![]()

See this visualization first on the Voronoi app.

Use This Visualization

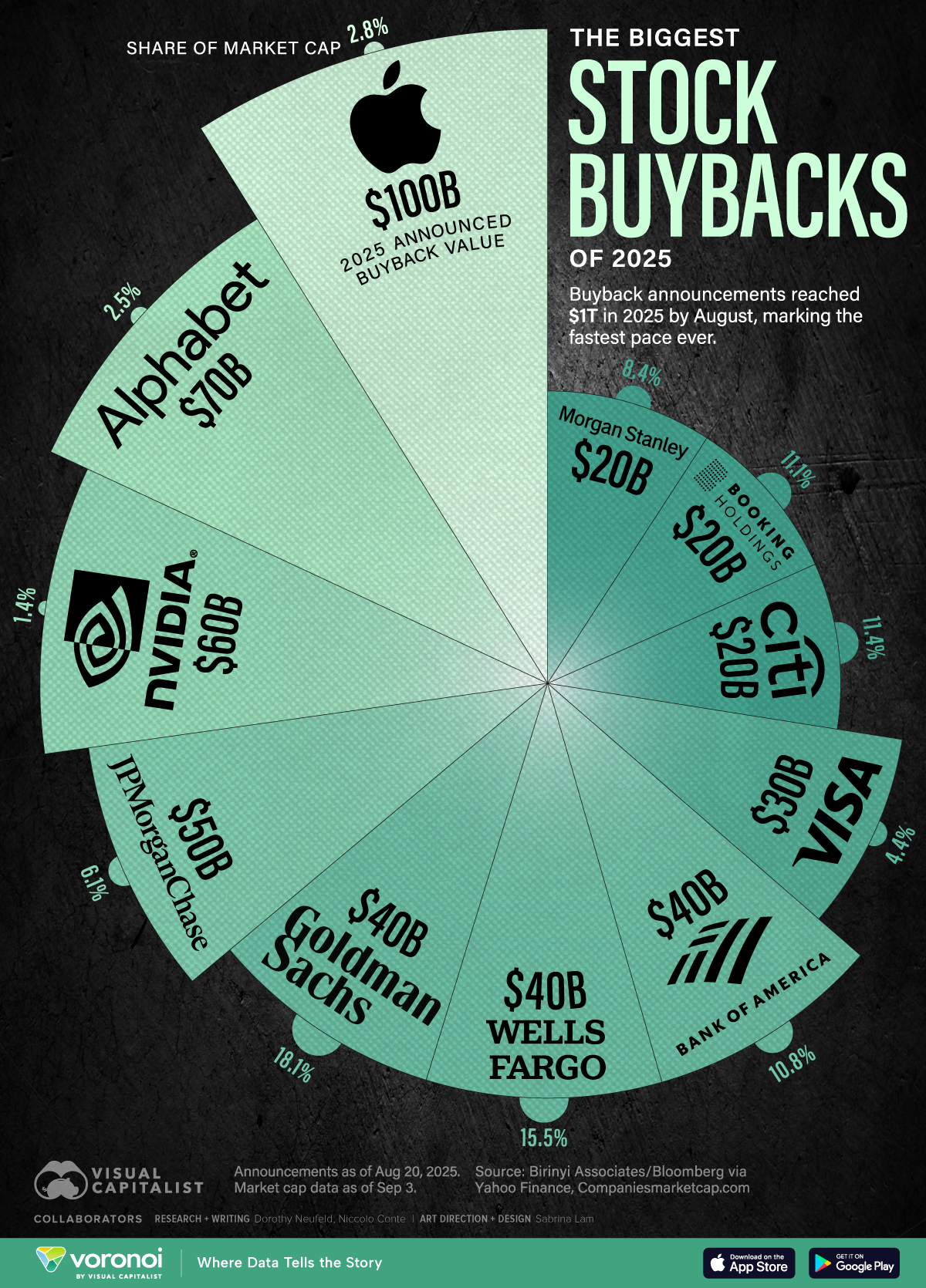

Visualizing the Biggest Stock Buybacks of 2025

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- U.S. stock buybacks surpassed $1 trillion in August, driven by Big Tech and financial firms.

- In May, Apple announced a $100 billion buyback, the largest to-date.

- Nvidia’s $60 billion stock buyback is its highest ever, marking a sign of confidence from management as it sits on $57 billion in cash.

Corporate America is repurchasing shares at the fastest rate on record, driven by Trump’s tax cuts and solid earnings.

Also driving this trend is an uncertain trade picture, leading companies to stall investment plans and instead direct cash into buybacks. While tech giants have posted the largest stock buybacks, financial firms are buying a larger share relative to their market cap.

This graphic shows the largest stock buybacks so far this year, based on data from Birinyi Associates and Bloomberg via Yahoo Finance

Stock Buybacks Are Booming

Here are the biggest stock buyback announcements as of August 20, 2025:

| Company | 2025 Announced Buyback Value | Share of Market Cap |

|---|---|---|

| Apple | $100B | 2.8% |

| Alphabet | $70B | 2.5% |

| Nvidia | $60B | 1.4% |

| JPMorgan Chase | $50B | 6.1% |

| Goldman Sachs | $40B | 18.1% |

| Wells Fargo | $40B | 15.5% |

| Bank of America | $40B | 10.8% |

| Visa | $30B | 4.4% |

| Citigroup | $20B | 11.4% |

| Booking Holdings | $20B | 11.1% |

| Morgan Stanley | $20B | 8.4% |

Market cap data as of September 3, 2025.

Leading the charge is Apple, with a $100 billion buyback—falling close to its record $110 billion in share repurchases last year.

Google-parent Alphabet ranks next, with a $70 billion buyback announcement in April, a similar level seen in the past two years. The company also reported roughly $21 billion in cash and cash equivalents.

More recently, Nvidia announced a $60 billion stock buyback, representing 1.4% of its market cap. Notably, the company’s buybacks have accelerated from $25 billion in 2023.

At the same time, America’s big banks are contributing to the surge, signaling confidence in consumer strength. In total six banks—JP Morgan, Goldman Sachs, Wells Fargo, Bank of America, Morgan Stanley, and Citigroup—rank in the top 10. Going further, Goldman Sachs repurchased $40 billion in shares, equal to 18.1% of its market value, the highest share overall.

Learn More on the Voronoi App ![]()

To learn more about this topic, check out this graphic on the foreign revenue of Magnificent Seven firms.