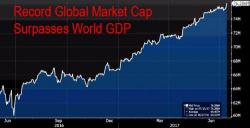

World Stocks At All Time Highs After Nikkei's Record Winning Streak; Euro Slides With Spain On Edge

In an otherwise quiet session, Sunday's convincing election victory for Japanese Prime Minister Shinzo Abe’s ruling coalition, which gave it another constitution-changing supermajority, pushed the Nikkei to the highest level since 1996, after a record 15 consecutive days of gains - the longest winning streak on record - and sent world stocks to new all-time highs on Monday.