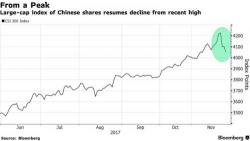

Chinese Stock Rout Resumes As Top Fund Sees "High Probability" Of Bond Carnage

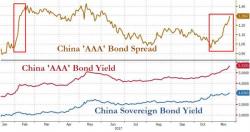

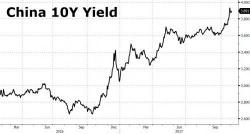

In early November, we discussed how commentators were disturbed by the sell-off in Chinese government bonds after the Party Congress, which saw yields rise to 4.0%. The anomaly was that yields in less-liquid, unsecured Chinese corporate bonds had barely moved. Some sleuthing on the part of the Wall Street Journal discovered that the most likely explanation was that redemptions in China’s shadow banking sector, especially in the infamous $4 trillion Wealth Management Products (WMP), meant that cash needed to be raised…quickly. Highly liquid government bonds were the easiest option.