Global Stocks Rise To 1.5 Year High After Chinese Intervention Halts Dollar Rally

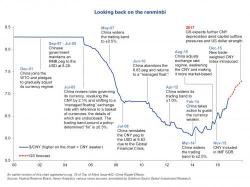

Asian stocks rose, led by Hong Kong, while European shares and U.S. equity-index futures are little changed. Euro, yen climb as the dollar posted an unexpected loss following some serious fireworks out of China, which intervened in funding market to crush offshore Yuan shorts.

Top news stories include Macy’s and Kohl’s cutting their outlook after weak holiday season, Deutsche Bank exploring lending money to PE firms buying distressed loans, Apple planning to invest $1b in SoftBank’s new technology fund.