The Global Bubble Has Burst - "Will Tear At The Threads Of Society"

Excerpted from Doug Noland's Credit Bubble Bulletin blog,

Bubble Economy or Not?

Excerpted from Doug Noland's Credit Bubble Bulletin blog,

Bubble Economy or Not?

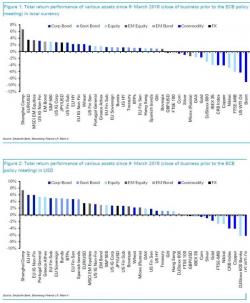

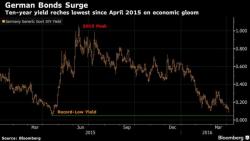

Almost exactly one month ago, on March 10,Mario Draghi unveiled his quadruple bazooka, which among other features, included the first ever monetization of corporate bonds (this has unleashed such an unprecedented scramble for European bonds that there are virtually none left in the open market leading to massive illiquidity and forcing yield chasers to sell CDS instead of buying bonds, thus laying the ground work for the next AIG debacle).

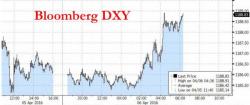

Unlike yesterday's overnight session, which saw some substantial carry FX volatility and tumbling European yields in the aftermath of the TSY's anti-inversion decree, leading to a return of fears that the next leg down in markets is upon us, the overnight session has been far calmer, assisted in no small part by the latest China Caixin Services PMI, which rose from 51.2 to 52.2 (even if the employment index dropped to a three year low, suggesting China's labor problems are only just starting).

The market's slumberous levitation of the past month, in which yesterday's -0.3% drop was the second largest in 4 weeks and in which the market had gone for 15 consecutive days without a 1% S&P 500 move (in March 2015 the sasme streak ended at day 16) may be about to end, after an overnight session, the polar opposite of yesterday's smooth sailing, which has seen a sudden return of global risk off mood.

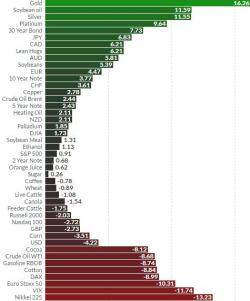

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years