![]()

See more visualizations like this on the Voronoi app.

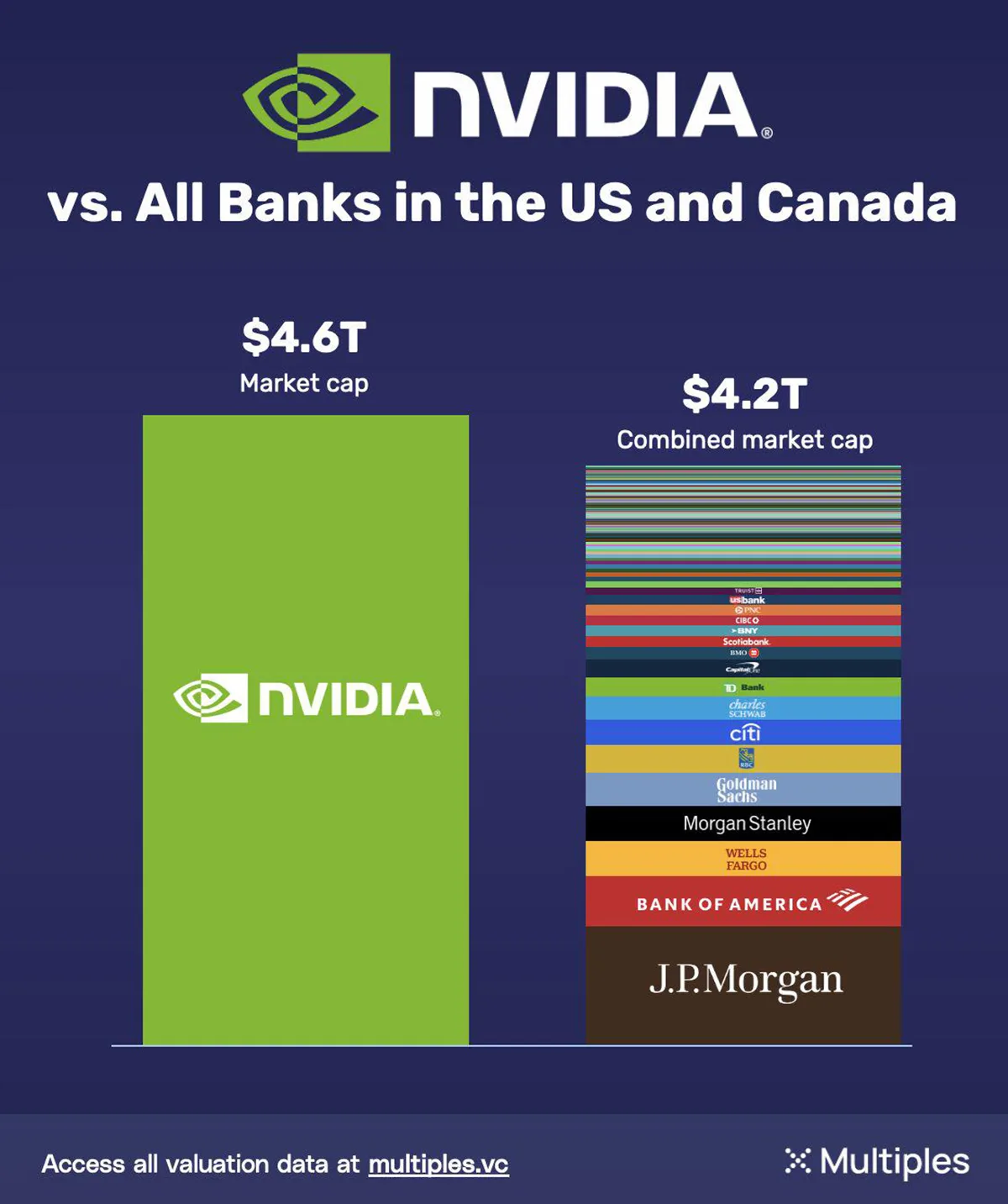

Chart: Nvidia’s Market Cap Compared to Banks

- Nvidia’s market cap of $4.6T now exceeds the combined market cap of every major U.S. and Canadian bank ($4.2T).

- JPMorgan Chase, the largest North American bank, is worth just $816 billion—less than one-fifth of Nvidia.

- As AI demand surges, Nvidia’s valuation boom has triggered comparisons to past market bubbles.

Nvidia has reached another valuation milestone. the world leader in AI chips and GPU technology has a market capitalization that surpasses the combined valuations of every major publicly traded bank in the United States and Canada.

The comparison, visualized by Reddit user u/alex-medellin, uses market cap data from FactSet and highlights the accelerating divergence between the tech and financial sectors.

For comparison, here are the valuations of just some of the top banks in the U.S. and Canada:

| Company | Market Cap (Oct 16, 2025; in billions USD) |

|---|---|

| JPMorgan Chase | $816.4 |

| Bank of America | $371.6 |

| Wells Fargo | $264.4 |

| Morgan Stanley | $258.2 |

| Goldman Sachs | $234.7 |

| Royal Bank Of Canada | $205.4 |

| Toronto Dominion Bank (TD) | $134.6 |

| Bank of Montreal | $89.9 |

| Scotiabank | $79.6 |

| CIBC | $74.6 |

| National Bank of Canada | $42.4 |

The biggest surprise?

Even combining the valuations of JPMorgan Chase, Bank of America, and every other major institution like Goldman Sachs, TD Bank, and Scotiabank, still doesn’t top Nvidia’s market worth. This illustrates how a single AI-focused firm has eclipsed an entire sector once thought too big to be challenged.

AI’s Meteoric Rise vs. Banking Giants

Nvidia’s growth reflects the seismic shift in investor priorities, particularly toward the AI compute power fueling everything from generative AI to robotics. A few short years ago, the company’s valuation was under $1 trillion.

Meanwhile, traditional banks, despite their critical roles in the economy, have grown at a comparatively modest pace. Even the largest, JPMorgan Chase, is valued at less than one-fifth of Nvidia’s market cap.

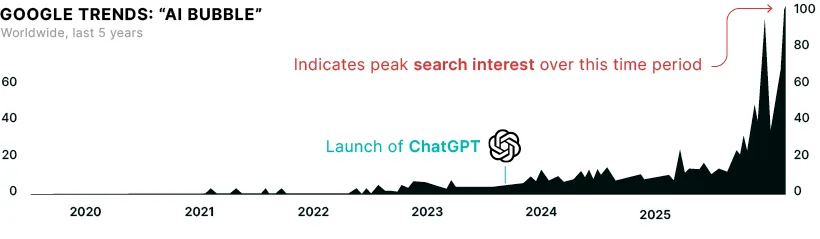

Are We in an AI Bubble?

The explosive rise of Nvidia and other AI-focused companies has sparked growing speculation that we may be in the midst of an AI-driven market bubble. Online search trends for terms like “AI bubble” have reached an all-time high, reflecting a noticeable shift in public and investor sentiment.

Financial analysts are increasingly sounding the alarm. A recent report from Deutsche Bank cautioned that Nvidia’s valuation growth is entering “uncharted territory,” with little historical precedent for such concentrated gains in a single sector.

Meanwhile, institutional investors are reportedly hedging against potential downside scenarios, despite continued enthusiasm for AI infrastructure investments.

Still, the capital keeps flowing. AI startups continue to attract billions in fresh funding. But with valuations expanding faster than revenues, and sky-high expectations baked into stock prices, many are wondering whether this is a transformative new era, or an echo of the dot-com boom.