S&P Futures, Global Stocks Rise Ahead Of The Fed; Oil Rebounds

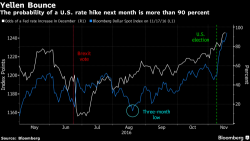

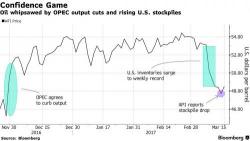

It is fitting that just a few hours until the Fed's second rate hike in two quarters, and one day after Goldman downgraded global stocks to Neutral for the next 3 months, not to mention with the results of the anticipated Dutch election due shortly, that global stocks as well as S&P futures are higher, while crude oil has finally managed to stage a rebound as the Dollar DXY index is fractionally in the red.