Draghi Considers Money Helicopters

It’s debatable whether or not the most recent move of the European Central Bank was unexpected, but it certainly sparks a lively discussion on the open market. Not only did the ECB reduce the lending rate on the refinancing facilities from 0.05% to 0% which basically means the banks that are part of the Eurosystem can borrow money for free, it also reduced the interest rate on the deposit facility by 0.10% to a negative 0.40%. Yes, -0.40%.

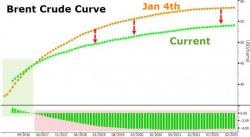

Source: Bloomberg.com