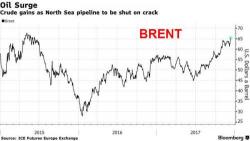

Futures Flat As FOMC Meeting Begins; Brent Jumps Over $65 For First Time Since 2015

E-mini futures are modestly in the green this morning, though net of fair value the S&P index is poised for another record high open as the FOMC begins its last meeting for 2017 in which it is expected to raise rates by 25bps. European stocks gain while Asian equities slide led by weakness in Chinese airplane stocks.