![]()

See this visualization first on the Voronoi app.

Use This Visualization

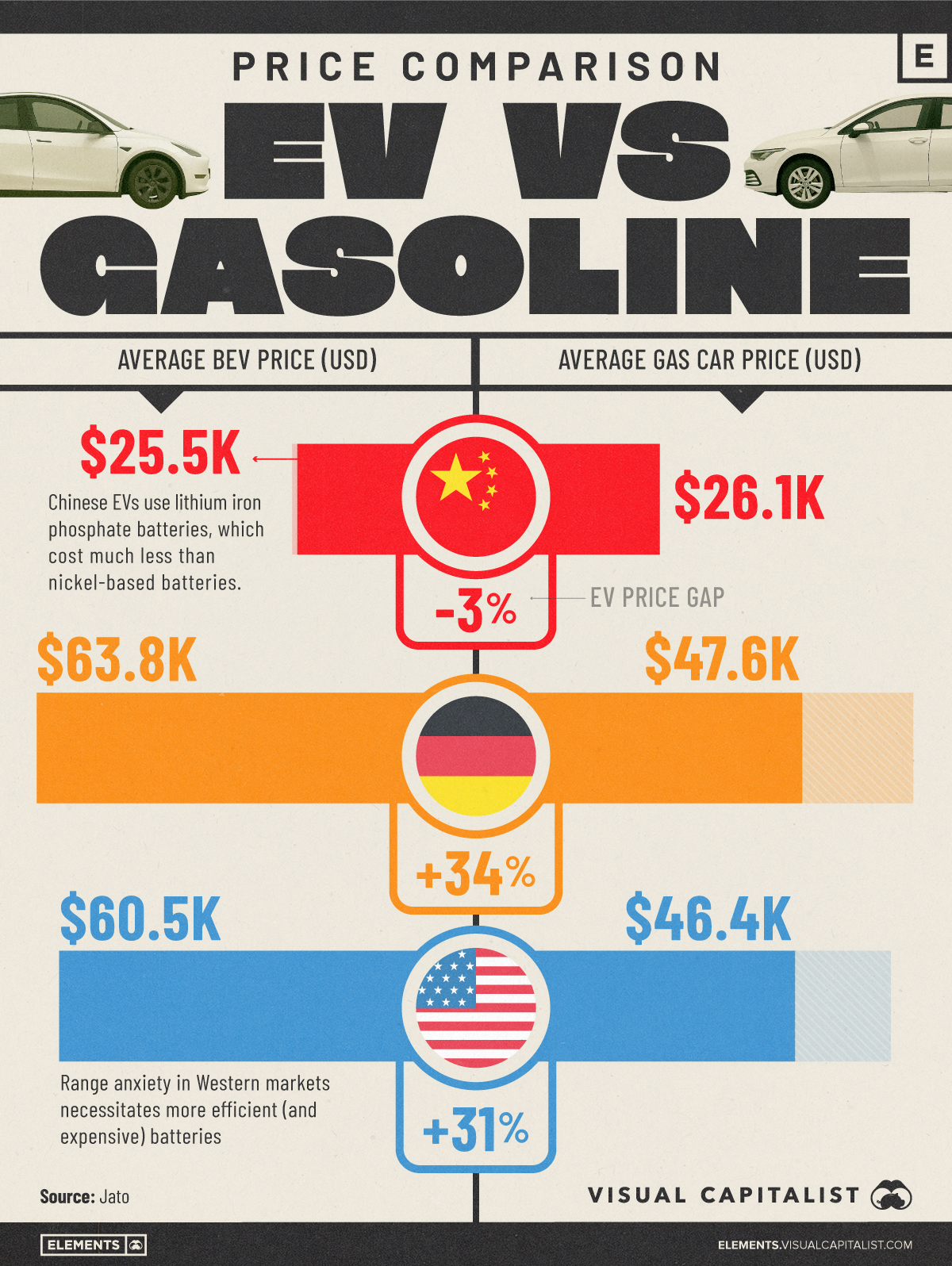

Price Comparison: EVs vs. Gasoline Cars

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- In China, electric vehicles have become more affordable than their gas counterparts

- On the other hand, EVs in Germany and the U.S. still remain significantly more expensive

Electric vehicles (EVs) have seen rapid adoption and price shifts globally, but affordability remains uneven across countries. This visualization compares the average price of battery electric vehicles (BEVs) with traditional gas-powered cars in China, Germany, and the United States.

The chart highlights a unique reversal in China, where EVs are now cheaper than gas-powered cars on average.

The data for this visualization comes from Jato, as of the first quarter of 2025.

China Leads on EV Affordability

In China, the average BEV costs $25,465—roughly 3% less than the average gas car. This pricing advantage is a result of years of industrial policy support, scale manufacturing, and intense domestic competition.

Chinese automakers like BYD have produced budget-friendly EVs tailored for mass-market appeal, accelerating the transition to electrification. In addition, Chinese EVs usually use lithium iron phosphate batteries, which cost less than nickel-based batteries.

| Country | Average BEV Price (USD) | Average Gas Car Price | Difference |

|---|---|---|---|

| China | $25,465 | $26,163 | -3% |

| Germany | $63,837 | $47,558 | 34% |

| United States | $60,465 | $46,395 | 31% |

Western EVs Still Carry a Premium

Conversely, in both Germany and the United States, EVs remain much more expensive than gas vehicles. In Germany, the average BEV costs $63,837, compared to $47,558 for a gas car—a 34% premium. Similarly, U.S. buyers face a 31% price gap between EVs and gas cars.

The pricing gap in Western markets suggests that electrification may progress at uneven rates unless costs come down. As Chinese EV makers expand internationally, they may disrupt these markets by introducing lower-cost alternatives.

Meanwhile, automakers in Europe and the U.S. will need to balance innovation with affordability to drive mass EV adoption.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out Russia’s Most Popular Car Brands on Voronoi, the new app from Visual Capitalist.