‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

On January 16, 2013, the Bundesbank - one of the biggest gold holder in the world, with 3,378 tonnes - shocked the world: out of the blue, the German central bank announced that by December 31, 2020, it intends to store half of Germany’s gold reserves in its own vaults in Frankfurt, up from only 31% at the time. The plan would mean repatriating a total of 674 tonnes of gold, 300 from the New York Fed's gold vault, and another 374 from the Bank of France.

Submitted by Ronan Manly, BullionStar.com

On August 10, the Wall Street Journal (WSJ) published an article about the Federal Reserve Bank of New York (FRBNY) custody gold and the NY Fed’s gold vault. This vault is located under the New York Fed’s headquarters at 33 Liberty in Manhattan, New York City.

When global financial markets crash, it won't be just "Trump's fault" (and perhaps the quants and HFTs who switch from BTFD to STFR ) to keep the heat away from the Fed and central banks for blowing the biggest asset bubble in history: according to the head of the German central bank, Jens Weidmann, another "pre-crash" culprit emerged after he warned that digital currencies such as bitcoin would worsen the next financial crisis.

Submitted by Mike Shedlock via MishTalk.com,

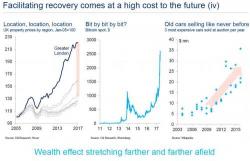

Eurozone Target2 imbalances have touched or exceeded the crisis levels hit in 2012 when Greece was on the verge of leaving the Eurozone. Others have noted the growing imbalances as well.

I had a couple of questions for the ECB regarding Target2, which they have answered, I believe disingenuously.

First, we will explain Target2, then we will take a look at various charts, viewpoints, and the email exchange with the ECB.

Target2 Background