Published

56 mins ago

on

May 22, 2025

| 86 views

-->

By

Julia Wendling

Graphics & Design

- Amy Realey

- Zack Aboulazm

The following content is sponsored by Tema ETFs

Visualized: The Declining Diversification of the S&P 500

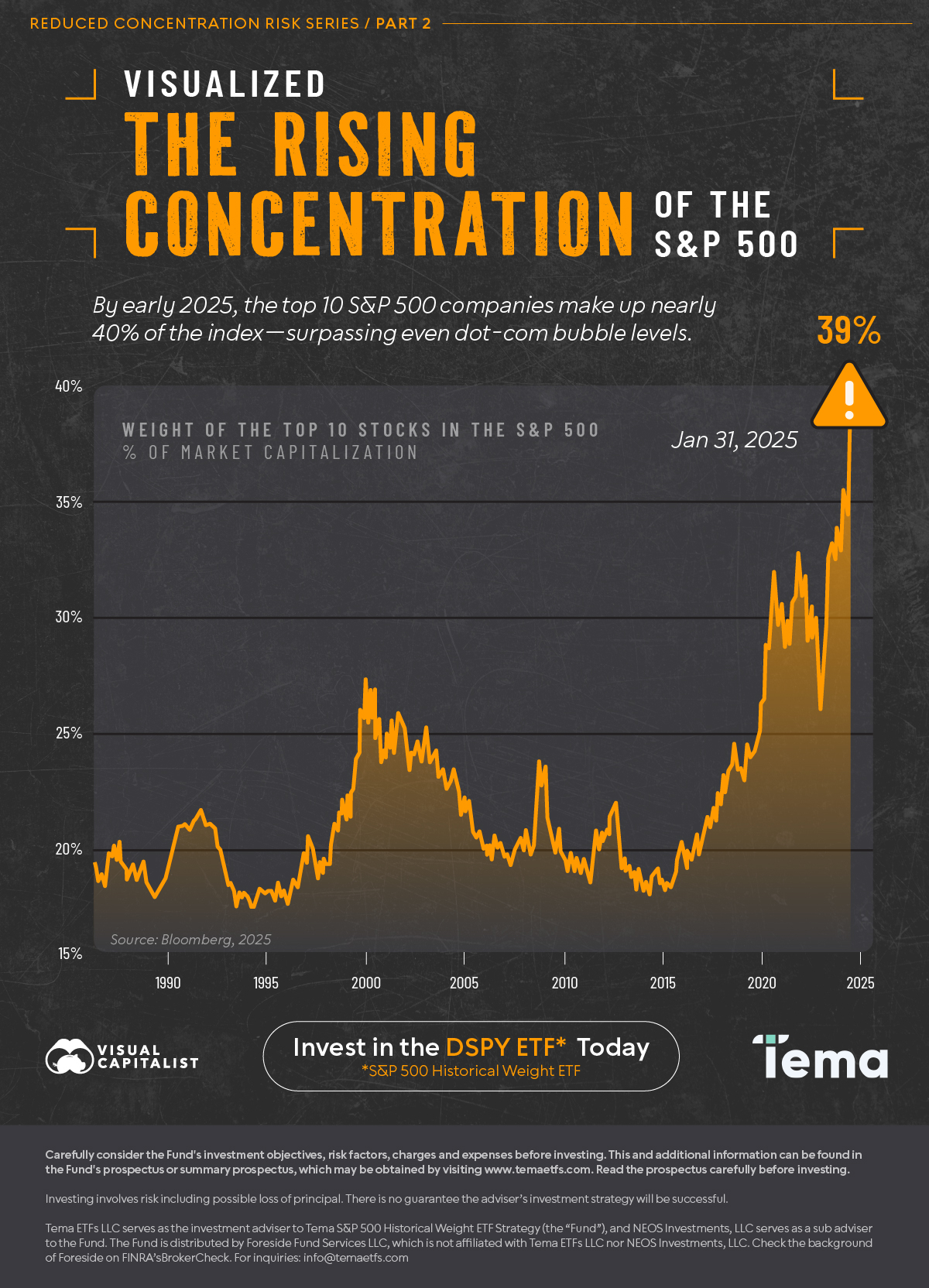

By early 2025, the top 10 companies in the S&P 500 made up nearly 40% of the index—surpassing even the peak levels seen during the dot-com bubble.

