Now that the massive new tax bill has passed, I thought I'd do a little experiment with a spreadsheet to see how a hypothetical Silicon Valley, California earner might be affected. I was sure his tax bill would be higher, but I am surprised at how much higher.I wouldn't be surprised if some people decided not to stay in their homes since their tax bite is so substantial.

I will preface this by saying I'm not a tax expert, but I've got a pretty good understanding of taxes, and I put together a deliberately simplistic spreadsheet for this experiment. And while it may be simplistic, it still makes a powerful point, and the tiny amount of rounding error for an actual tax form won't change the conclusion.

In this examination, I make the following assumptions:

- The individual earns a very handsome salary of $500,000

- He bought a $3 million house in Palo Alto (which is going to be a pretty decent but not opulent home). He has a $1 million mortgage at an interest rate of 4%.

- He pays property tax of 1.2%

- His state income tax rate comes in at 10% (California is actually 13.3%, but I'm making it a little lower to take into account lower income levels aren't taxed as highly)

- His blended federal income tax rate is 30% (again, the actual highest rate is 37%, which is the new rate, reduced from 39.6%, but for this experiment, I'm moving it down quite a bit)

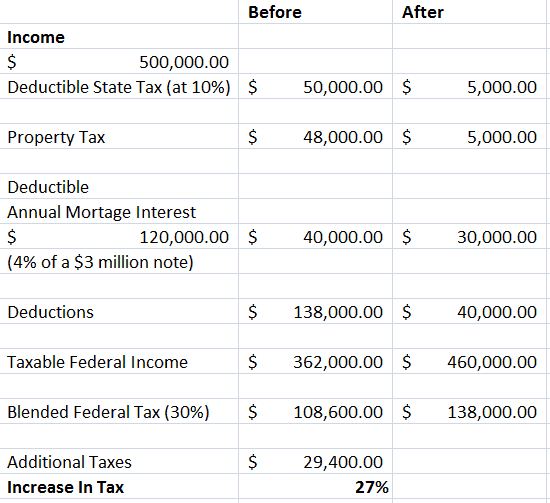

So here is the spreadsheet. I want to stress this is extremely simplified (hey, almost a tax return on a postcard!) but here we go:

In the left column, which is "pre-reform", this person has state income tax and property tax totaling $98,000, which he can used to offset income for the purposes of calculating federal income tax. In the right column, he is limited to $10,000. So suddenly he's got an extra $88,000 in income which is taxed that wasn't taxed before.

He's already limited to deducting only the first $1 million of his mortgage, but even that drops down to $750,000 (we're assuming his home purchase was after 12/15/2017, when the law changes).

So, in the end, his federal tax bill is $29,400 higher than it was. That isn't small. That's a nice new car. Or a year's tuition at a private school. And it sure as hell isn't tax "relief."

Now some of you who live in places with lower (or no) state income taxes or inexpensive real estate may be thinking, "Awww, fuck 'em, those rich Californians." But this isn't some scumbug Goldman Sachs managing director who is making tens of millions of dollars.

I also don't have a personal ax to grind here. I bought my house so long ago, so cheaply, and I owe so little on it, that none of this applies to me personally. However, I think hardly any of those affected have any CLUE what is about to hit them. There is an enormous tidal wave heading toward huge masses of professionals in states like California, Washington, and New York that are about to have the rug pulled out from under their feet.

But, hey, what am I complaining about, with reassurances like this coming from the White House:

[image]https://slopeofhope.com/wp-content/uploads/2017/12/paycheck.png[/image]

Oh, and since I'm in the Silicon Valley.......

Our poor hypothetical taxpayer has one more indignity to suffer: between (1) rising interest rates (2) the loss of deductibility in state income taxes (3) the reduction of deductibility in mortgage interest (4) the loss of deductibility in property taxes..............his house is going to sink in value as it dawns on people how badly they've been screwed. So on top of massively higher expenditures to pay federal taxes (after all, SOMEONE has to pay for Bob Corker's tax cuts!), he's making payments on a diminishing asset.

Congratulations, America. You're not even sure what's hit you yet.