By The SRSrocco Report

It's no secret to the precious metal community that silver is one of the most undervalued assets in the market, however 99% of Mainstream investors are still in the dark. This was done on purpose to keep the majority of individuals invested in Wall Street's Greatest Financial Ponzi Scheme in history.

You see, this is the classic PUMP & DUMP strategy. Unfortunately, it's not a lousy penny stock that Wall Street is pumping, rather it's the entire market. Most pump & dump stock campaigns last a day, week or a few months. Sadly, this one has gone on for decades and the outcome will be disastrous for the typical American.

The problem is quite simple... there are way too many PAPER ASSETS floating around backed by very little PHYSICAL ASSETS. Or, let me put it another way. There are way too many DEBTS in the market masquerading as assets, while very few investors hold true STORES OF WEALTH.

And one of the best stores of wealth in the market is SILVER. Yes, gold is also another excellent store of wealth, but silver will outperform gold spectacularly when the Mainstream investor finally gets precious metal religion.

I was inspired to write this article due to a recent announcement by one of the well known silver analyst in the Mainstream and alternative media. Jeff Christian of the CPM Group made this statement which was reported in a recent Bloomberg article, Why Poor Man's Gold May About To Get More Investor Love:

Not everyone is convinced.

“There’s a lot of bullishness forming around silver,” said Jeffrey Christian, managing director at New York-based CPM Group, a precious metals adviser. “We are of mixed minds. Silver is in surplus, plain and simple.”

Investors will only increase their purchases if there are more worrying economic, financial and political developments, Christian said in an e-mail dated March 3. CPM Group data on supply and demand show annual surpluses from 34 million ounces to 177 million ounces stretching back to 2006.

As many of you know, Jeff Christian's CPM Group publishes the Silver Yearbook. According to their figures, the global silver market has enjoyed annual surpluses since 2006. Several of my readers forwarded this statement to me and asked me what I thought of it.

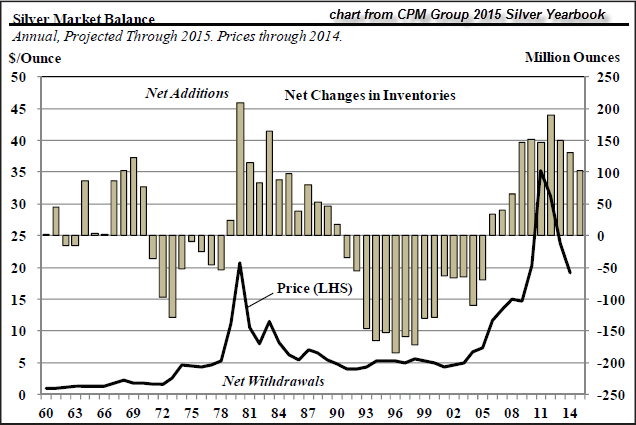

Here is the CPM Group's chart showing annual silver surpluses since 2006:

Well, there you have it... the silver market did enjoy annual surpluses since 2006. Or did it?? If you were from the Mainstream media and you only read the CPM Group's Silver Yearbook you would have been bamboozled by the data in this chart. Why? Because Jeff Christian's CPM group cleverly OMITS silver investment demand from this calculation... LOL.

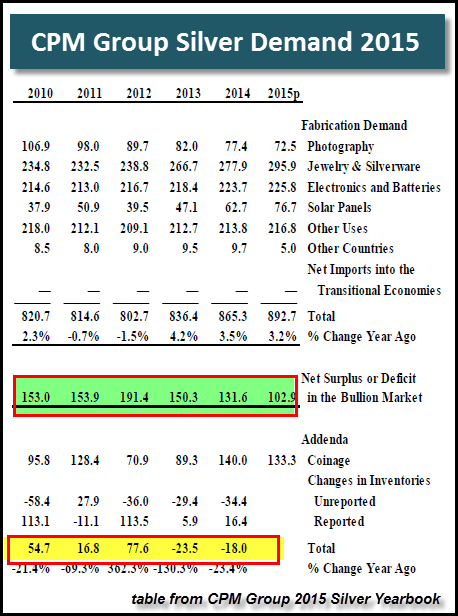

Here is part of the CPM Groups Silver Demand table showing how they arrive at their supposed surplus:

On the top is total supply, then they subtract out Photography, Jewelry & Silverware, Electronics & Batteries, Solar Panels and Other Uses to arrive at their surplus figure highlighted in green. They take that figure to make the annual silver surplus chart above it.

