1987 Versus 2017: Will History Repeat Or Just Echo?

Authored by Sara Potter via FactSet,

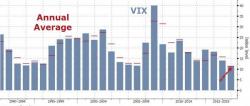

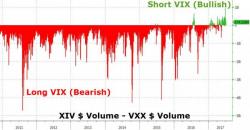

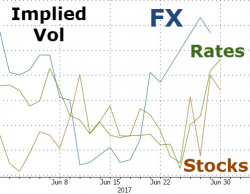

Last week, I detailed the various factors leading up to the stock market crash of October 19, 1987. As we approach the 30-year anniversary of Black Monday, are there signs that the bull market of 2017 could end in the same way? Let’s compare the financial, economic, and political factors now and then to paint a better picture.