Global Markets Rebound As Tech Rout Ends; Sterling Rises

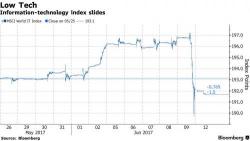

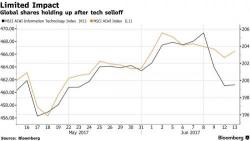

As the Fed begins its two-day meeting, global stocks have recovered their footing and European shares rise, led by a bounce in tech stocks as last Friday's global selloff that started in the sector shows signs of abating. Asian stocks and U.S. futures gain as investors turn their attention to today's Jeff Sessions testimony as well as tomorrow's barrage of macro data including Yellen, CPI and retail sales.