daily range in the DJIA over the last 90 years is 1.6%. Even during the current bull market since 2009, the average range is 1.08%. Thus, the recent action should hardly be characterized as volatile.

The reason it perhaps seems so tumultuous is because we are emerging from a long stretch of calm in the market – record calm, at that. Prior to Thursday, the DJIA had gone 72 days without experiencing a daily range as wide as 1%. If that sounds like a long stretch, it’s because it is a record. In fact, the record prior to this recent streak was just 49 days in a run that ended in late February of this year. And prior to 2016, the record going back to 1928, according to our database, was a mere 32-day streak back in 1944 – less than half the recent streak.

Furthermore, historically, there have been just 16 streaks that have lasted as long as 21 days, i.e., 1 month.

Interestingly, this recent streak is the first of any of the 16 that saw 3 straight 1% daily ranges immediately following its culmination. So is mean-reversion starting to rear its volatile head here following the record calm? And is there a nefarious message to the sudden uptick in volatility?

* * *

If you’re interested in the “all-access” version of our charts and research, please check out The Lyons Share. Find out what we’re investing in, when we’re getting in – and when we’re getting out. Considering that we may well be entering an investment environment tailor made for our active, risk-managed approach, there has never been a better time to reap the benefits of this service. Thanks for reading!