Then they QUIETLY subtract Official Silver Coin demand below it and make adjustments for changes in inventory. The figure highlighted on the bottom is the real annual net silver market balance. If we go by the CPM Groups figures here, they actually show a deficit for 2014 and 2015. How Mr. Christian can call this a surplus is beyond me.

You see, the CPM Group's Investment calculation is titled as an "Addenda". Why an addenda??? And where is Silver Investment Bar demand? I hate to say it, but CPM Group's Supply & Demand figures receive a POOR GRADE compared to the data put out by the GFMS Team at Thomson Reuters who publishes the World Silver Surveys.

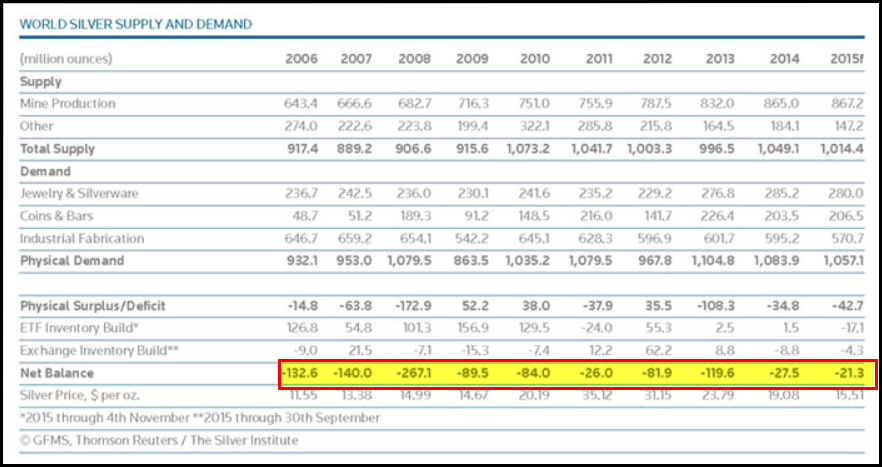

According to the Silver Institute news release on the Silver Interim Report, the GFMS Team at Thomson Reuters published the following Silver Supply & Demand table:

As we can see, they do a much better BANG UP job with their data by also subtracting Silver Bar & Coin demand from their total supply figures. Then first arrive at an annual Physical Surplus or Deficit. I didn't highlight this but it's located right below total Physical Demand. Once they get that figure they adjust for any ETF or Exchange Inventory Build, positive or negative. Lastly, they end up with a NET BALANCE which is highlighted in yellow.

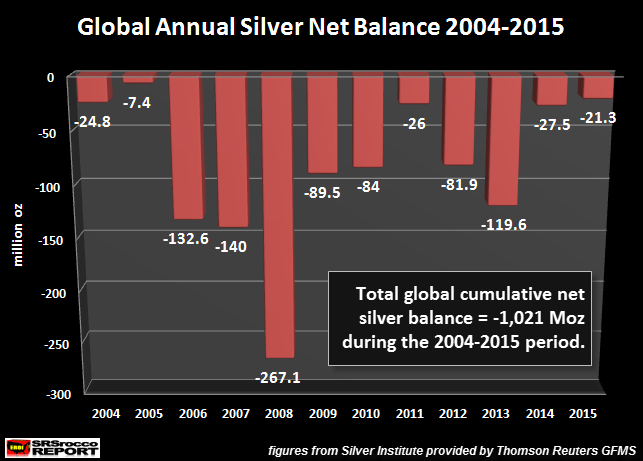

This is the true overall surplus or deficit figure for the silver market. As we can see, the GFMS Team shows annual silver deficits as far as they eye can see. Okay at least for the past decade. I took these figures and made the chart below (also included data for 2004):

So, if we are going to use real professional data, the silver market suffered a 1 billion oz net deficit since 2004. How Mr. Christian can say, "The silver market is in surplus" is beyond me. Of course Jeff Christian is probably guilty of using semantics in his official statements to the press. There is probably some excellent reason why Mr. Christian tends to ignore silver investment demand in his surplus-deficit figures and is more negative about silver than other analysts. However, we can plainly see from the data above, Jeff Christian is most certainly talking out of a different part of his body than the folks at GFMS.

