Published

46 mins ago

on

July 29, 2024

| 424 views

-->

By

Alan Kennedy

Graphics & Design

- Athul Alexander

The following content is sponsored by Range ETFs

See Important Information

×

Range Disclosures

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by visiting www.rangeetfs.com/ofos. Read it carefully before investing or sending money.

The Fund is distributed by SEI Investments Distribution Co.

Risk Disclosures: Investing involves risk, including possible loss of principal. There is no guarantee the Fund will achieve its stated investment objectives.

The Fund is non-diversified. Its concentration in an industry or sector can increase the impact of, and potential losses associated with, the risks from investing in those industries/sectors.

Investments in the energy industry are subject to significant volatility due to changes in commodity prices. Additional risks include changes in exchange rates, government regulation, world events, economic and political conditions in the countries where energy companies are located or do business, and risks for environmental damage claims.

A significant portion of the revenues of offshore oil companies depend on a relatively small number of customers, including governmental entities and utilities. As a result, governmental budget restraints may have a material adverse effect on the stock prices of companies in the industry. Offshore oil services companies operate in a highly regulated, competitive and cyclical industry, with intense price competition.

Offshore oil services companies are exposed to significant and numerous operating hazards. Offshore oil services companies can be significantly affected by natural disasters and adverse weather conditions in the regions in which they operate. The revenues of offshore oil services companies maybe negatively impacted by contract termination and renegotiation.

International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Investments in smaller companies typically exhibit higher volatility.

The Fund may invest in securities denominated in foreign currencies. Because the Fund’s NAV is determined in U.S. dollars, the Fund’s NAV could decline if currencies of the underlying securities depreciate against the U.S. dollar or if there are delays or limits on repatriation of such currencies. Currency exchange rates can be very volatile and can change quickly and unpredictably.

Because the Fund is new, investors in the Fund bear the risk that the Fund may not be successful in implementing its investment strategy, may not employ a successful investment strategy, or may fail to attract sufficient assets under management to realize economies of scale, any of which could result in the Fund being liquidated at any time without shareholder approval and at a time that may not be favorable for all shareholders. Such liquidation could have negative tax consequences for shareholders and will cause shareholders to incur expenses of liquidation.

The Fund is a recently organized investment company with no operating history. As a result, prospective investors have no track record or history on which to base their investment decision. Moreover, investors will not be able to evaluate the Fund against one or more comparable funds on the basis of relative performance until the Funds has established a track record.

The Global Demand for Oil (2022-2045F)

Economists have been attempting to forecast the point of peak oil—the year when oil demand reaches its maximum level—since the 1970s. Despite increasing warnings regarding climate change, global demand has continued to rise over the last few years and could continue.

In this graphic, Visual Capitalist partnered with Range ETFs to explore the global oil demand and determine which region will demand the most in 2045.

Projecting Global Oil Demand

As per OPEC, Oil demand could be as much as 17% higher by 2045 than it was in 2022. These projections are in millions of oil barrels per day and broken down by oil product.

| Oil Product | 2022 | 2025F | 2030F | 2035F | 2040F | 2045F |

|---|---|---|---|---|---|---|

| Jet Fuel | 7 | 8 | 9 | 10 | 10 | 11 |

| Gasoline | 26 | 28 | 29 | 29 | 29 | 29 |

| Diesel | 29 | 30 | 31 | 32 | 32 | 32 |

| Ethane | 13 | 14 | 16 | 16 | 16 | 17 |

| Other | 24 | 26 | 27 | 27 | 28 | 27 |

| Total | 99 | 106 | 112 | 114 | 115 | 116 |

Oil’s importance in the global economy and its role as a fuel in many nations and industries worldwide contribute to the strength in demand. Additionally, the demand for jet fuel could grow by as much as 60% between 2022 and 2045, as currently, there is no carbon-neutral alternative to kerosene.

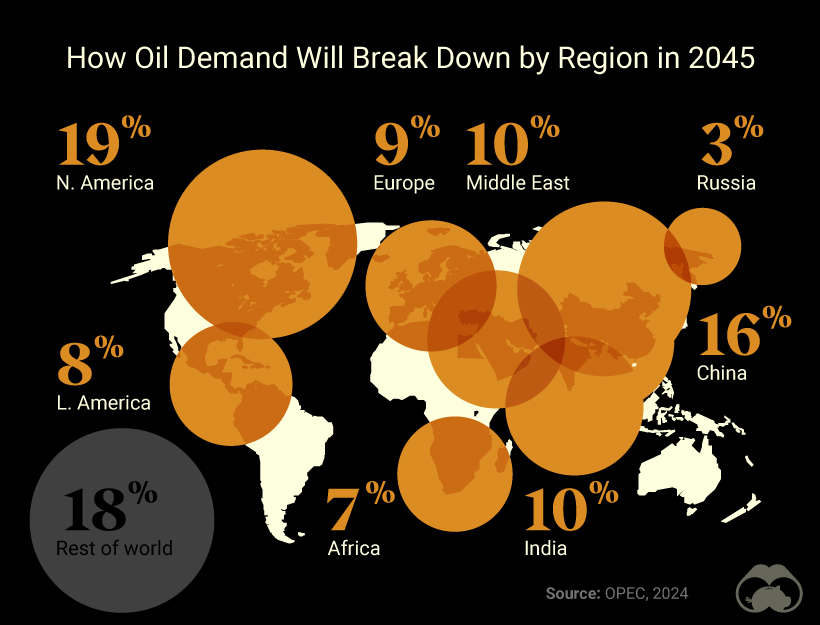

Who Will Be Using This Oil?

The forecasts also describe how much of this demand could flow to each region by 2045. Here is how it breaks down:

Despite significant investments in clean energy, large economies like those in North America, China, and India are forecast to have the most demand in 2045. This would be driven by each region’s need to use oil in transportation, industrial processes, and energy generation.

The Future of Oil

Oil’s continued importance as a fuel will likely keep demand growing over the next two decades.

Investors can take advantage of the growing potential oil demand by gaining exposure to various companies at the forefront of the offshore oil industry through the Range Global Offshore Oil Services Index ETF (OFOS).

Learn more about the Range Global Offshore Oil Services Index ETF (OFOS)

Related Topics: #china #demand #investing #oil #etf #oil demand #north america #range #range etfs #global oil demand

You may also like

-

VC+2 weeks ago

Get the Ultimate Visual Briefing on Global Energy Trends (VC+)

An exclusive visual deep dive to understanding the 2024 Statistical Review of World Energy. See what’s included.

-

Energy3 weeks ago

Charted: What Powered the World in 2023?

This graphic shows the sources of energy used globally in 2023, measured in exajoules, with fossil fuels making up 81% of the energy mix.

-

United States3 weeks ago

Mapped: Energy Costs by State in 2024

Wyoming has the highest energy costs in 2024.

-

Commodities1 month ago

Visualizing Saudi Aramco’s Massive Oil Reserves

Saudi Aramco controls almost 259 billion barrels worth of oil and gas reserves.

-

Energy2 months ago

Comparing Saudi Aramco’s $1.9T Valuation to Its Rivals

See how much larger Saudi Aramco’s market cap is compared to rivals like Chevron, ExxonMobil, and Shell.

-

Batteries2 months ago

Ranked: The World’s Largest Lithium Producers in 2023

Three countries account for almost 90% of the lithium produced in the world.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post Visualizing the Global Demand for Oil (2022-2045F) appeared first on Visual Capitalist.