Published

55 mins ago

on

May 8, 2024

| 12 views

-->

By

Bruno Venditti

Graphics & Design

- Alejandra Dander

The following content is sponsored by Sprott

Visualizing the Copper Investment Opportunity in One Chart

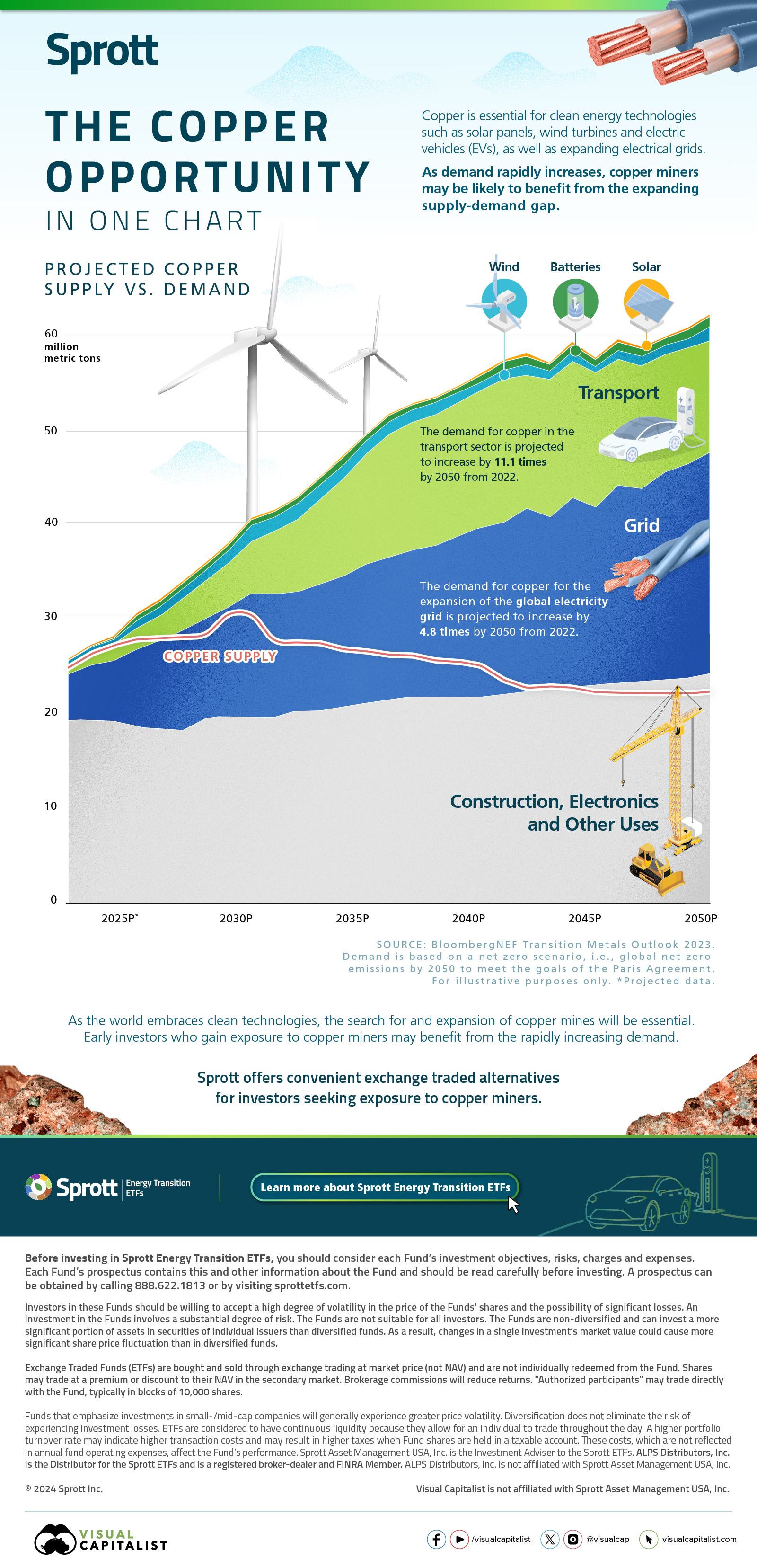

Copper is essential for clean energy applications such as solar panels, wind turbines, and electric vehicles (EVs), as well as for expanding electrical grids.

The surge in demand for the metal, driven by the growing adoption of these technologies, presents a unique investment opportunity for early investors in copper mining companies.

This chart by Sprott explores the growing gap between copper supply and demand until 2050, based on projections from BloombergNEF’s Transition Metals Outlook 2023.

Projected Copper Supply vs. Demand

Copper is naturally abundant on Earth, but extracting the metal at the pace necessary for an electrified economy could be a challenge. The timeline for bringing a copper mine from discovery to production is lengthy, averaging over 16 years.

Top producers like Chile and Peru are facing strikes and protests, along with declining ore grades. Russia, ranked seventh in copper production, faces an expected decline in production due to the ongoing war in Ukraine.

Meanwhile, the increasing adoption of carbon-free technology only highlights copper’s significance.

High Demand for Transport and Electricity Grid

The demand for copper in the transport sector is projected to increase by 11.1 times by 2050, from 2022. EVs, for example, can contain more than a mile of copper wiring.

Additionally, the demand for copper needed to expand the global electricity grid is projected to increase by 4.8 times by 2050, from 2022.

By 2030, the copper supply gap is projected to approach 10 million metric tons, with both copper prices and copper mining stocks potentially set to benefit.

As the world embraces clean technologies, the search for and expansion of copper mines will be essential. Early investors who gain exposure to copper miners may benefit from the rapidly increasing demand.

Sprott offers convenient exchange-traded alternatives for investors seeking exposure to copper miners.

Learn more about Sprott Energy Transition ETFs.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #copper #investment #etf #metals #money #electricity #commodities #renewables #etfs #evs #critical minerals #sprott

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Visualizing the Copper Investment Opportunity in One Chart";

var disqus_url = "https://www.visualcapitalist.com/sp/visualizing-the-copper-investment-opportunity-in-one-chart/";

var disqus_identifier = "visualcapitalist.disqus.com-166608";

You may also like

-

Mining15 hours ago

Where the World’s Aluminum is Smelted, by Country

This infographic shows estimated aluminum smelter production by country in 2023, based on data from the USGS.

-

Mining1 week ago

Visualizing Global Gold Production in 2023

Gold production in 2023 was led by China, Australia, and Russia, with each outputting over 300 tonnes.

-

Lithium2 weeks ago

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Mining3 weeks ago

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining1 month ago

Charted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Mining3 months ago

Charted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Visualizing the Copper Investment Opportunity in One Chart appeared first on Visual Capitalist.