On "Average", Stocks Are Testing The Post-2009 Uptrend

Via Dana Lyons' Tumblr,

At this moment, an index that tracks the average stock move is testing the uptrend since 2009.

Via Dana Lyons' Tumblr,

At this moment, an index that tracks the average stock move is testing the uptrend since 2009.

While it took the equity markets over 24 hours to wake up to the realization that the first Fed tightening in 9 years is actually just that, and that not only monetary conditions will progressively get more constrictive especially if the Fed is intent on 4 more hikes in 2016, but that P/E multiples will contract by at least 3% according to a still optimistic Goldman Sachs, something far more interesting happened in repo markets, where the consensus expectation was that the Fed's rate would be accompanied by a major liquidity drain via reverse repos.

5 Key Charts Show Rising Interest Rates Good For Gold Bullion

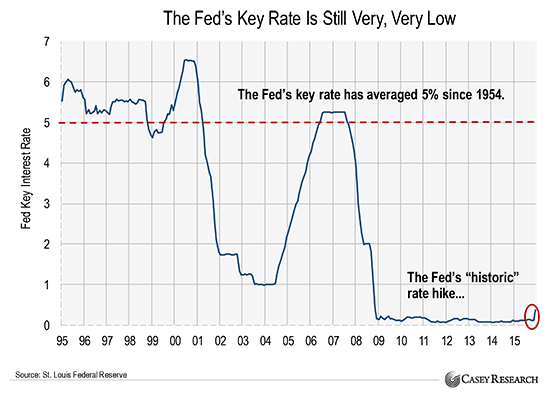

Gold fell to the lowest level in dollar terms since 2009 yesterday after the Fed’s “historic” 25 basis point interest rate rise on Wednesday. The rate hike has been heralded as the “end of cheap money.” This may or may not be the case but what is more important for precious metal buyers is the impact of potential rising rates on gold prices.

Central Bankers are flummoxed.

Having cut interest rates over 600 times since 2009 (and printed over $15 trillion), they’ve yet to generate the expected economic growth.

Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

The Fed Rate Hike: the Torpedo is Launched

Posted with permission and written by Bullion Bulls Canada, Jeff Nielson (CLICK FOR ORIGINAL)