USDJPY Plunges As Dollar Drops To 11 Month Lows, Commodities Rise

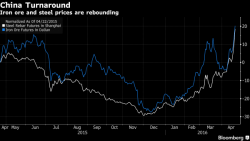

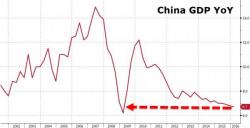

Following yesterday's Yen surge in the aftermath of the disappointing BOJ announcement, the pain for USDJPY long continued, with the key carry pair tumbling as low as 106, the lowest level since October 2014 before stabilizing around 107, and is now headed for its biggest weekly gain since 2008, which in turn has pushed the US dollar to to its lowest close in almost a year as signs of slowing growth in the U.S. dimmed prospects for a Federal Reserve interest-rate increase. As a result, global stocks fell and commodities extended gains in their best month since 2010.