Key Takeaways

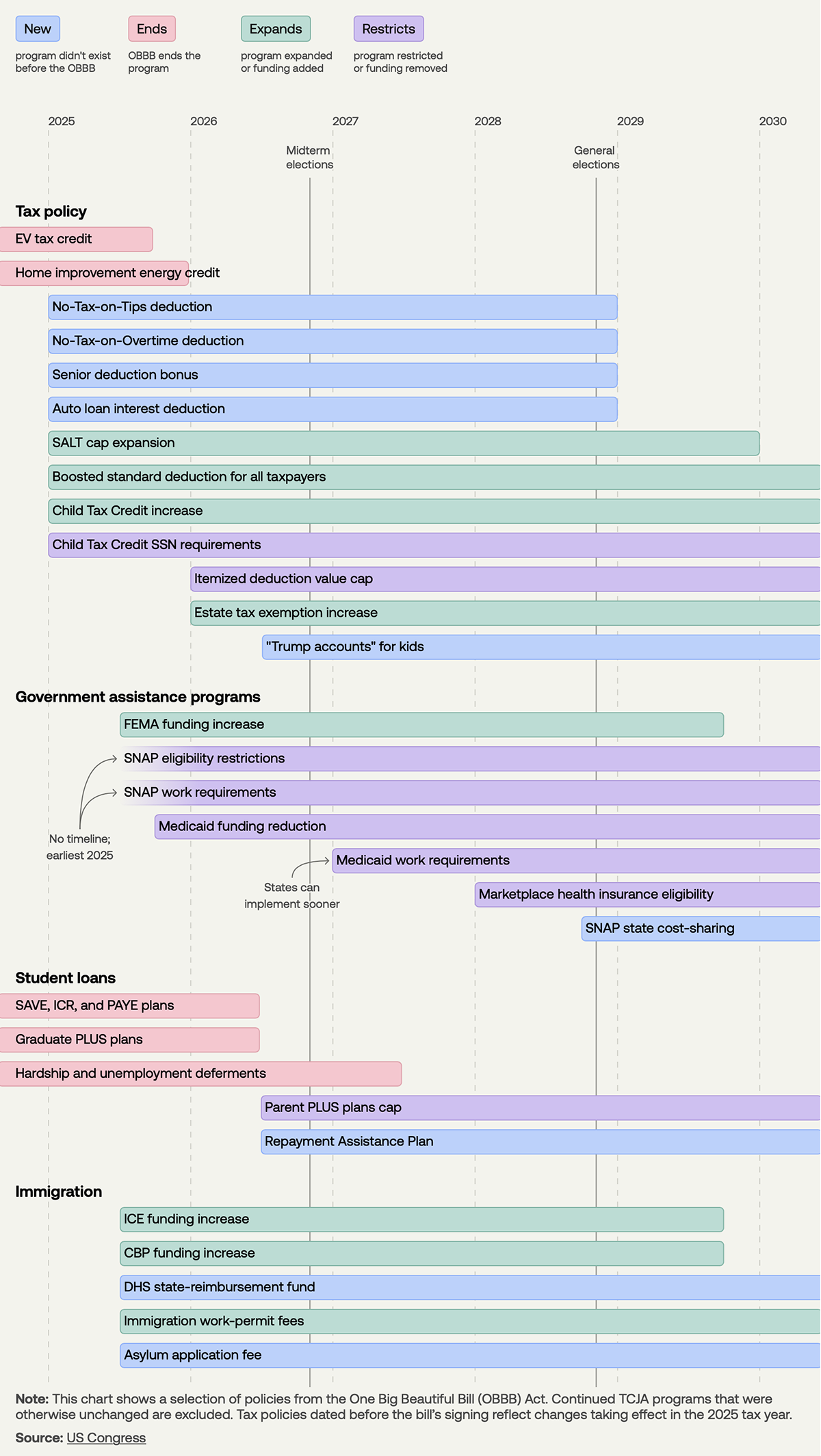

- The One Big Beautiful Bill (OBBB) introduces sweeping tax, immigration, and social program changes, many of which are phased in over several years.

- Key provisions start in 2025, but major tax and assistance program changes will roll out gradually until at least 2028.

- The bill contains both expansions and restrictions—some boosting benefits like the Child Tax Credit, others tightening eligibility for programs like SNAP and Medicaid.

Signed into law in 2025, the One Big Beautiful Bill is a flagship policy package intended to reshape U.S. tax policy, immigration enforcement, student loan programs, and government assistance over the next decade.

According to USAFacts, the OBBB’s changes are designed to both stimulate growth and reduce spending—depending on the program in question. Much like the rollout of earlier landmark legislation such as the Tax Cuts and Jobs Act, OBBB’s provisions are staggered, meaning their real-world effects will emerge slowly over time.

The graphic below, by USAFacts, is a full timeline of policy rollouts:

In 2025, high-visibility tax changes like the new EV tax credit and the elimination of the home improvement energy credit take effect. The same year, several deductions, such as No-Tax-on-Tips and No-Tax-on-Overtime, come into play. Notably, expansions to the Child Tax Credit and the standard deduction will impact millions, while restrictions on SNAP and Medicaid programs loom on the horizon.

By 2027, the midterm election year, new limits on itemized deductions and Social Security number requirements for the Child Tax Credit will be in place. Meanwhile, expansions like the SALT cap lift and FEMA funding boost aim to offset some restrictions elsewhere.

Beyond Taxes: Loans, Assistance, and Immigration

The bill also reshapes the student loan landscape, ending certain income-driven repayment plans and hardship deferments by 2025, but introducing caps and repayment assistance plans in later years.

In immigration policy, OBBB increases funding for ICE and CBP while introducing fees for work permits and asylum applications. This reflects a broader theme in the bill: pairing expansions of enforcement and certain tax breaks with tightened eligibility and new user fees in other areas.

Long-Term Impacts and Political Timing

Because many of OBBB’s provisions activate in politically sensitive years—2027’s midterms and 2029’s general elections—implementation may become a flashpoint in future debates.

Historical precedent shows such sweeping policy changes can influence electoral outcomes, as seen in prior administrations’ major legislative pushes (more on early-term executive actions here).

Learn More on the Voronoi App ![]()

Check out What’s in President Trump’s 2026 budget proposal? to see how future spending priorities align—or clash—with OBBB’s long rollout.