Content originally published at iBankCoin.com

While everyone on Main street demonizes Goldman for doing God's work, the greedy goblins from Morgan Stanley are, ever so quietly, outperforming Goldman at every turn -- reducing them to a second rate investment bank.

Last quarter, Morgan's bond desk beat out Goldman's for the first time in six years -- likely a result of inferior recruiting at the world's 'best' investment bank. Over at the equities desk, Goldman posted a billion less in revenues than Morgan last year -- the largest difference since 2013.

Operationally, both firms are struggling -- one more than the other, however.

Ahead of earnings next week, Goldman is expected to show a trading desk decline of 16% to Morgan Stanley's -4%.

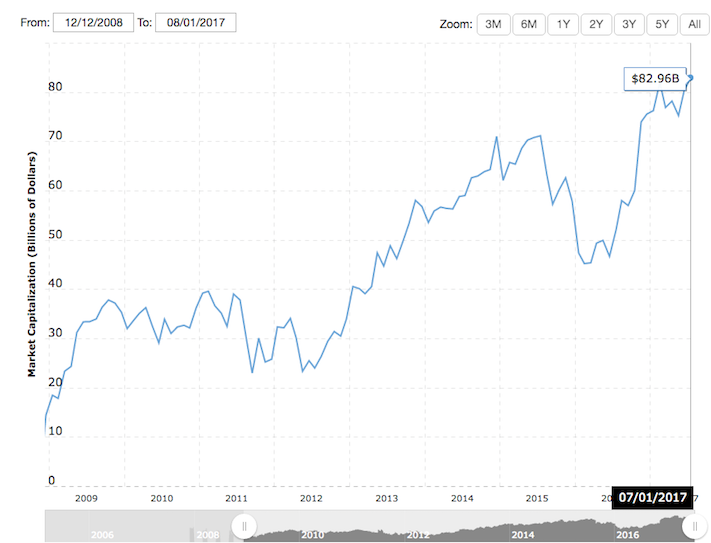

Year to date, MS is crushing GS, +9.7% for the year, compared to Goldman's -5.2%. Perhaps the brain drain to the Trump administration is taking a toll?

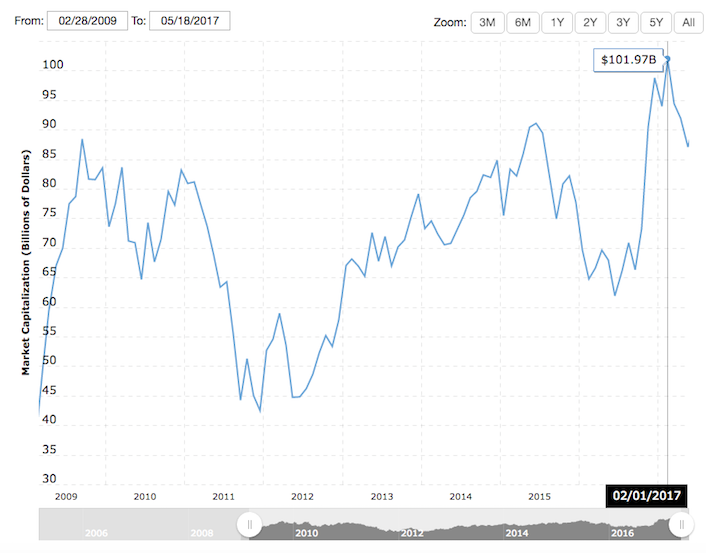

Either way, the two firms' market caps are about to converge, with Goldman's at 91 billion and Morgan's approaching 85 billion.

During the last slump in financials, circa 2011, Goldman's market cap bottomed out at $44b, about twice as large as Morgan's. Since then, the craven misanthropes from Morgan have been busy little bees, catching up to their historical arch nemesis.

You're almost there lads.

Look how horrible Goldman's performance has been. Literally, everyone is laughing at their stock and income statement. Everyone.