Is The BoJ About To Shock Markets Anew Tonight?

Nikkei Asian Review's William Pesek wonders if the BoJ is about to shock the markets again as pressure is mounting on Kuroda to save Abenomics...

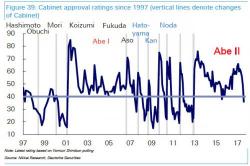

Masaaki Shirakawa could be forgiven for some Schadenfreude. In March 2013, the then-Bank of Japan governor was shown the door by a prime minister who felt he had not eased monetary policy enough. Now his successor is starting to worry about his own job security.