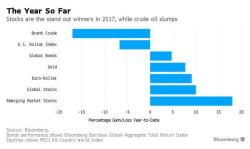

Global Stocks Rebound From Korea Jitters; S&P Flat As Fed Minutes Await; Oil Slides

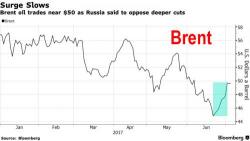

S&P futures were little changed at 2,425, ignoring the N.Korea tensions of the past two days which will likely be a major topic in the upcoming G-20 summit, as European stocks fluctuate and Asian markets advance. Crude oil fell, snapping the longest winning streak this year, as Russia said it opposed any proposal to deepen OPEC-led production cuts.