Global Stocks Slide On Trump Probe Report, Fed Indigestion

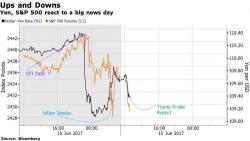

Is it going to be another May 17, when US stocks tumbled as concerns of a Trump impeachment over obstruction of justice and impeachment surged ahead of Comey's tetimony?

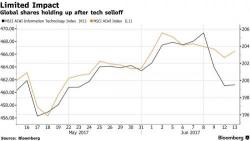

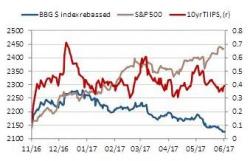

Overnight, S&P500 futures accelerated their decline following yesterday's WaPo report that Special Counsel Mueller has launched a probe into potential obstruction of justice by Trump...