Published

54 minutes ago

on

November 14, 2025

| 6,206 views

-->

By

Ryan Bellefontaine

Graphics & Design

- Zack Aboulazm

The following content is sponsored by Payactiv

View the full-size version of this graphic

Explainer: What is Earned Wage Access and Why Do You Need it?

Key Takeaways

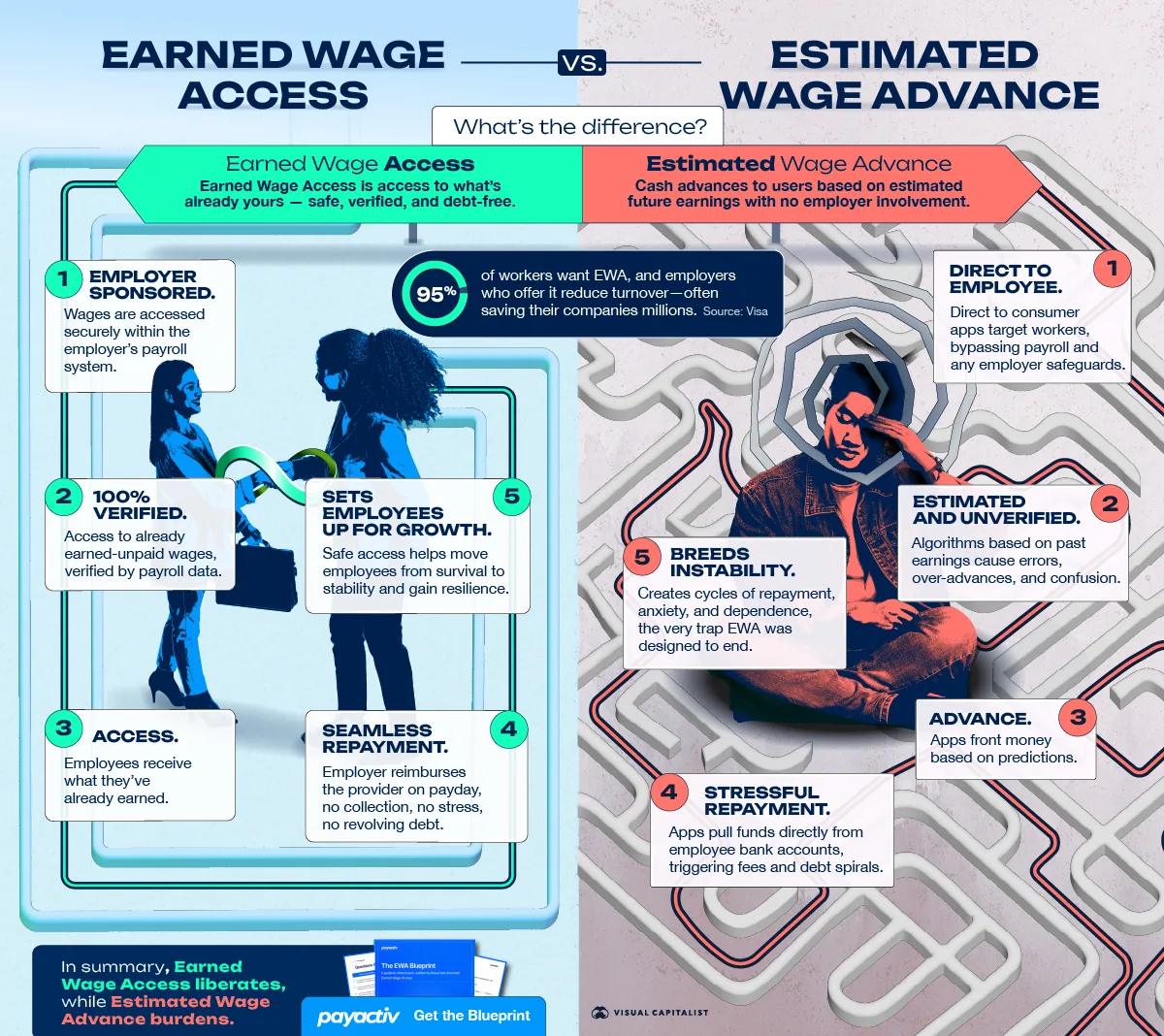

- Employer-integrated Earned Wage Access unlocks payroll-verified, already-earned wages, causing workers to avoid taking on new debt.

