Published

45 mins ago

on

August 12, 2024

| 27 views

-->

By

Julia Wendling

Article & Editing

- Alan Kennedy

Graphics & Design

- Lebon Siu

The following content is sponsored by Franklin Templeton

What Investors Need to Know About Bitcoin Halvings

Since the cryptocurrency’s inception in 2009, four Bitcoin halvings have occurred. The most recent one took place on April 19th, 2024.

For this graphic, the second in a three-part Demystifying Bitcoin series, Visual Capitalist teamed up with Franklin Templeton to explore Bitcoin’s price performance in the wake of previous halving events.

What Are Bitcoin Halvings?

Roughly every four years, the reward for adding a block to the Bitcoin blockchain is cut in half. This process, which is known as a halving event, is built into Bitcoin’s foundation.

Halvings create scarcity in the Bitcoin market as the supply of newly minted bitcoin being introduced decreases.

Here’s what the mining reward after each halving looks like:

| Halving Date | Mining Reward |

|---|---|

| November 28, 2012 | 25.000 |

| July 9, 2016 | 12.500 |

| May 11, 2020 | 6.250 |

| April 19, 2024 | 3.125 |

After the most recent halving, the reward for adding a block to the blockchain fell from 6.250 bitcoins to 3.125 bitcoins.

The Price of Bitcoin After Previous Halving Events

Though the magnitude of the increases varied, the price of bitcoin consistently rose one, two, and four years after each of the previous halvings.

Historically, the largest gains occur at the end of the four-year cycle, close to the following halving event. The only exception was one year after the first-ever halving, which saw the price of bitcoin increase by 8,782%.

| Halving Date | 1 Year Later (%) | 2 Years Later (%) | To Next Halving (~4 years) (%) |

|---|---|---|---|

| November 28, 2012 | 8,782 | 2,945 | 5,156 |

| July 9, 2016 | 285 | 923 | 1,216 |

| May 11, 2020 | 561 | 239 | 644 |

Will Bitcoin’s price performance after April’s halving follow suit?

Exploring Digital Assets

Halvings mark important dates for the asset class. They have the potential to influence the cryptocurrency’s price by simulating scarcity.

Following the previous three halvings, the price of bitcoin appreciated. If the asset’s price behavior continues along the same trend, investors could benefit following the fourth halving as well.

The third piece in the Demystifying Bitcoin series will examine the disruptive opportunity of the emerging protocol economy.

Learn more about the exciting world of digital assets with Franklin Templeton.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #bitcoin #blockchain #crypto #cryptocurrency market #Franklin Templeton #bitcoin halvings

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "What Investors Need to Know About Bitcoin Halvings";

var disqus_url = "https://www.visualcapitalist.com/sp/what-investors-need-to-know-about-bitcoin-halvings/";

var disqus_identifier = "visualcapitalist.disqus.com-169212";

You may also like

-

Cryptocurrency2 months ago

Visualizing the 15 Most Valuable Bitcoin Addresses

The most valuable Bitcoin address is worth $17.5B.

-

Green3 years ago

Visualizing the Power Consumption of Bitcoin Mining

Bitcoin mining requires significant amounts of energy, but what does this consumption look like when compared to countries and companies?

-

Bitcoin4 years ago

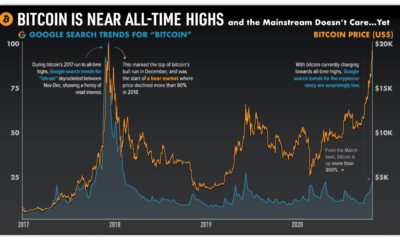

Bitcoin is Near All-Time Highs and the Mainstream Doesn’t Care…Yet

As bitcoin charges towards all-time highs, search interest is relatively low. How much attention has bitcoin’s recent rally gotten?

-

Technology5 years ago

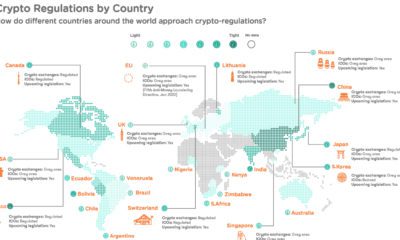

Mapped: Cryptocurrency Regulations Around the World

Cryptocurrency regulations are essential for the future of digital finance, making it more attractive for businesses, banks, and investors worldwide.

-

Technology5 years ago

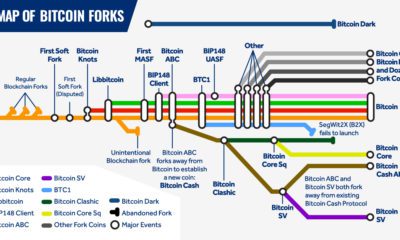

Mapping the Major Bitcoin Forks

Bitcoin forks play a key role in Bitcoin’s evolution as a blockchain. While some have sparked controversy, most Bitcoin forks have been a sign of growth.

-

Cryptocurrency5 years ago

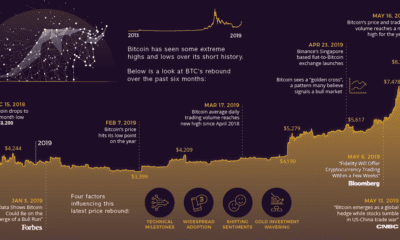

The Beginning of a Bitcoin Bull Run?

After 15 months of losses and stagnation, Bitcoin has made a miraculous recovery — going on a 150% bull run since its lows in December 2018.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post What Investors Need to Know About Bitcoin Halvings appeared first on Visual Capitalist.