Published

1 hour ago

on

January 14, 2026

| 460 views

-->

By

Julia Wendling

Graphics & Design

- Abha Patil

The following content is sponsored by Terzo

Breaking Down America’s $13 Trillion ETF Market

Key Takeaways

- ETFs have become a cornerstone of U.S. investing, with the market totaling $13.4 trillion in assets.

- Equities dominate the ETF market, with roughly $10.5 trillion—nearly 80% of total ETF assets.

- Bond ETFs hold a distant but significant $2.2 trillion, while hundreds of billions more are allocated to commodities, currencies, real estate, and other specialized strategies.

Exchange-traded funds (ETFs) have become one of the most popular investment vehicles in the United States. They have given investors low-cost, diversified access to nearly every corner of global markets.

This visualization, created in partnership with Terzo, breaks down America’s $13.4 trillion ETF market by asset class. It offers a clear view of how capital is distributed across equities, bonds, and other investment categories—and how that allocation shapes portfolio risk and returns.

What Is an ETF?

An ETF is an investment fund that trades on stock exchanges, much like an individual stock. Most ETFs are designed to track an index, sector, commodity, or asset class. This allows investors to gain broad exposure without having to pick individual securities.

Compared to mutual funds, ETFs typically offer lower fees, greater transparency, and the flexibility to trade intraday. This has fueled their rapid adoption among both retail and institutional investors.

ETF Assets by Class

Equities dominate the ETF landscape by a wide margin. U.S. equity ETFs hold roughly $10.5 trillion in assets under management (AUM), accounting for nearly 80% of all ETF assets. Bond ETFs follow with just over $2.2 trillion, reflecting growing demand for fixed income exposure in a more liquid and accessible format.

| Asset Class | Assets Under Management (AUM) |

|---|---|

| Equities | $10.5T |

| Bonds | $2.2T |

| Commodities | $318B |

| Currencies | $160B |

| Real Estate | $77B |

| Other* | $102B |

| Total | $13.4T |

Beyond stocks and bonds, ETFs have expanded into a wide range of asset classes. Commodity ETFs manage about $318 billion AUM, while currency ETFs hold roughly $160 billion. Real estate ETFs account for $77 billion AUM, and a collection of other specialized strategies, including alternatives and niche exposures, add another $102 billion.

Understanding the Financial Landscape

Understanding the broader financial landscape is essential, but real advantage comes from knowing what’s happening inside your own business. Great insights start with great data, and by transforming company contracts into actionable intelligence, you can make decisions based on reality, not assumptions.

See NirvanAI in action and learn how it helps you make decisions with confidence.

More from Terzo

-

Markets4 weeks ago

2025 in Review: The Ups, Downs, and Returns of Global Markets

Which country led stock markets in 2025? See the biggest shocks, rebounds, and year-end returns in this global recap.

-

Markets1 month ago

Mapped: The Biggest Housing Bubble Risks Globally

Which global cities are most at risk of a housing bubble? This new map ranks the world’s most overheated real estate markets.

-

Technology1 month ago

Ranked: The Top Factors That Build AI Trust

Want AI your team will trust? Pull back the curtain on the top factors that make people believe in artificial intelligence.

-

Technology2 months ago

Ranked: AI Hallucination Rates by Model

Find out how common AI hallucination is for leading models, and what that means for the businesses that rely on them.

-

Technology2 months ago

The Dangers of AI: Visualizing the Top Risks Companies Face

Among the dangers of AI, one stands apart as causing trouble for almost a third of companies. What do leaders need to know?

-

Business2 months ago

Ranked: Which Universities Build the Most Entrepreneurs?

Which university has had the most alumni become entrepreneurs in the last decade? Hint: its not Stanford or Harvard.

-

Economy2 months ago

Mapped: Where Workers Are Supporting the Most Seniors

In many advanced economies, the number of retirees is climbing while the working-age population shrinks. What are the countries where workers are supporting the most seniors?

-

Economy2 months ago

The United States of Unemployment

The national unemployment rate for the U.S. rose to 4.3% in August 2025. But that figure masks vast differences in local labor market health across states.

