"Starts With A Whimper, Ends With A Bang": Trader Previews Fed's Balance Sheet Reduction

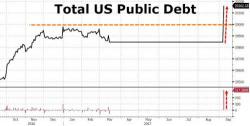

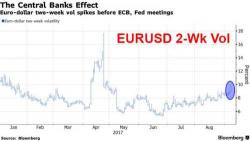

Ahead of this week's main central bank event, in which Wall Street consensus broadly expects the Fed to officially announce balance sheet shrinkage in this week's FOMC meeting, with the actual process set to begin in October, here is a less than bullish preview of what may happen from Bloomberg commentator Garfield Reynolds, who covers FX, bonds and commodities.

Fed’s Pruning Will Send Yields Higher for Longer: Macro View