![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

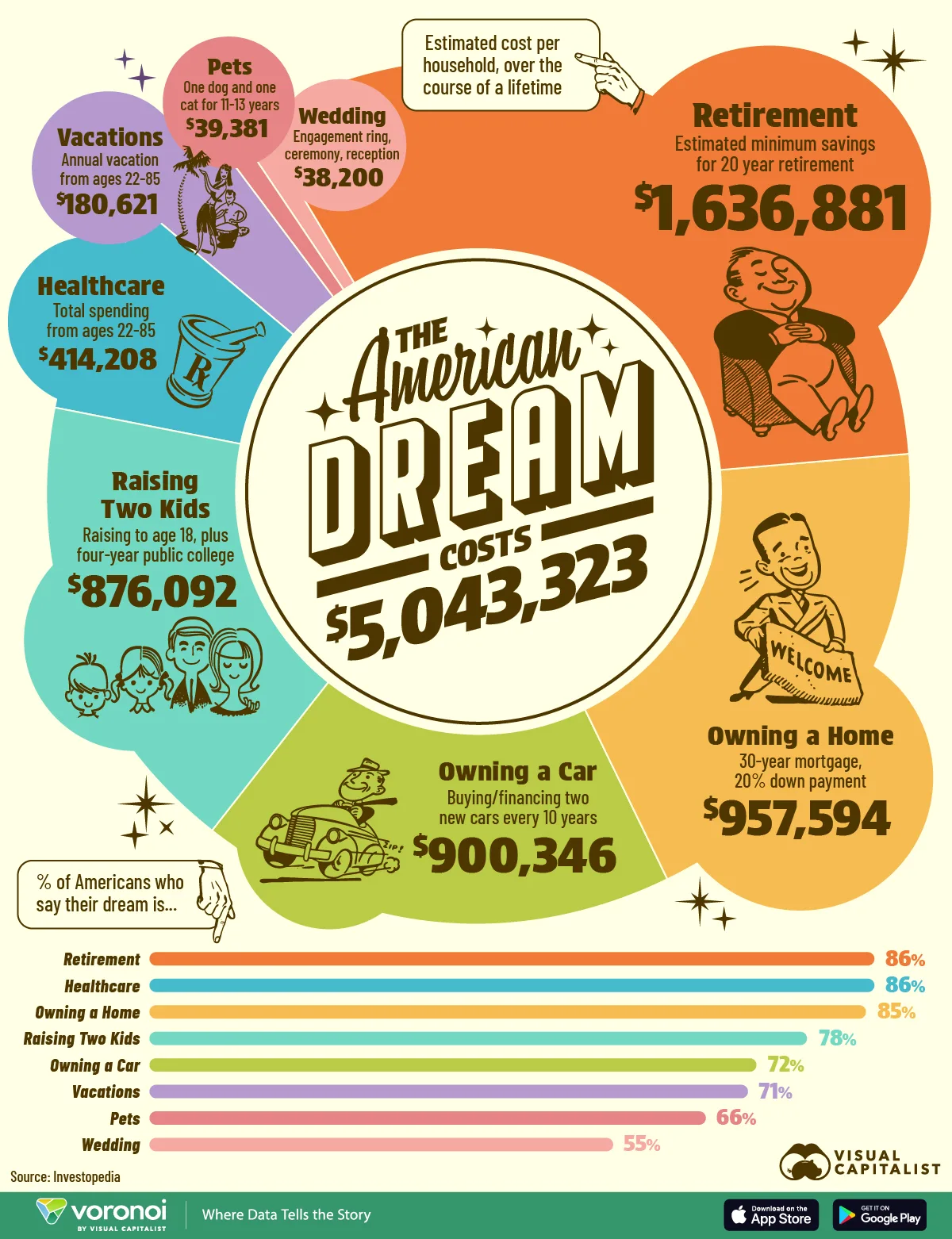

Visualizing the Cost of the American Dream in 2025

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Achieving the American Dream now carries a price tag of over $5 million per household.

- A 20-year retirement is the largest expense, requiring an estimated $1.6 million in minimum savings.

The American Dream isn’t cheap. Owning a home, raising a family, and retiring comfortably now total over $5 million across a lifetime for a household.

This milestone has grown increasingly out of reach as the median age of a U.S. homebuyer has risen to 56, up from 31 in 1981. Meanwhile, U.S. fertility rates have hit record lows amid rising unaffordability.

This graphic shows the cost of the American dream in 2025, based on analysis from Investopedia.

The full methodology that shows how Investopedia calculated each of these costs can be found here.

The American Dream Costs $5 Million Over a Lifetime

Below, we show the lifetime cost for a household of each key markers of the American Dream:

| Goal | Lifetime Cost | Description | % Americans Who SayIt's Their Dream |

|---|---|---|---|

| Retirement | $1,636,881 | Estimated minimum savings for 20 year retirement | 86% |

| Healthcare | $414,208 | Total spending from ages 22-85 | 86% |

| Owning a home | $957,594 | 30-year mortgage, 20% down payment | 85% |

| Raising two children | $876,092 | Raising to age 18, plus four-year public college | 78% |

| Owning a new car | $900,346 | Buying/financing two new cars every 10 years | 72% |

| Yearly vacation | $180,621 | Annual vacation from ages 22-85 | 71% |

| Pets | $39,381 | One dog and one cat for 11-13 years | 66% |

| Wedding | $38,200 | Engagement ring, ceremony, and reception | 55% |

Retirement is set to cost $1.6 million, the biggest expense overall.

This was calculated by taking $63,609 in average U.S. retirement spending per year, while factoring a 2.5% rate of inflation over 20 years. Today, 86% of Americans say its their dream to retire comfortably.

Home ownership has an average lifetime cost of $957,594. To calculate these costs, Investopedia applied the median U.S. home price of roughly $415,000 with a 20% down payment. Then, payments for a 30-year fixed mortgage at 6.69% were calculated, excluding maintenance and Homeowners Association fees.

As we can see, car ownership also comes at a large cost—estimated at $900,346. However, it’s worth noting that this applies to a household buying two new cars every 10 years. While this includes insurance costs, maintenance, and monthly payments, it does not factor in the proceeds from selling your car.

Meanwhile, raising two children will total $876,092 (including a four-year degree at a public college). If your dream is to have a wedding, the average cost now stands at $38,200, including the ring, ceremony, and reception.

Learn More on the Voronoi App ![]()

To learn more about this topic, check out this graphic on America’s home buyers by generation.