Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Courtesy of Phil’s Stock World

A rate hike – what’s that?

It has been so long since the Federal Reserve has raise interest rates in the US that Banks and Brokerage houses are having seminars for their workers to help them understand the repercussions of a rising rate environment. If you are working with Mortgage Brokers or Financial Planners under the age of 35 – then it’s very possible that in their entire professional careers, they have never been in an economic environment like this. Even for the older market professionals and traders, it’s been so long it’s hard to remember.

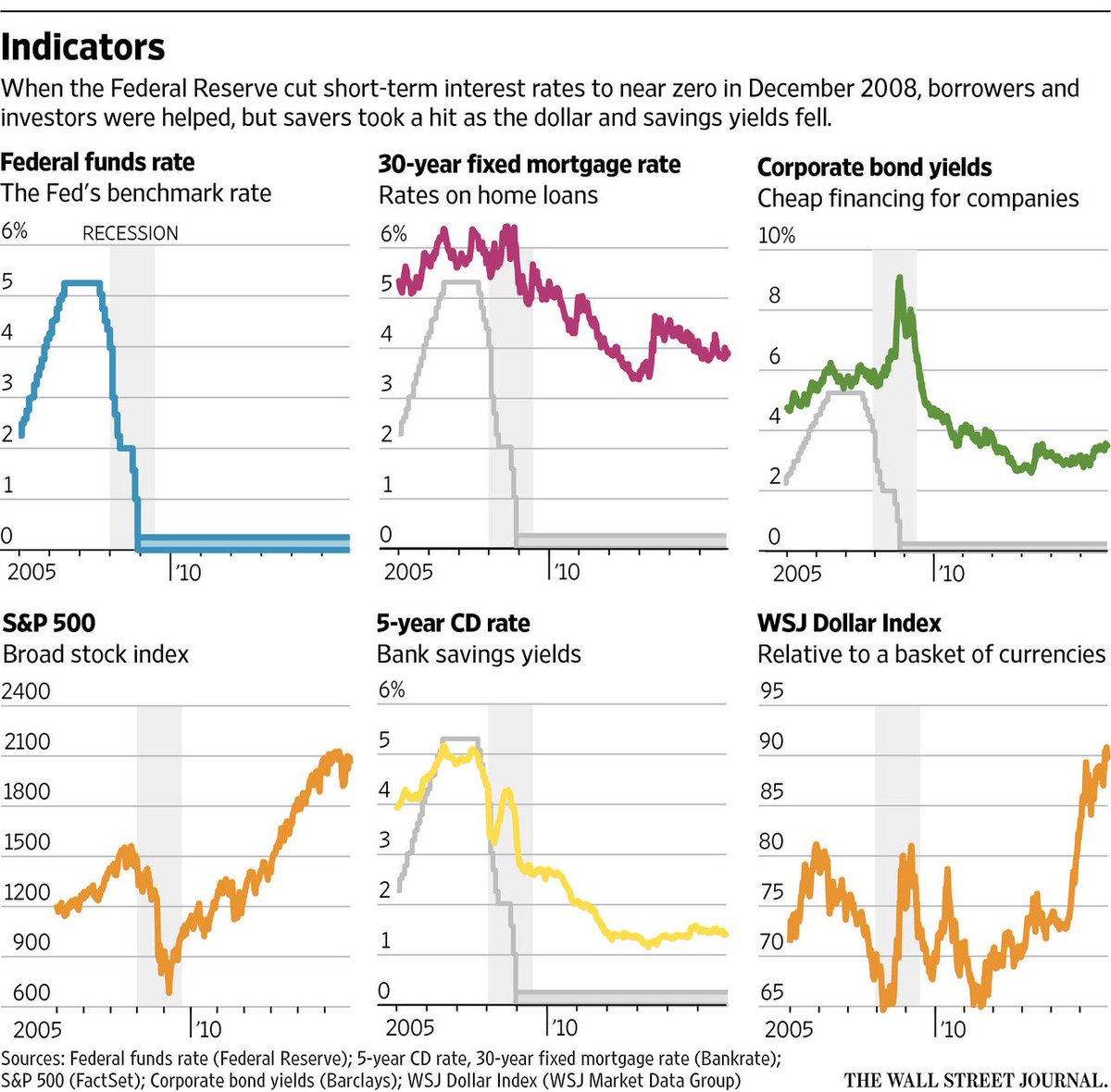

The Fed last began tightening rates back in June of 2004 mainly to cool a rapidly rising housing market but also to cool off the “irrational exuberance” in the stock market, as the S&P had gone from 800 in August of 2002 to 1,300 in April of 2006 (up 62.5%) while housing prices had doubled off their mid 90’s lows. The pace of that tightening was 1% every six months, topping out at 5.25% 2 years later:

As you can see – it had a bit more than the desired effect on the housing market though housing prices continued to go up all the way into 2006 before completely collapsing almost all the way back to where they were 10 years earlier – a real “lost decade” for home buyers. Only then did the ripple effects spill out to the stock market and it was the mortgage lenders themselves and the Financial Institutions that traded their collateralized debt that ultimately took the economy down.

It would seem the Fed has gotten smarter and is not going to even let a runaway housing market get started this time – and that’s a smart choice as we sure can’t afford another round of bailouts, and the low rates have let most homeowners survive the downturn, albeit without the gains they hoped they would make from their housing investments.

Since our September, 2011, lows on the S&P at 1,100, the S&P has climber 950 points, which is 86.3% and Janet Yellen has already said that’s a bubble she is wary of. It’s very doubtful that the Fed will tighten as aggressively as they did in the 2004-6 cycle and a big thing we’ll be watching today is what kind of signals they do give as to their future intentions. As I mentioned on Monday, Hilsenrath (the Fed Whisperer) has already prepared the faithful for a gentle, gradual tightening process but we’ve been at almost zero for so long – almost any increase will seem huge to spoiled borrowers.