- Conversely, direct-to-consumer estimated advances bet on future pay, use bank pulls, and trap workers in debt cycles.

- Offering responsible, employer-integrated EWA boosts stability, morale, and retention while cutting turnover costs.

Workers are navigating tight budgets as everyday costs climb. Tools that bridge timing gaps now shape whether people fall behind or finally catch their breath.

Created in partnership with Payactiv, this graphic contrasts employer-integrated access to already-earned pay with direct-to-consumer estimated advances, showing how verification, repayment, and employer involvement drive different outcomes for workers and organizations.

How Earned Wage Access Works

Employer-sponsored Earned Wage Access (EWA) connects directly to employee Time & Attendance and payroll systems. Employees can securely unlock wages they’ve already earned, not guesses about future income. Because access is based on employer-verified hours, amounts are precise, predictable, and aligned with actual pay.

Repayment is simple: on the regular pay cycle, the employer settles with the provider, so workers aren’t stuck repaying a lender or juggling collections. When properly structured, this model is often treated as non-credit because it’s access, not an advance.

Over time, this model helps workers transition from crisis management to stability, supporting savings habits, dignity, and reducing day-to-day financial stress.

This model is also very in demand. In Visa’s Earned Wage Access Insights Report, 95% of employees say they’d be interested in working for an employer who offers Earned Wage Access.

What Estimated Wage Advances Do

Estimated wage advance apps target workers directly, bypassing employer payroll. Instead of verified hours, they rely on projected earnings, which can misalign with reality if shifts change, hours drop, or income varies.

Repayment typically pulls from a worker’s own bank account and involves “instant transfer” fees, tips, and credit-like charges, or paycheck reroutes. As these costs and shortfalls accumulate, they can create debt spirals, anxiety, broken autopay, and bank switching—shifting risk back onto people who can least afford it.

Why Real EWA Matters

The real difference isn’t just speed. It’s who is in the partnership, how pay is verified, and how repayment flows.

Employer-integrated EWA provides workers with a safer way to access their earned wages, while direct-to-consumer estimated advances create a two-way relationship that resembles debt.

Demand for responsible EWA is strong, and employers that offer integrated access often see higher morale, better retention, and lower turnover costs—sometimes in the millions.

The Bottom Line

If it’s earned, it’s access. If it’s estimated, it’s an advance.

Earned Wage Access reinforces the worker–employer relationship while supporting long-term stability, and workers are asking for it.

Find out more in Payactiv’s EWA Blueprint

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #payday loans #loans #salary #jobs #wages

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "Explainer: What is Earned Wage Access and Why Do You Need it?";

var disqus_url = "https://www.visualcapitalist.com/sp/pay01-what-is-earned-wage-access-and-why-do-you-need-it/";

var disqus_identifier = "visualcapitalist.disqus.com-184439";

