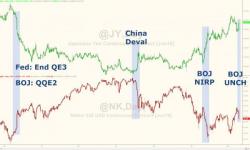

Japanese Bloodbath After BoJ Disappoints - Nikkei Drops 1000 Points, USDJPY Crashes

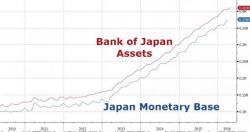

If there was a sign that nothing else matters but central bank largess, this was it. The moment The Bank of Japan statement hit and proclaims "unchanged" a vacuum hit USDJPY and Japanese stocks. Reflecting that Japan's economy has "continued a moderate recovery trend" which is utter crap given the quintuple-dip recession, Kuroda and his cronies said they will "add easing if necessary" and apparently that is not now. Not so much as a higher ETF purchase or moar NIRP..