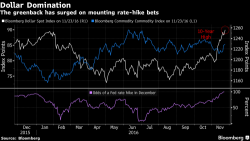

Global Stocks Pressured As Oil Slides On OPEC Deal Concerns; US Futures, Dollar Rise

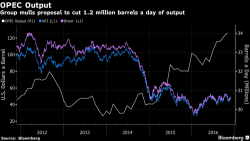

European stocks were little changed and oil fell as investors assessed declining prospects for an OPEC deal and risks from Italy’s referendum. Asian stocks declined, while S&P futures pointed to a fractionally higher open, erasing 3 points from yesterday's drop.

Trader attention today - and tomorrow - will be focused on oil which retreated back under $47 as OPEC members failed to bridge differences on production cuts, while a rally in metals ran out of steam. The rand plunged after President Jacob Zuma survived a leadership threat.