Global Markets Stumble, Spooked By Japanese Stock Fireworks

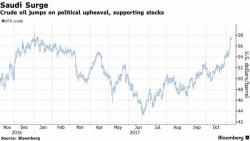

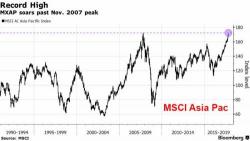

The overnight fireworks in Japan, which saw the Nikkei plunge by 860 intraday points and sent vol and volumes soaring (before recovering most losses), spooked traders in Asia and around the globe, and U.S. equity futures are red this morning, along with European shares and oil.