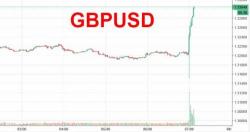

Pound Surges After BOE Keeps Rates Unchanged, Warns "Some Withdrawal Of Stimulus Is Likely"

As expected, the BOE kept its interest rate unchanged at 0.25%, in a 7-2 vote, while maintaining the rest of its bond monetization programs in line in a 9-0 vote.

MPC holds #BankRate at 0.25%, maintains government bond purchases at £435bn and corporate bond purchases at £10bn. pic.twitter.com/D1w1kcvgrz

— Bank of England (@bankofengland) September 14, 2017