Sorry to be blunt here, but the evidence proves who the guilty party is here.

SILVER OUTBREAK: Investment Demand Will Totally Overwhelm The Market

Some readers may think that is a hyped title. Sure, it may be... but it's true. I have said countless times in articles and interviews that investment demand will be the driving force for silver price in the future, not industrial demand.

Jeff Christian tends to harp on industrial demand.

Yes, it's true... industrial demand has been falling and WILL CONTINUE TO FALL. According to the figures by the GFMS Team, industrial silver demand was 645 million oz (Moz) in 2010, but has fallen to 570 Moz in 2015. Sure, that might include the falling Photography demand, but that's part of industrial consumption. And remember this, a lot of silver used in photography is recycled. So, as silver photography demand declines, so does the amount of recycled silver.

So once again, for all of the Mainstream silver analysts out there... forget about INDUSTRIAL SILVER DEMAND as a determining factor for price going forward. It's a non issue. The key will be investment demand and I have a chart to prove it:

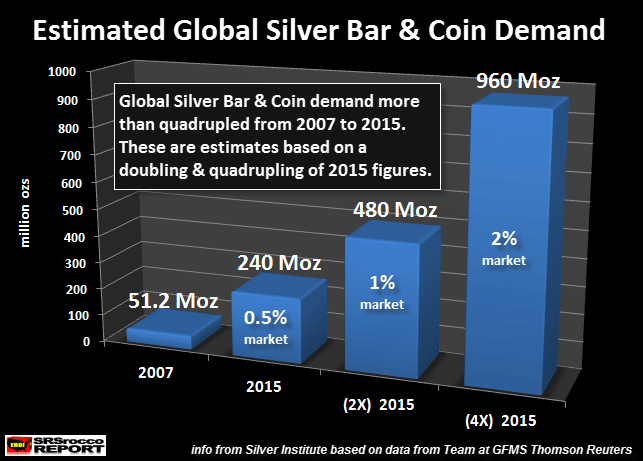

According to the data by the GFMS Team, total Silver Bar & Coin demand was a paltry 51.2 Moz in 2007. This surged after the U.S. Investment Banking & Housing Market collapse to 240 Moz in 2015. While GFMS reports a total of 206 Moz for Silver Bar & Coin demand, they do not include private rounds and bar demand.

In an email exchange with the GFMS Team, they told me that getting figures for private silver rounds and bars was quite difficult. However, they were working on a system and would be publishing this figure in the future. They "unofficially" stated in the email that estimated private silver rounds and bars was likely 30-40 Moz in 2015. This is how I came up with the 240 Moz figure shown in the graph above.

In discussions with many analysts, I came up with a figure of 0.5% of the market was buying silver. Official estimates put the figures of global precious metal buying at approximately 1%. So, in all reality... global silver buying is probably less than 0.5%. But, let's just use that figure as a ballpark.

So, once the world starts to wake up to the fact that they are the BIGGEST PAPER BAG HOLDERS of increasing worthless paper assets, there will be a mad rush into the silver market. Thus, if we had just a doubling to 1%, it would be 480 Moz of physical Silver Bar & Coin demand. And a quadrupling of 2015 demand would equate to 960 Moz. Just think about how that would impact the annual surplus-deficit figure... LOL.