This graphic, created in partnership with Tema and based on Bloomberg data, visualizes the rising concentration of the largest stocks within the S&P 500 over time.

What Does “Concentration Risk” Mean?

The S&P 500 includes just over 500 companies and serves as a key benchmark for U.S. equity markets. It’s weighted by market capitalization, meaning the largest companies carry more influence—so when they move, the entire index moves with them.

While strong performance from a few giants isn’t necessarily bad, it does create concentration risk. This means that although investors may appear diversified across hundreds of stocks, their portfolios may still be heavily dependent on just a few. If one or more of those top holdings falter, it may have an outsized impact on overall returns.

The Rise of Concentration in the S&P 500

The dominance of the top 10 stocks has grown steadily over the past few decades. In 1990, they made up about 20% of the index. Today, they’re approaching 40%.

To put this into perspective, even at the height of the dot-com bubble, concentration levels hovered just under 30%. The current figures mark a significant departure from historical norms—and a potential warning sign for investors concerned about concentration risk.

Bringing Balance Back

Investing in the S&P 500 doesn’t have to mean putting 40% of your portfolio in just 10 companies. There are more balanced approaches available—ones that seek to spread risk more evenly and help to potentially guard against the vulnerabilities of overconcentration.

The Tema S&P 500 Historical Weight ETF (DSPY) mirrors the S&P 500 while adjusting company weights to reflect their 35-year historical average levels. This strategy aims to reduce today’s high concentration risk and provide investors with a more balanced approach to investing in the S&P 500.

Disclosure

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com.

Read the prospectus carefully before investing.

Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk. Therefore, you should carefully consider the following risks before investing in the Fund.

Risk Information

Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Large-Capitalization Risk. Returns on investments in securities of large companies could trail the returns on investments in securities of smaller and mid-sized companies. The securities of large-capitalization companies may also be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies may also be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes.

Calculation Methodology Risk. The Adviser relies on various sources of information to “weight-adjust” the S&P 500, including information that may be based on assumptions and estimates.

Neither the Fund nor the Adviser can offer assurances that the calculation methodology or sources of information will provide accurate “weight-adjusted” S&P 500. Errors in the S&P 500 data, S&P 500 computations or the construction of the S&P 500 in accordance with its methodology, and errors in the process of “weight-adjusting” the S&P 500 may occur from time to time and may not be identified and corrected by the Index Provider or the Adviser for a period of time or at all, which may have an adverse impact on the Fund and its shareholders.

“Standard & Poor’s,” “S&P”, and “S&P 500” are trademarks of Standard & Poor’s Financial Services, LLC and have been licensed for use by Tema ETFs LLC (“Tema”). Tema S&P 500® Historical Weight ETF Strategy is not sponsored, endorsed, sold, or promoted by Standard & Poor’s and Standard & Poor’s makes no representation regarding the advisability of investing in Tema S&P 500® Historical Weight ETF Strategy.

Tema ETFs LLC serves as the investment adviser to Tema S&P 500 Historical Weight ETF Strategy (the “Fund”), and NEOS Investments, LLC serves as a sub adviser to the Fund. The Fund is distributed by Foreside Fund Services LLC, which is not affiliated with Tema ETFs LLC nor NEOS Investments, LLC. Check the background of Foreside on FINRA’s BrokerCheck. For inquiries: [email protected]

Related Topics: #apple #google #investing #tesla #amazon #s&p 500 #stocks #microsoft #nvidia #concentration #magnificent 7 #tema

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Visualized: The Rising Concentration of the S&P 500";

var disqus_url = "https://www.visualcapitalist.com/sp/visualized-the-rising-concentration-of-the-sp-500-tema01/";

var disqus_identifier = "visualcapitalist.disqus.com-178061";

You may also like

-

Markets6 days ago

The Surging Value of the Magnificent 7 Versus the S&P 500 (2014-2024)

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up