You may also like

-

Economy4 days ago

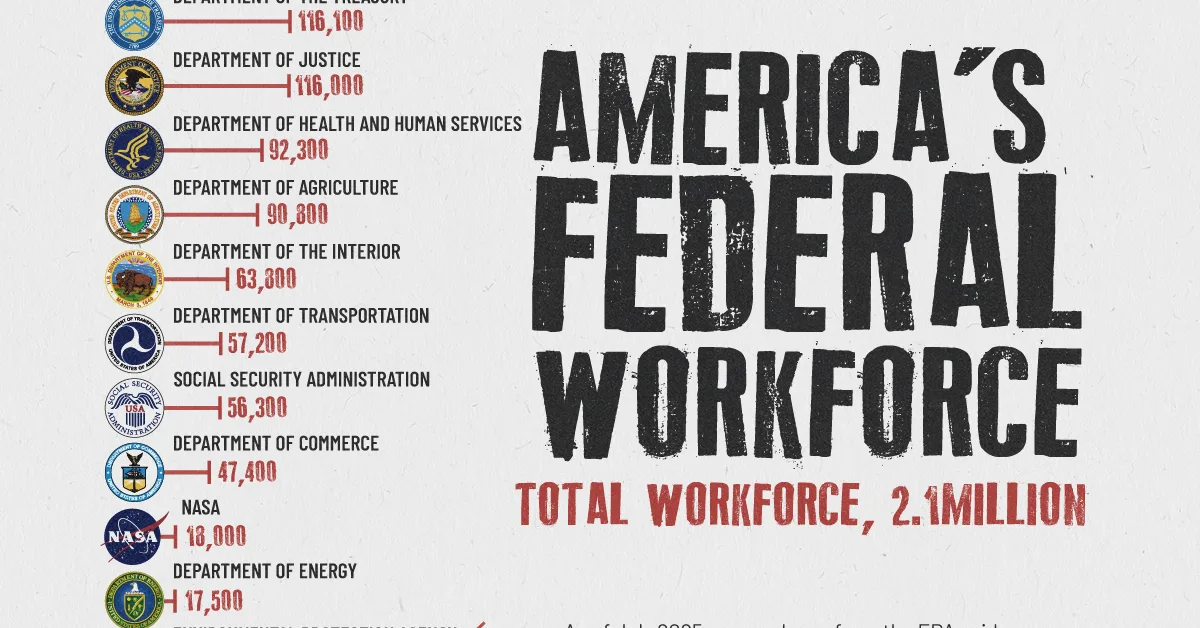

Charted: America’s 2.1 Million Federal Workers

We break down America’s 2.1 million federal workers by agency, revealing the massive scale of defense and veterans’ services.

-

Jobs6 days ago

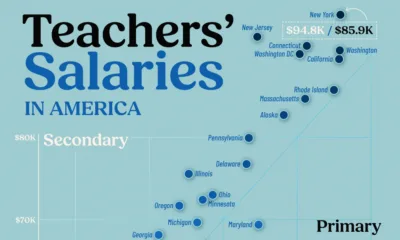

Visualized: Where School Teachers Earn the Most in America

We visualized average teacher salaries by state, showing how pay ranges from under $50,000 to over $90,000.

-

Education3 weeks ago

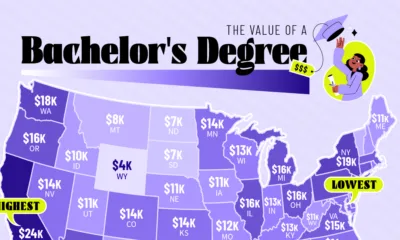

Mapped: The Value of a College Degree, by U.S. State

The added value of a bachelor’s degree ranges from $3,000 to nearly $24,000 across the United States.

-

Jobs3 weeks ago

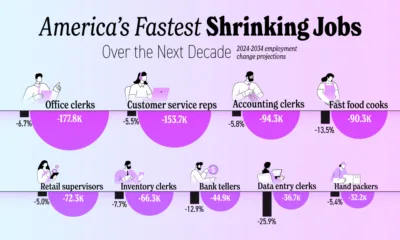

Ranked: The Fastest Shrinking Jobs in America by 2034

As artificial intelligence and automation reshapes the workforce, we identify the fastest shrinking jobs in America over the next decade.

-

Jobs2 months ago

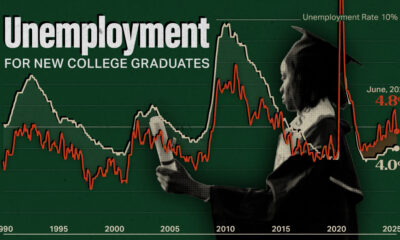

Charted: The Rising Unemployment Rate of College Graduates

New graduate unemployment has been steadily rising above the overall U.S. unemployment rate, reversing a trend of more than two decades.

-

Jobs3 months ago

Mapped: The Top Employment Sector for Every Country

Using World Bank data, this map shows the top employment sector by country: services in rich nations, agriculture in poorer ones.

Subscribe

Please enable JavaScript in your browser to complete this form.Join 375,000+ email subscribers: *Sign Up