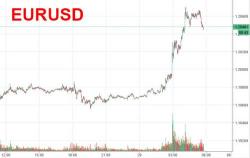

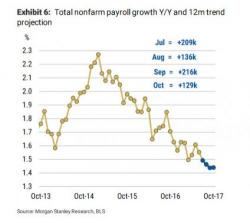

All Eyes On August Payrolls, As Global Stocks Rise In Bullish September Start; Yuan Surge Continues

With payrolls looming (our full preview is here), carbon-based traders around the globe are leery of putting on any major trades and so the overnight session has been rather dull, dominated by the now traditional overnight algo-mediated levitation, which means the VIX is lower and S&P futures are once again modest higher as European and Asian shares continue their ascent.