-

Markets3 months ago

Ranked: The Economies Most Dependent on International Trade

A trade war has threatened economic ties in 2025. Which economies are most exposed to these shifts in international trade?

-

Economy3 months ago

Top Countries Behind U.S. Tariff Revenue

Tariff rates vary by country, as does the value of goods each nation exports to the U.S. Which countries contribute the most?

-

Business3 months ago

Industries Hiring and Firing the Most Employees

As the U.S. labor market cools, which industries are still hiring—and which are cutting back their workforces?

-

Markets4 months ago

The $150T Global Debt Market

Global debt continues to climb, reaching $150T in Q1 2025. Which countries carry the heaviest burdens?

-

Money4 months ago

NEW: Fed Rate Cuts vs. Other G7 Countries

How do Fed rate cuts in the U.S. compare with the interest rate changes in other G7 countries, and what does it mean for business?

-

Jobs4 months ago

Ranked: The Fastest Growing Jobs (2024-2034)

Explore the fastest growing jobs by projected growth rate, plus salary insights, in a rapidly changing job market.

-

Investor Education5 months ago

The $127 Trillion Global Stock Market in One Giant Chart

This graphic pieces together the $127T global stock market to reveal which countries and regions dominate—and how much equity they control.

-

Personal Finance5 months ago

Late to the Ladder: The Rise in First-Time Home Buyers’ Age

The median age of first-time home buyers has reached a historic high. See just how long it’s taking people to get on the property ladder.

-

Markets5 months ago

Unpacking Real Estate Ownership by Generation (1991 vs. 2025)

The Silent Generation’s share of real estate has dropped dramatically as people age, but how have Baby Boomers, Gen X, and Millennials fared?

-

Business6 months ago

America’s Economic Engines: The Biggest Industry in Every State

Real estate is the biggest industry by GDP in 26 states. Find out why it dominates—and what fuels the rest of the country.

-

Maps6 months ago

Mapped: Manufacturing as a Share of GDP, by U.S. State

Tariffs are rising to boost American-made goods. Which states gain the most—and least—from manufacturing today?

-

Technology7 months ago

Profit Powerhouses: Ranking The Top 10 U.S. Companies by Net Income

Collectively, the ten most profitable U.S. companies have a net income of $684 billion—more than the entire GDP of Belgium.

-

Money7 months ago

Millionaire Hubs: Mapping the World’s Wealthiest Cities

New York City has the highest millionaire population globally. Which other cities attract the world’s wealthiest?

-

Economy7 months ago

Tomorrow’s Growth: GDP Projections in Key Economies

The global economy is expected to have slighter slower growth going forward. Which countries are on track to have the biggest GDP increases?

-

Money8 months ago

Mapped: Interest Rates by Country in 2025

The U.S. has kept their target rate the same at 4.25-4.50%. What do interest rates look like in other countries amid economic uncertainty?

-

Markets9 months ago

U.S. Housing Prices: Which States Are Booming or Cooling?

The national housing market saw a 4.5% rise in house prices. This graphic reveals which states had high price growth, and which didn’t.

-

Investor Education10 months ago

The Silent Thief: How Inflation Erodes Investment Gains

If you held a $1,000 investment from 1975-2024, this chart shows how the inflation rate can drastically reduce the value of your money.

-

Politics10 months ago

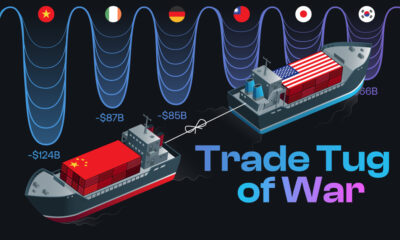

Trade Tug of War: America’s Largest Trade Deficits

Trump cites trade deficits—the U.S. importing more than it exports—as one reason for tariffs. Which countries represent the largest deficits?

Subscribe

Please enable JavaScript in your browser to complete this form.Join 375,000+ email subscribers: *Sign Up