[image]https://www.energyfuse.org/wp-content/uploads/2015/08/interest-rates.jpg[/image]

As rates rise, the Trillions of Dollars of Corporate Bonds that were purchased as low rates will begin to lose their value on the secondary market. Verizon (VZ) for example, sold $49Bn worth of 5% debt (all at once) in 2013 and has since refinanced it at even lower rates. That’s great for VZ but it won’t be so good for people holding 5% and lower corporate bonds as “safer” Treasuries begin to rise to match the yields.

Anyone with a portfolio knows a loss is a loss when you are staring at it and, with 10-year notes at 2.15%, heading to just 3% will knock the value of $2Tn worth of corporate bonds down by 10-20% on the resale market. We’re talking $200-400Bn in paper losses on somebody’s balance sheet! Although, it’s no sure thing as yet, 10-year notes jumped 33% when Greenspan first began tightening in 2004 but they went back down several times as no one really believed the high rates would last 10 years (and they were right!). At the time, Greenspan called it a “conundrum.”

Another thing that happens in a rising rate environment is home refinances dry up very quickly. Obviously, no one wants to refinance their loans for higher rates and that will prevent people from taking money out of their homes leaving less money to spend in the economy. Home sales will also come under pressure as mortgage rates rise.

This could be the end of 0% financing on cars, furniture, etc. as well as teaser rates on Credit Card Debt and $1.3Tn of student loans are geared to the Fed Funds Rate – making them harder to pay off with those minimum wage paychecks. With Corporations cut off from easy cash, we may finally see a decline in stock buybacks and M&A activity and that, of course, will not be a positive for the markets.

According to the WSJ, $541Bn has already been withdrawn from risky Emerging Markets in 2015 and the Fed hike may push that number much higher. Corporate Debt Ratios in emerging markets have jumped by 30% of their GDP in the past 5 years – clearly an unsustainable pace and potentially a disaster as the rollovers become more and more expensive. That’s why, so far, the Fed is the lone wolf among Central Bankers in moving towards raising rates. Others are still looking to go lower, some EU Banks are already negative.

