![]()

See more visualizations like this on the Voronoi app.

Use This Visualization

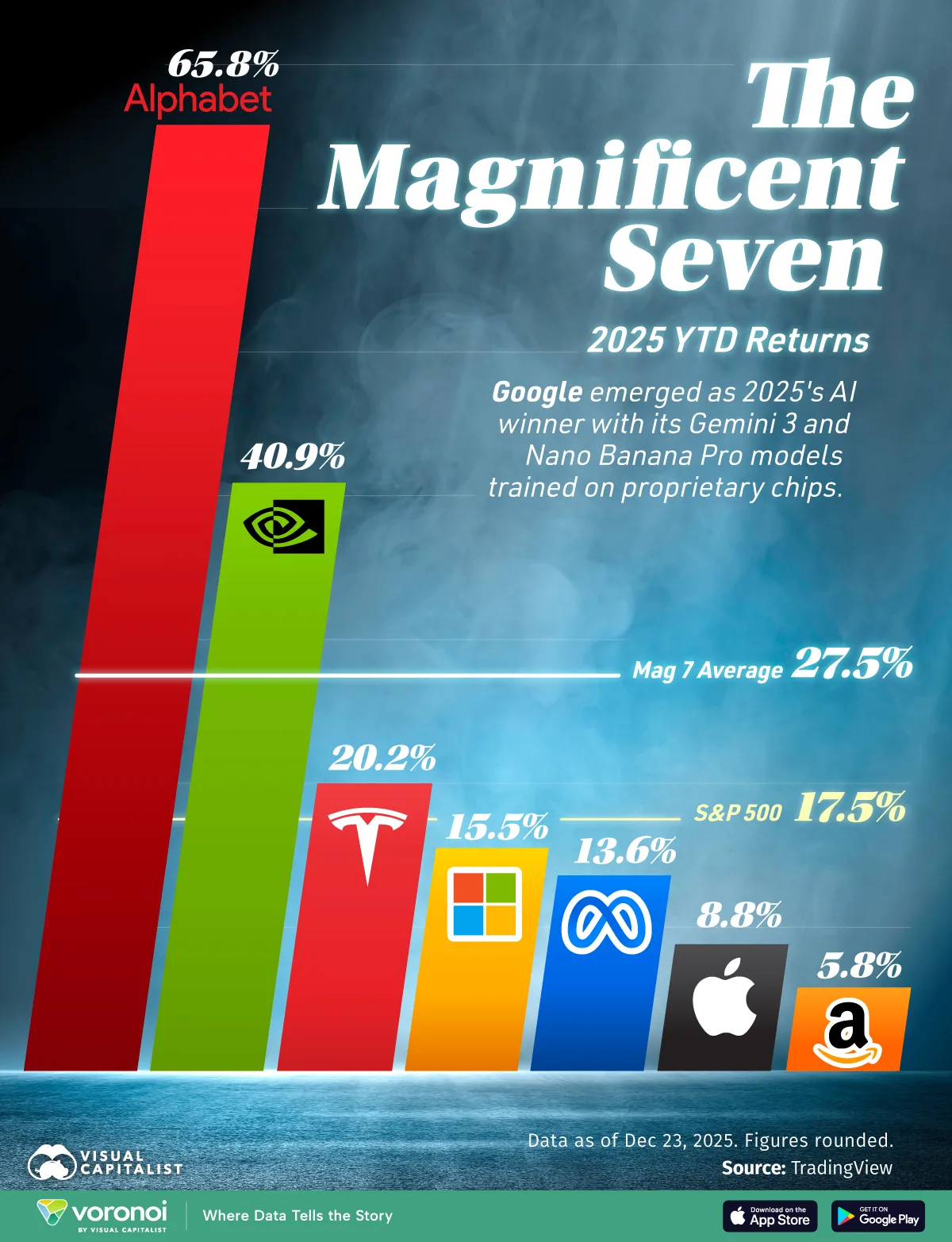

Ranked: The Performance of Magnificent Seven Stocks in 2025

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Magnificent Seven stocks are up 27.5% year-to-date as of December 23.

- Alphabet is the best-performing stock among the pack, driven by a 47% share price gain in the fourth quarter.

Performance across the Magnificent Seven stocks showed a clear divergence in 2025.

This year, Google-parent Alphabet has surged above the rest thanks to optimism surrounding its in-house TPU chips and AI tools. In contrast, Amazon posted only single-digit gains amid slowing growth in its cloud computing business over the year.

This graphic shows the performance of Magnificent Seven stocks in 2025, based on data from TradingView.

A Closer Look at the Magnificent Seven Stocks in 2025

As of December 23, Magnificent Seven stocks averaged 27.5% returns in 2025, continuing to outpace the S&P 500 index by a sizable margin:

| Company/ Index | 2025 YTD Returns |

|---|---|

| Alphabet | 65.8% |

| Nvidia | 40.9% |

| Tesla | 20.2% |

| Microsoft | 15.5% |

| Meta | 13.6% |

| Apple | 8.8% |

| Amazon | 5.8% |

| S&P 500 (market cap weighted) | 17.5% |

| Magnificent Seven Average | 27.5% |

With 65.8% returns, Alphabet, the world’s most profitable company, surged past Nvidia this year.

Back in 2015, Alphabet began developing Tensor Processing Units (TPUs), designed for AI model training and inferencing. But in recent months, it announced it would begin selling these chips, sending its share price soaring.

Not only is Meta in talks with Alphabet to buy its chips, the company signed a deal with Anthropic PBC to supply tens of thousands of chips to the AI firm.

Nvidia follows with a 40.9% return, well below its 171% gain in 2024 and the 239% surge the year before. Despite doubling revenue year over year, the company is facing intensifying competition from Alphabet, AMD, and Broadcom.

Meanwhile, Apple posted just 8.8% returns. This year, several high-level executives have left the company for other Big Tech firms amid a lackluster AI rollout. Among them is Jony Ive, a key builder of the iPhone, who went to OpenAI in a $6.5 billion pay package.

Learn More on the Voronoi App ![]()

To learn more about this topic, check out this graphic on the returns of global stock markets in 2025.