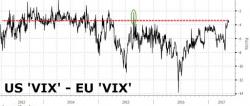

US Volatility Spikes To 21-Month Highs (Relative To Europe)

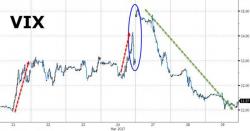

Today's sudden 'Minsky Moment' in markets has pushed US equity risk perceptions to their highest relative to Europe since August 2015, back to old 'norms'.

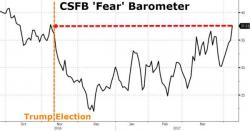

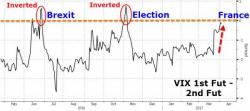

As Bloomberg notes, U.S. politics are taking center stage as risks recede in Europe following the French presidential election. With Donald Trump facing the deepest crisis of his presidency, the CBOE Volatility Index surged on Wednesday, while Europe’s VStoxx Index rose less than 5 percent.