Back in September, the IMF’s Christine Lagarde begged the Fed to wait until 2016 to raise rates “because of the implications for developing nations.” Lagarde said that she is concerned that many emerging markets may have expended their capacity to buffer against shocks in the wake of the financial crisis. In a much-ignored IMF report back in October, it was esimated that Emerging Markets have over-borrowed by roughly $3Tn:

The IMF estimates developing nations—led by China—may have over-borrowed by roughly $3 trillion, and is warning that those countries could face a wave of corporate defaults. The fund estimates around 25% of China’s corporate debt is at risk, especially in the real estate and construction sectors, and including many state-owned firms.

That “will unavoidably entail some corporate defaults, the exit of a number of nonviable firms, and write-offs on nonperforming loans,” they said.

We are, of course, already seeing those defaults begin to hit – this is why we went short China at the top on April 9th (FXI was $51.24, now $35.64 – down 30%) and I was banging the table to get out of China all that month. In fact, we noticed that Chinese bond defaults were becoming a problem early on:

- Thursday Thrust (4/9) – Peak China Achieved

- Wednesday’s Worrying Time Bomb (4/15) – Global Debt Past $200Tn

- Manchurian Monday (4/20) – $194,000,000,000 More Stimulus from China!

- Bad News is Still Good News in China as Poor PMI Boosts Market (4/23)

- Friday Failure (4/24) – Kaisa Bond Default Underlines China Housing Crash

- Monday Madness (5/2) – Weak Chinese Data Spurs Stimulus Hopes

I sounded like a broken record but if I got just some people to get out of China before it all collapsed, then it was worth it. In May, we finally had a little scare in China and then it rallied but then it completely and utterly collapsed, never to recover (so far), yet the US markets have been chugging along (and we are “Cashy and Cautious” on those now).

Another factor to consider is currency valuations. If the Fed hikes while others remain at ease, then the Dollar may get stronger against other currencies (it’s already at 10-year highs). That puts more downward pressure on commodity prices (priced in Dollars), with many Emerging Markets depend on commodities to survive. While it’s good for their exports, it also devalues any bonds they sell in their local currency as the relative value of bonds priced in Euros, Yen, Yuan, Aussie Dollars, Loonies, etc. falls compared to bonds priced in greenbacks.

Remember, China did everything it could to prevent a collapse and it still happened. How do you think other countries will do if faced with the same pressure as defaults begin to rise?

****

The Fed is in a particularly bad spot. As Paul Price and I wrote in August this year,

[A]ny increase in rates this year will be small, perhaps around 0.25%. Apart from a short-lived reaction by day traders, a small increase in rates is unlikely to have a major effect on stock prices. Even post-rate hike, absolute rates will be low. Income producing alternatives will still be scarce. The lack of risk-free returns drove indexes to higher than average P/E ratios in the first place. A small rate increase won’t change that.

When “safe” investments yield next to nothing, “risky” investments, like stocks, become more appealing, even when the S&P is near its all-time high.

The price of the SPY alone does not determine the best place for new money. The attractiveness of alternatives is also important. And as for new money, many central banks are in “printing” mode. Due to the lack of alternative investments, the demand for stocks has kept US equities almost constantly moving higher. The demand has also lowered the risk of holding stocks. Huge corporate buybacks, using cheaply borrowed money (available due to ZIRP) has further diminished supply while boosting demand.

Only significantly higher rates would break this pattern. But there’s a problem with that.

America’s greater than $18 trillion, and growing, national debt suggests that significantly higher rates are not coming anytime soon. A 1% nominal increase on the average coupon rate that Washington pays would add about $180 billion per year to US’s annual debt service expense.

Raising money to pay off growing government debt, exacerbated by rate hikes, would force the issuance of even more debt. The US, unlike Greece, can and will continue printing money. The money printing (issuing more debt) would inevitably lead to much higher inflation. As many have said more succinctly, we cannot cure an unpayable debt load by issuing more and more debt. The cost of servicing that debt would become a true budget buster. (Opportunity Vs. Risk in a Bifurcated Market)

Try Phil’s Stock World Daily Report, free, by signing up here.