Bizarro World: JGB Yields Slide After BOJ Tapers

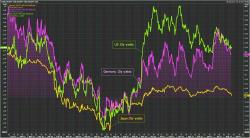

Something strange happened on July 24: on that day the Bank of Japan announced it would reduce the size of its purchases of five-to-ten year JGBs from Y500 billion to Y470 billion. However, instead of yields and the yen spiking, as some had expected would happen, they slumped. And, just as unexpectedly, 10Y JGB yields continued to slump over the next month, despite another reduction in the amount of JGB in the 5-10 year bucket that the BOJ would purchase on August when it further reduced the amount to Y440 billion.