Submitted by Mike Krieger via Liberty Blitzkrieg blog,

The increased use of eminent domain to transfer property to powerful political interests, the ramifications of the wars on terrorism and drugs, and the violation of the property rights of bondholders in the auto-bailout case have weakened the tradition of strong adherence to the rule of law in United States. We believe these factors have contributed to the sharp decline in the rating for the legal-system area.

To a large degree, the United States has experienced a significant move away from rule of law and toward a highly regulated, politicized, and heavily policed state.

– From the 2014 post: New Report – The United States’ Sharp Drop in Economic Freedom Since 2000 Driven by “Decline in Rule of Law”

The American public should be out in the streets by the hundreds of thousands demanding the resignation of President Barack Obama in response to the total sham settlement just announced by the U.S. government with Goldman Sachs. This farce should be seen for what it really is; a gigantic establishment middle finger waving contemptuously in the face of the reliably neutered and long-suffering American public.

A criminal financial organization that engaged in billions upon billions in fraud against the “muppet” public is once again getting off with barely a slap on the wrist and nobody’s going to do a thing about it. As I’ve said for years and years, until the public says enough is enough nothing is going to change. I suppose that’s simply not going to happen until the next economic downturn, which could emerge in earnest any day now.

David Dayan knows as much about this issue as anyone, and he just penned a scathing assessment of this perversion of justice at the New Republic. Here are a few excerpts from his piece, Why the Goldman Sachs Settlement Is a $5 Billion Sham:

This lack of accountability for Wall Street and the perception of a two-tiered justice system gnaws away at Americans’ trust. But now that the Goldman Sachs settlement Sanders referred to has been finalized, I’m sorry to say that he was wrong. If you are an executive on Wall Street who destroys the American economy, you don’t pay a $5 billion fine. You pay much, much less. In fact, you can make a credible case that Goldman won’t pay a fine at all. They will merely send a cut of profits from long-ago fraudulent activity to a shakedown artist, also known as U.S. law enforcement.

Goldman Sachs made far more than $2 billion on the sale of mortgage-backed securities, by the way. Check out this list from the settlement documents of all the securitizations they issued that are covered by the settlement; it comes to roughly 530 securitizations, each of which typically held $1 billion in loans. I wouldn’t insult Goldman’s money-earning prowess by suggesting it only made $2 billion in profit on $530 billion in mortgage-backed securities. So even if you think Goldman is paying some kind of penalty, at best it’s a cut of the profits.

And who benefits from Goldman’s payments? Not the investors who were the actual victims of the misconduct; as I noted before they end up paying more money by seeing principal cut on the loans they own. Some homeowners get affordable loans or reduced mortgage debt, even though Goldman Sachs specifically harmed investors. But the biggest beneficiaries in this transaction are the Justice Department, the New York Attorney General’s office, and the other state and federal agencies who receive cash awards, from the civil penalty and the resolution of other claims.

The upshot: Law enforcement settled a case on behalf of investors and then walked away with the proceeds, while investors got nothing. Goldman Sachs and the Justice Department get to divvy up the profits of a fraud scheme perpetrated on the public.

The Goldman Sachs settlement is the last of a series of enforcement actions hammered out by a state/federal task force on financial fraud, co-chaired by New York Attorney General Eric Schneiderman. Four other banks—JPMorgan Chase, Bank of America, Citigroup, and Morgan Stanley—paid similarly dubious fines over the packaging and sale of fraudulent mortgage-backed securities. The origins of this task force represent a failed choice by Schneiderman that let even more damaging misconduct on the part of banks go relatively unpunished.

Instead of a vigorous investigation, the Justice Department and 50 state attorneys general moved directly to negotiating a settlement. Schneiderman initially opposed that, but reversed himself. He theorized that the real money wasn’t in foreclosure fraud, but in this criminal packaging and selling of securitizations, this defrauding of investors. So he made a deal to create a task force with enough resources to examine and prosecute that misconduct.

All that evidence of fraudulent foreclosures, the largest consumer fraud in American history, turned into the National Mortgage Settlement, a “$25 billion penalty” against five mortgage companies, where only $5 billion was in the form of cash. Despite promises that 1 million homeowners would see principal reductions from that settlement, only 83,000 ever did. But no matter; Schneiderman promised that the task force would result in outcomes “an order of magnitude” bigger.

That simply didn’t happen.

Of course it didn’t.

So the most wide-ranging financial crisis misconduct was quickly settled without investigation. And despite Schneiderman swearing that the task force would explore all options for accountability, none of its members ever issued a single criminal subpoena. The banks bought their way out of the problem on the cheap, no executive saw a jail cell or had to return a penny of personal compensation, and the law enforcement agencies, not the victims, reaped the majority of the rewards.

As we all know, this is just the latest example of how Wall Street gets away with pretty much anything it wants because it owns the government.

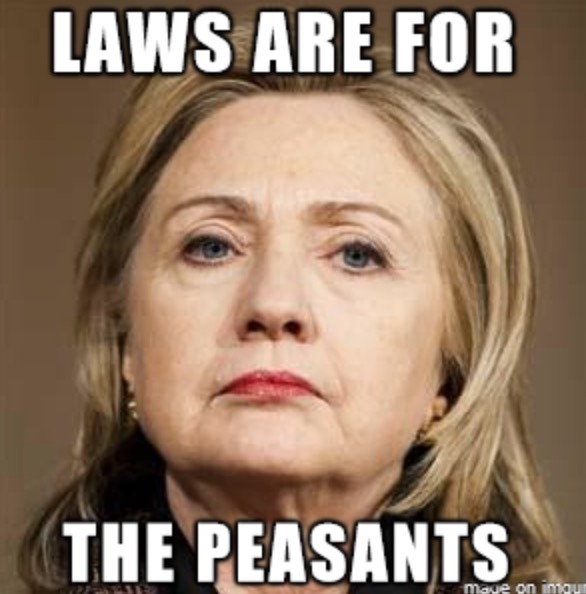

A Hillary Clinton presidency will guarantee that this stuff will not only carry on, but will get exponentially worse. After all, we all know that…

The fact that “we the people” put up with this is a national embarrassment.