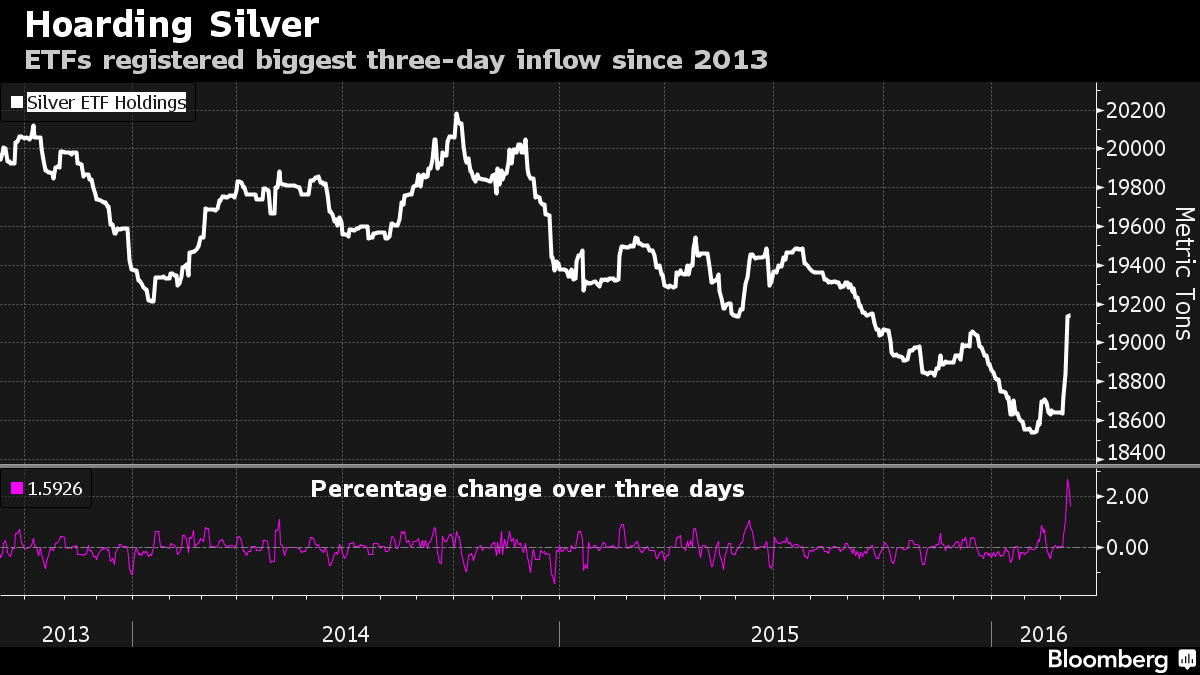

I actually believe just a doubling to 1% and 480 Moz of physical Silver Bar & Coin demand would totally overwhelm the market. Why? Because I haven't even included the huge inflows from the Mainstream Investors. The same Bloomberg article linked above published the chart called Silver Hoarding- ETF Demand:

As we can see, global Silver ETF's added a whopping 500 metric tons in the past several weeks. That turns out to be 16 Moz. I would imagine Mr. Christian will also omit this data when he regurgitates his 2016 silver surplus figures next year.

I believe the reason Christian suggests that the silver markets has been in a surplus because he doesn't see investment as true demand like industrial consumption. Most of industrial silver is lost forever, while a Silver Eagle coin is likely held in private hands waiting for the opportunity to sell it at a much higher price. However, most physical silver investment is being held TIGHTLY and will enter back into the market because its owners realize the Global Financial System will get flushed down the toilet when the Central Banks lose control.

While we have no idea if all of this silver is actually being deposited at these ETF's, it is a sign that the Mainstream investor has a lot of leverage in the market. Actually, the Mainstream investor has more leverage because they comprise 99% of the market while the precious metals investor is 1%.

It makes a great deal of sense why the Fed and Wall Street continue to downplay gold and silver. Because a small percentage switch of investors into these metals would totally overwhelm the market and price.

Fortunately for precious metals investors, this is only a matter of time. While Ponzi Schemes can go on for many years, they all end in a disaster. The present insanity and extreme volatility in the markets provides us a clue that the END maybe coming a lot sooner than we realize.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: