Mueller Subpoena Spooks Dollar, Sends European Stocks, US Futures Lower

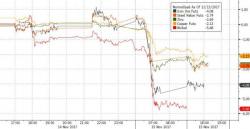

Yesterday's torrid, broad-based rally looked set to continue overnight until early in the Japanese session, when the USD tumbled and dragged down with it the USDJPY, Nikkei, and US futures following a WSJ report that Robert Mueller had issued a subpoena to more than a dozen top Trump administration officials in mid October.